Taps Coogan – December 27th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

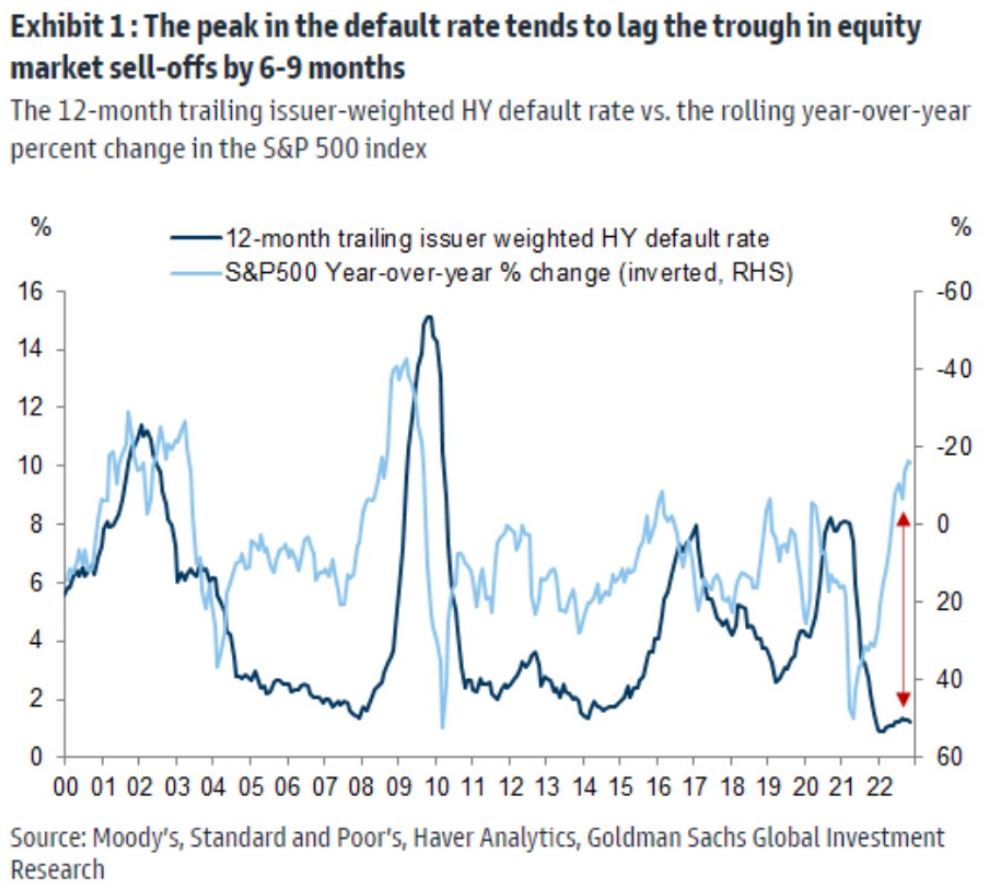

The following chart, from Goldman via Lance Roberts, highlights the delayed relationship between equity bear markets and high yield default rates.

The punchline is that declines in the S&P 500 have tended to lead increases in high-yield defaults by six months to a year. That portends a rise in defaults for 2023 which, given the sharp rise in borrowing costs and near-universal expectations of a recession, seems pretty plausible.

Of course, watchers of junk bonds will note that yields have already risen pretty dramatically. The BofA broad high yield index is currently yielding over 8%, meaning a moderate increase in the default rate is arguable already priced into bonds bought today.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

>

Of course, watchers of junk bonds will note that yields have already

risen pretty dramatically. The BofA broad high yield index is currently

yielding over 8%, meaning a moderate increase in the default rate is

arguable already priced into bonds bought today.

Those watches only look at the surface tho, when you look at returns from par on CUSIPs, the statistics are garbage… neg return from par, neg return skew, and return kurtosis on junk > 100. 85% unsecured. if anyone can pick up tail protection for pennies on the dollar now, you will make bank