Taps Coogan – August 6th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

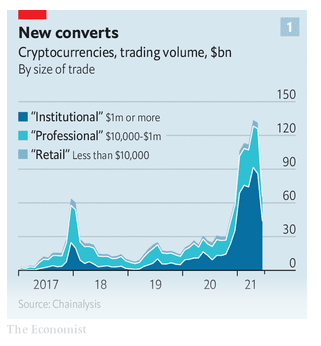

As the following chart from the Economist via Christophe Barraud, highlights, cryptocurrency trading volumes have effectively halved since the third round of stimulus checks ran out back in April-May. Bitcoin’s price is down roughly 40% since then.

It turns out that trading an asset with no revenue, dividend, or future income stream isn’t fun when its price isn’t going up.

Successful currencies are defined by how widespread their utilization is, not by how rapidly their price changes. Successful reserve assets are define by their resilience to declines in currencies’ purchasing power.

Bitcoin is not a currency (at least not a good one) and it’s not correlated to dollar purchasing power or inflation. It is a clever transfer mechanism.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Why would I spend a bitcoin if it’s ‘value’ could be double in a month?

Why would I accept bitcoin as payment if it’s ‘value’ could be half in a month?

Why do the bitcoin shills always tell you it’s ‘value’ in the very “toilet paper” fiat currencies they say it’s designed to replace?

My 3 basic questions.

Imagine a return policy in a world denominated in a volatile currency?

We live in opposite world…..the opposite of reality IS our reality.