Submitted by Taps Coogan on the 7th of July 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

In today’s odd world of ’economists’ applying goal seeking revisions to national GDP calculation methodologies (see here, here, here) and grossly misrepresentative unemployment statistics (see here), one must be cautious not to form their economic outlooks solely based off of these increasingly abstracted economic statistics. After all, the central bankers, at the reins of the global economy, espouse that it is an ‘undue lack of confidence’ in the economy that holds back growth. Meanwhile, their constant interventions have done little but constrain the environment that true free markets require to flourish. For central bankers, what better way to induce that confidence then through the massaging of economic statistics.

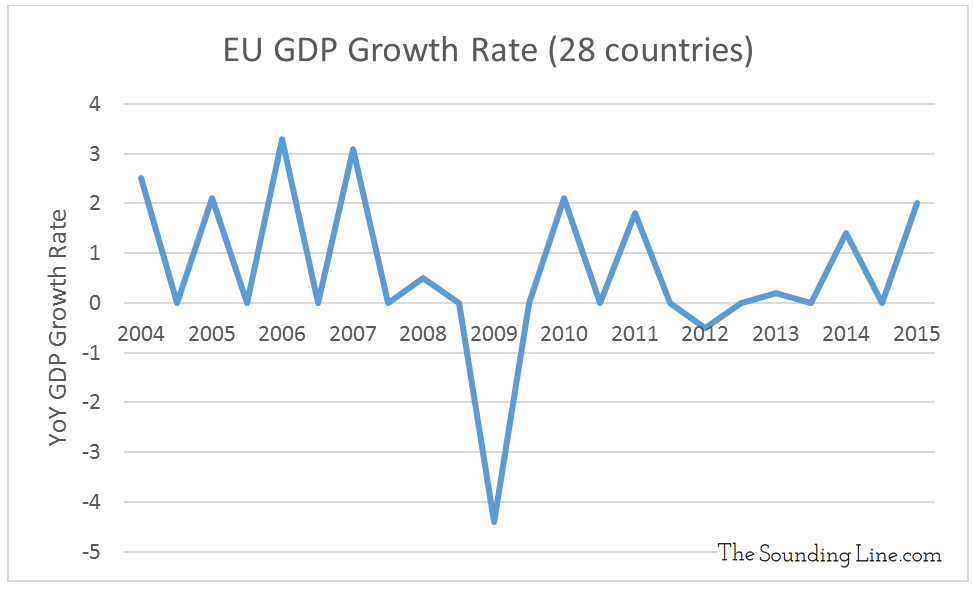

According to official figures from Eurostat, GDP growth in the EU has recovered from the 2008 recession and reverted to its normal, albeit very low, yearly growth rate around 2%.

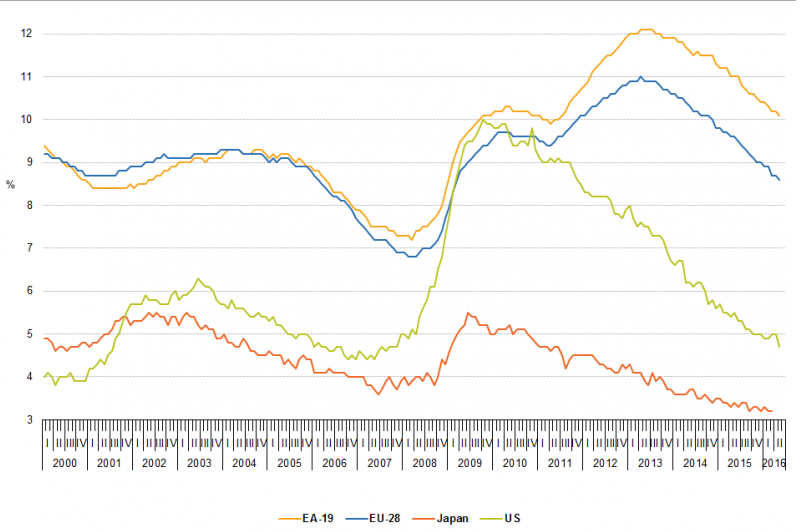

Similarly, the official EU unemployment rate which, having peaked over 11% in 2013, is reported to have fallen below 9%, its normal, albeit high, pre-2007 level (EU is EU-28 in the chart below, Eurozone: EA-19).

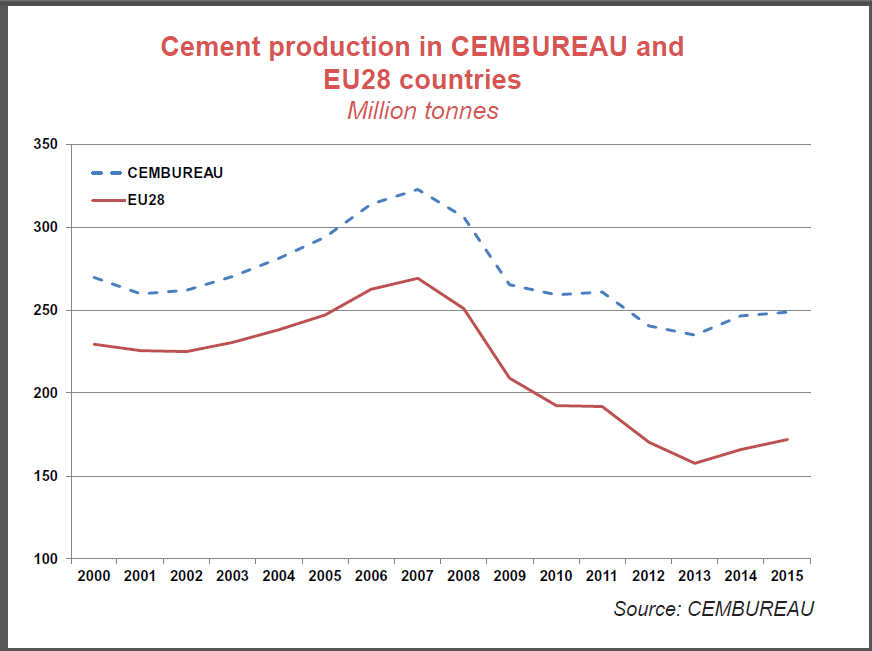

Yet it is difficult to reconcile these optimistic measures with more concrete measures of economic activity. Take for example, well… concrete itself. Cement production and consumption is a reasonably good indication of economic health in the area of construction. The more homes, factories, and infrastructure being built, the more cement being consumed, and the higher the economic activity.

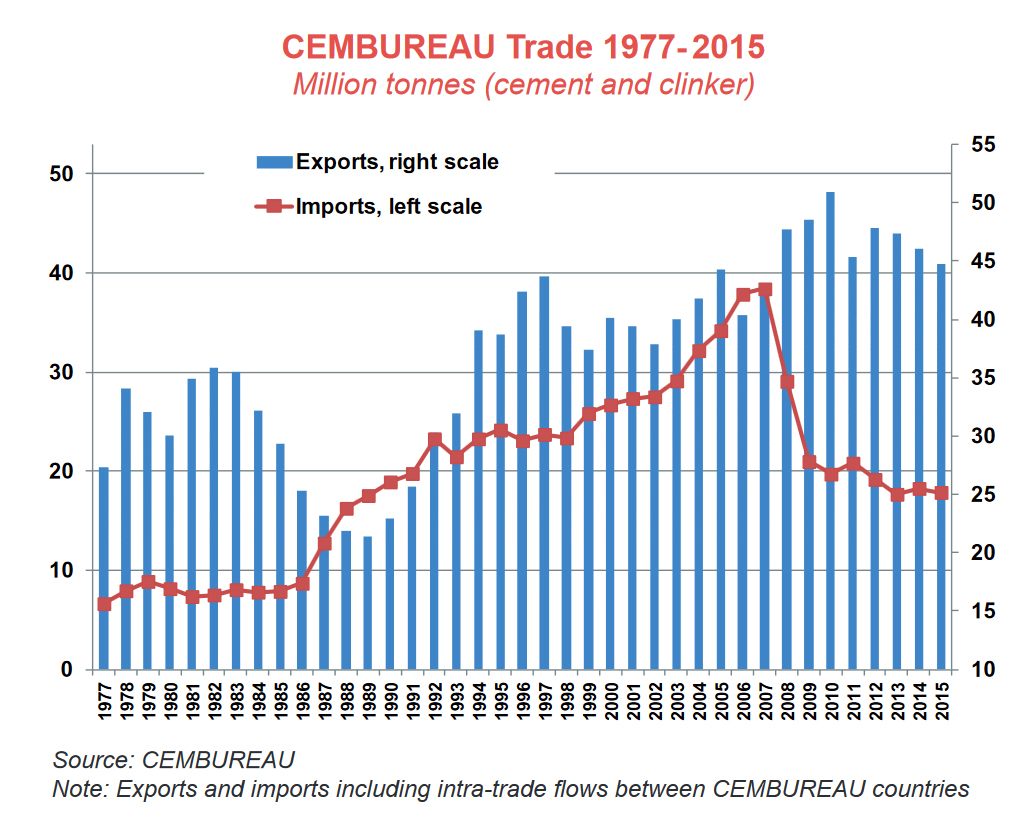

The charts below, courtesy of CEMBUREAU, show that cement production in the EU is still far lower than before the 2008 recession (The CEMBUREAU group shown the charts is the EU plus Turkey). Additionally, cement imports are declining and exports are higher than before the crisis. Taken together that means that the EU is consuming dramatically less cement than before the recession and the trend is continuing to decline.

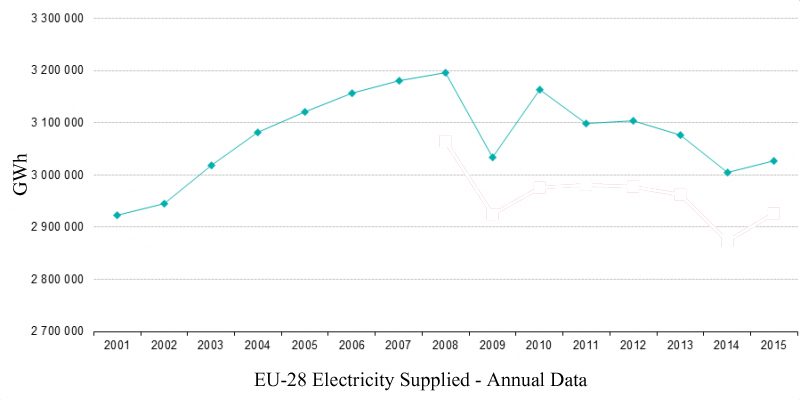

Another telling indication that the EU economy has not meaningfully recovered is in the amount of electricity supplied for all varying purposes in the EU, which is still below the 2009 recession lows, as shown below.

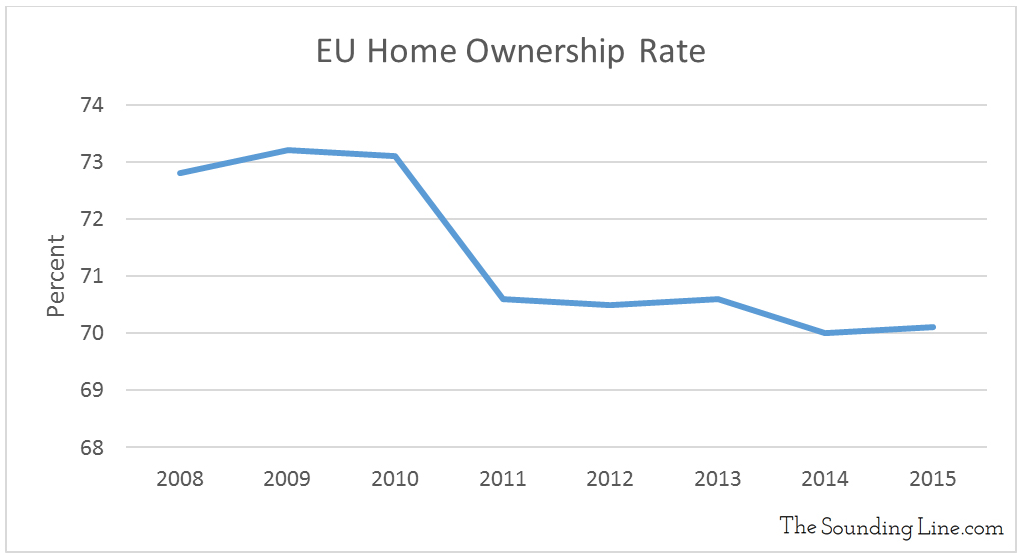

Yet another indicator correlated with the financial well-being of people, the home ownership rate, has not experienced a recovery since the 2008 recession.

The list of concerning measures goes on, but the point is straightforward. Healthy skepticism is warranted when someone points to an unemployment figure or a GDP growth rate of less than 2% as justification that an economy is improving. After all, an economy must grow faster than its population for the average person’s welfare to improve and in most of the EU’s largest economies that is simply not happening (see here). One can’t help but wonder if promoting a false confidence and putting off difficult but much needed reform is the best approach for the EU leaders to be taking. Based on the results of the Brexit vote, even their ‘good’ data did not hold any sway.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.