Submitted by Taps Coogan on the 16th of May 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

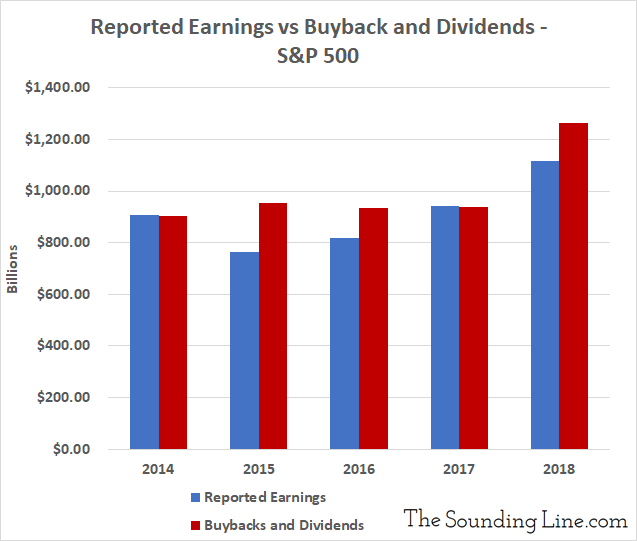

According to the latest figures from S&P Global, companies listed on the S&P 500 spent more on dividends and buybacks in 2018 than they actually made in total reported earnings ($1.26 trillion vs $1.1 trillion). In fact, for the last five years, dividends and buyback have exceeded cumulative earnings by $445 billion or roughly 10%. Buybacks alone have averaged 66% of reported earnings over the last five years and equaled 72% of earnings in 2018. 444 of the 500 companies listed on the S&P 500 repurchased shares in 2018.

To further put the enormous scale of buybacks and dividends into perspective, since the end of 2014, dividends and buybacks have actually exceeded the total increase in S&P 500 market capitalization by $1.3 trillion or roughly 47%. Buybacks alone represent 87% of the increase in S&P 500 market capitalization during that period.

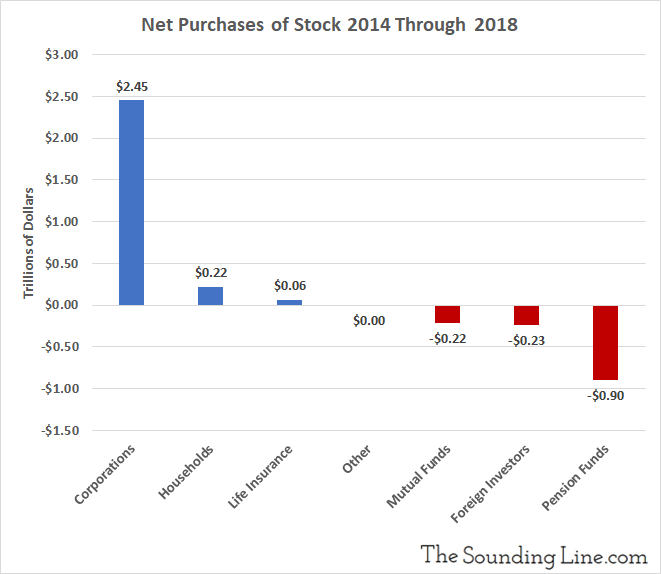

Is anyone a net buyer of stocks, other than companies themselves? Based on recent research from Goldman Sachs, the answer to that question is basically ‘no.’ Goldman analyzed net stock purchases from 2014 through 2018, including ETF purchases, and determined that corporations had purchased a net $2.4 trillion of their own shares. Combined, all other classes of investors sold a net $1.07 trillion. For five years running, the only significant net buyer of shares has been corporations themselves.

Whether explicitly debt financed or not, massive buybacks are only possible in a world where companies have a limitless supply of cheap credit. That allows them to spend more than all of their earnings on dividends and buybacks (which don’t deduct from reported earnings) and never have to worry about saving for future investment, paying down debt, or a rainy day.

The enabler of the cheap credit that is propping up the only significant net purchaser of stocks is easy monetary policy. It’s yet another reminder of just how much of today’s markets boil down to interest rates and central banks.

Companies are aware of just how important their buyback programs are to their share prices and it’s hard to see them stopping unless the cost of borrowing forces them to do so. It’s hard to imagine central banks letting borrowing costs rise to that extent, and thus, its hard to imagine how this whole cycle, which is so obviously unsustainable, actually comes to an end. Whatever pushes borrowing costs that high will have to be something that central banks cannot stop, because history has shown us that they will certainly try.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

EXACTLY!! I’ve not seen the exact numbers before, but this proves out what we have thought to be true for the past few years. This is a bubble that’s going to pop soon, I’m afraid…

What lengths will central banks go to in order to forestall it though