Submitted by Taps Coogan on the 14th of February 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

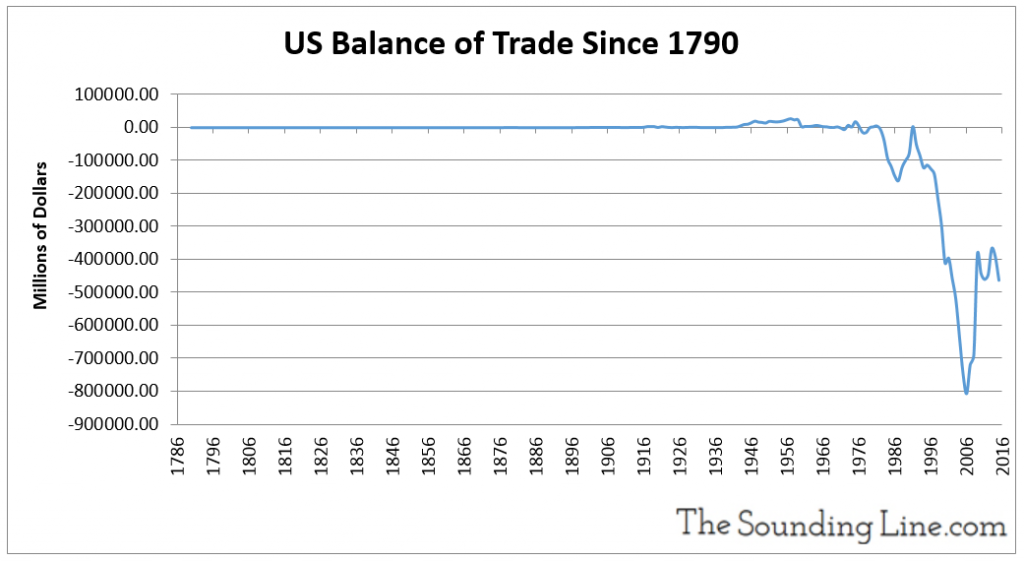

Piecing together data from a variety of sources, the following chart shows the approximate US balance of trade since 1790, shortly after the country’s founding. Negative values indicate a trade deficit, i.e. the US is importing more than it exports.

The US maintained very closely balanced trade for the first 200 years of the country’s history. It wasn’t until the early 1980s that the US made the stark shift to large perennial trade deficits. Since 1982 the US has run a cumulative $10.3 trillion in trade deficits.

In principal, large trade deficits should be self-correcting and multi-decade periods of trade deficits impossible. That fact that exactly such a multi-decade period has occurred since the early 1980s is just cause to review what has gone wrong.

When Americans import goods and services, they send US dollars overseas. In the case of trade deficits, more US dollars are sent overseas via imports than return to the US via exports. Thus trade deficits increase the quantity of dollars held by foreigners overseas. If the quantity of dollars overseas increases but the demand for US goods and services remains low, the value of the US dollar abroad should decrease. This weakening of the value of the dollar abroad makes US exports become cheaper, enticing foreigners to purchase more US goods. Thus changes in currency exchange rates can be caused by trade deficits and act as a natural feedback loop reducing trade imbalances.

So why has hasn’t this happened for the US?

Economists often point to the reserve currency status of the US dollar to explain why America has been able to sustain perennial trade deficits.

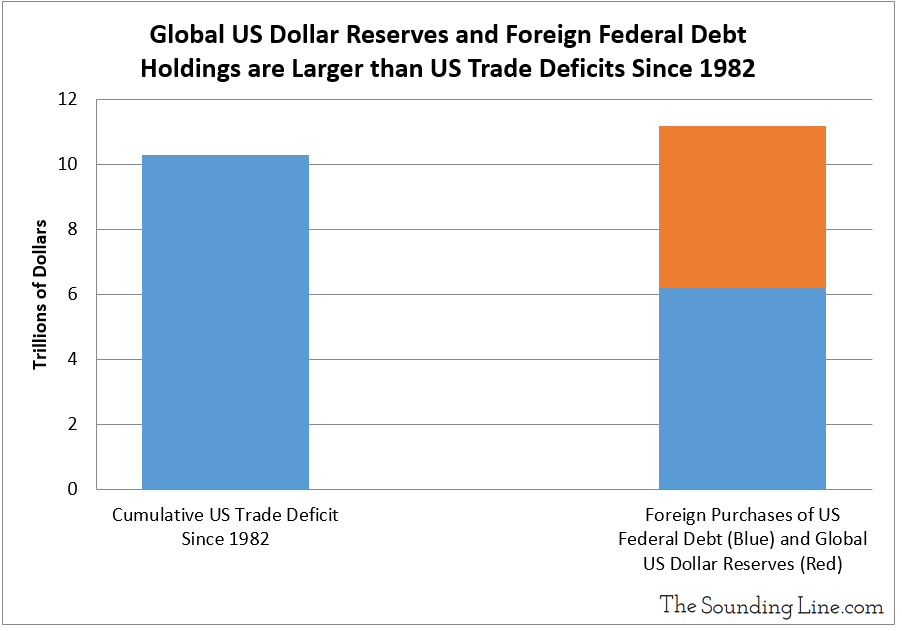

It is true that foreign governments and central banks have built up large reserves of US dollars. In 2015 the IMF estimated that approximately 5 trillion US dollars were held in reserve around the world (62.9% of all reserves here). By building reserves of US dollars, foreign governments and banks take US currency out of circulation overseas. This reduces the inflationary pressure of trade deficits. In a sense, the US dollar has become a top American export.

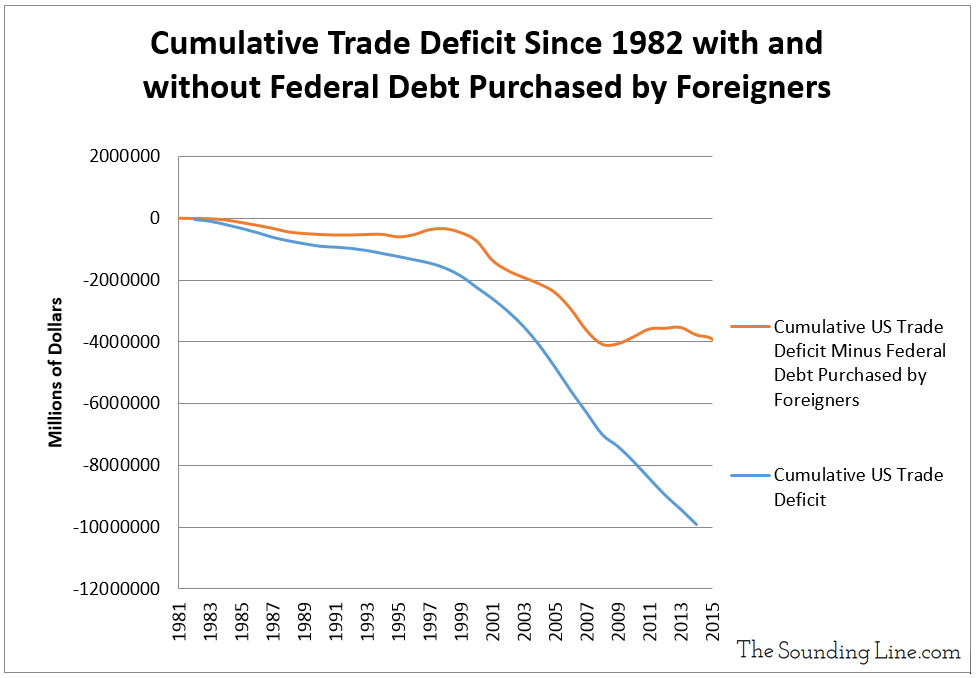

The US has accumulated more than $10.3 trillion in trade deficits since 1982. So while the $5 trillion buildup of foreign reserves has helped reduce the buildup of US dollars in circulation abroad, it is only half of the answer. There is still $5.3 trillion of cumulative trade deficits unaccounted for since 1982.

The missing piece of the puzzle is America’s enormous debt. America’s largest export is debt, which is not counted in official trade statistics. America has moved from the world’s largest creditor (lender) to the world’s largest debtor in less than 40 years.

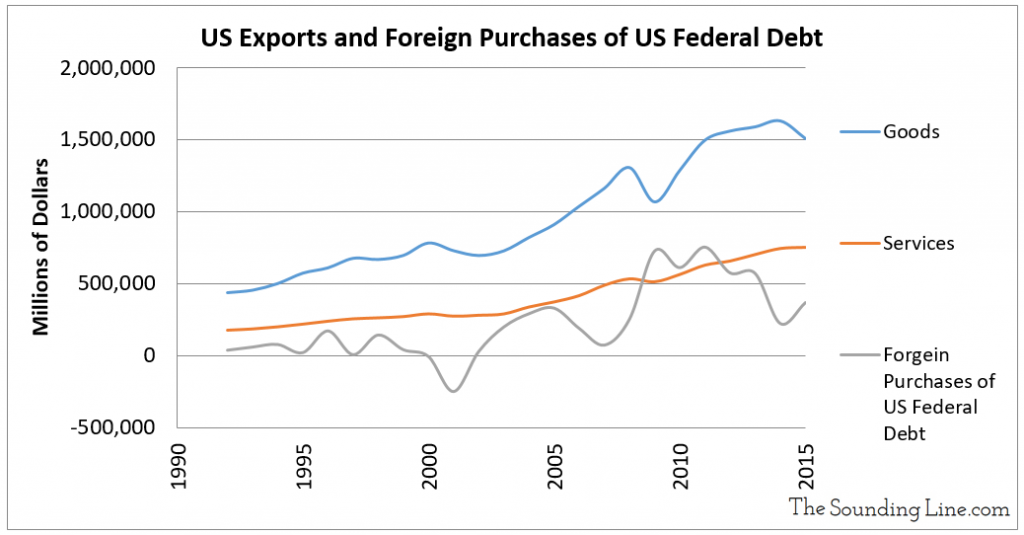

As of 2016, foreign investors and institutions have purchased over $6.2 trillion in US federal debt. In fact, federal debt has become America’s largest single export, occasionally surpassing all service sector exports combined!

In a tragic declaration of the state of the US economy, foreigners prefer to buy American debt than American products and services. The purchase of American debt by foreigners, combined with the buildup of US dollar reserves by foreign countries, has stopped US dollars from accumulating abroad and prevented the weakening of the US dollar which is needed to balance trade. If one counts US dollar reserves and debt as exports, the US has been a net exporter since 1982.

Because the US is in effect a net exporter, the US dollar has not weakened sufficiently and US trade deficits have grown. The trade weighted US dollar index, a measure of the US dollar against the currencies of the largest US trading partners, is stronger now than in 1980.

One can see how US trade deficits and US federal government budget deficit become two sides of the same coin. Budget deficits create and enable the export of US federal debt, which in turn prevents the US from balancing its trading deficit. If the US federal government ran a balanced budget and stopped issuing new debt, foreigners would likely purchase American goods and services in the place of debt. Conversely, if foreigners lost their appetite for US debt (which may be happening now) and the US balanced its trade deficits, the federal government would have a much harder time financing budget deficits. Instead of goods and services, America has exported the servitude of its future generations, servitude which will be required to service debt which has gone to finance a bloated government. It’s a bad deal by all accounts.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.