Taps Coogan – June 11th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

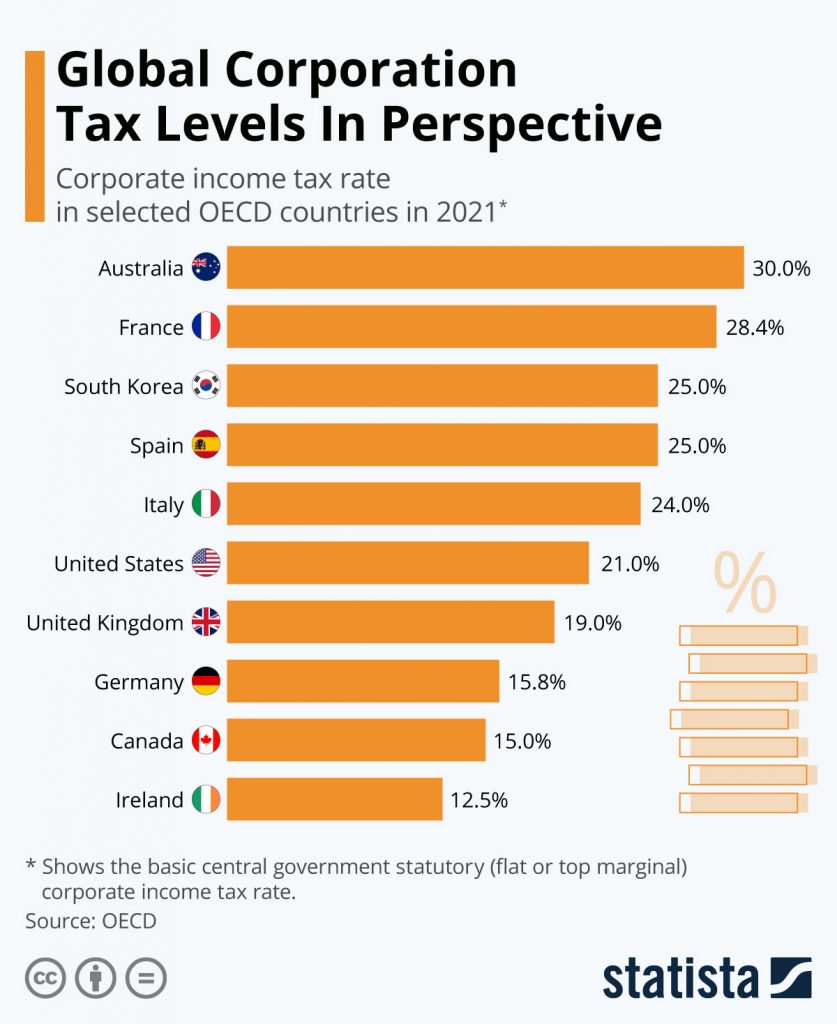

The following chart, from Statista, shows the corporate tax rate in several major developed economies around the world.

Before the prior administration’s corporate tax cut, the US corporate rate was 35% plus state taxes. That amounted to the highest rate in the developed world by a healthy margin, leading to a wave of high profile ‘corporate inversions’ whereby companies like Burger King, Medtronic, Johnson Controls, etc… moved to domicile in other countries such as Canada or Ireland to cut their tax bills.

Despite the high rate in 2017 (the tax cuts became active in 2018), corporate taxes only brought in $297 billion of revenue. In other words, in a year when the economy was booming, the stock market was surging, and the corporate tax rate was 35%, corporate taxes where responsible for just 9% of federal revenues. Corporate taxes funded just 27 days of federal spending for all 2017.

Since 2017, federal spending has roughly doubled and that’s before getting into the various trillion dollar ‘infrastructure’ bills under consideration. Corporate tax revenues are expected to be $283 billion this year.

That’s right, after cutting the rate from 35% to 21%, and despite spending much of the current year in various forms of lockdown with huge cohorts of businesses shuttered completely, we are likely to gather nearly as much in corporate taxes this year as we did in booming 2017 when the rate was 35%. Higher corporate taxes rates don’t necessarily equate to higher corporate tax revenues.

If the US raises its corporate rate to 28%, once state taxes are added back in, the US will have the highest corporate rate in the developed world once again. That will be doubly true when France finishes cutting its top rate to 25%.

Even if the entire world somehow agreed to raise their corporate taxes even higher, it’s all a drop in the ocean anyways. Corporate taxes are irrelevant.

This week the Senate passed a $250 billion spending bill. Just that bill, which includes $50 billion for the semiconductor industry alone, will consume nearly all corporate tax revenue this year. The Federal Government is guesstimated to spend $7.5 trillion this year, excluding any stimulus and ‘infrastructure’ bills to come, such as the $250 billion handout that just got passed. Corporate taxes are going to cover something like 3% to 4% of spending this year. That’s less than two weeks of spending. The federal government now spends about three times the amount of total corporate profits in the entire nation.

Instead of raising the corporate tax rate to 28%, we’d likely get more tax revenues by cutting the corporate rate to zero and allowing the economy to boom. Corporate taxes are a double tax anyways. Uncle Sam will get his cut when corporate profits are reinvested, distributed to shareholders, or otherwise used, and will likely end up collecting far more from the economic boom that would ensue from eliminating the corporate tax than they would from any corporate tax hike they could dream up.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Federal Revenue sources as a % of GDP over time would be a good measure.