Submitted by Taps Coogan on the 23rd of March 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

In the coming days, Congress is likely to grant the Federal Reserve the authority to directly purchase long dated corporate bonds in response to the ongoing market turmoil. It is a terrifyingly bad idea. If the Federal Reserve is permitted to do with corporate bonds what they have done with treasuries, what is left of America’s free-market dynamism will die.

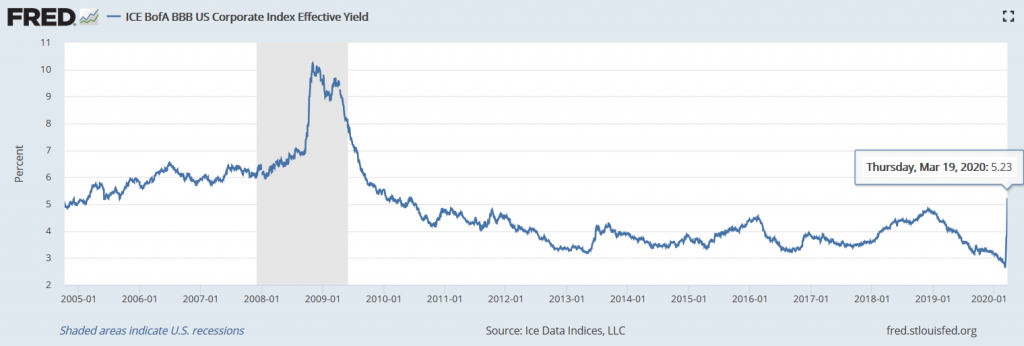

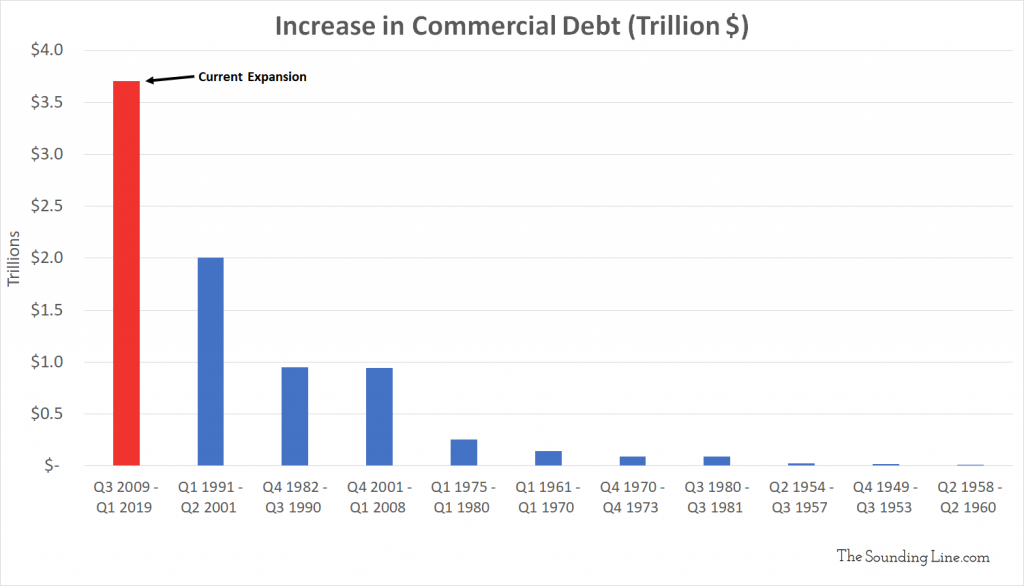

There is no arguing that the corporate debt markets are now under strain. 80% of leveraged loans are now distressed and both BBB and junk bond yields have blown out to their widest levels in a decade. However, while corporate bond yields have jumped, they are still nowhere near their Global Financial Crisis (GFC) highs. The problem is not the level of corporate bond yields. The problem is the amount of corporate debt.

By any relevant metric, the increase in corporate and commercial indebtedness since the GFC has been the largest in history. Piggybacking off of the Fed’s suppression of interest rates, companies have gorged on debt. The result is that a rise in ‘investment grade’ BBB rated corporate bonds to barely 5% is now apparently an extinction level event for financial markets.

What Congress and the Fed are proposing to do is not a backstop of short term corporate paper markets. The Fed is already doing that. It also should not be confused with restarting the Term Asset-Backed Securities Loan Facility (TALF), though the Fed is likely restart the TALF as well. It also shouldn’t be confused with the Primary Market Corporate Credit Facility (PMCCF) or the Secondary Market Corporate Credit Facility (SMCCF) that the Fed will be financing and which will be buying corporate bonds, though not directly on the Fed’s balance sheet.

The Fed wants Congress to permit it to purchase long dated corporate bonds directly on its balance sheet as part of its QE program, much like the ECB already does. The Fed wants to print money and lend it to individual private companies for long periods of time at artificially low interest rates, entirely at its discretion. They want to directly manipulate the bond yields of individual companies. Don’t take my word for it. In a recent oped, Bernanke and Yellen both referenced the ECB and BOE’s corporate bond buying programs as models for the Fed to adopt.

Which companies will the Fed give free money to? Which companies will they allow to fail? How low should corporate borrowing costs be and for which companies? How much debt should they allow each company to carry? What if companies issue bonds to buyout competitors? What if a company defaults on the Fed? The Fed can’t answer any of these questions. That won’t stop them from showering America’s largest and most indebted companies with free cash.

Just as the “temporary” QE and interest rate policies that the Fed unveiled during the GFC ended up becoming permanent, so will the Fed’s plan to do the exact same thing with corporate bonds. It’s definitional. If the Fed must now buy corporate bonds because “investment grade” companies are so indebted that they can’t survive a temporary rise in borrowing costs without issuing long term debt, incentivizing them to take on more debt will just keep lowering the threshold at which the Fed has to buy more of their debt.

Indeed, the only reason to be lobbying for the right to directly buy corporate bonds on their own balance sheet is because the Fed buying them through an ‘external’ special purpose vehicle (SPV), like the PMCCF or the SMCCF, is inherently temporary. Extending those programs after the Coronavirus outbreak has passed will be controversial. Rolling over corporate bonds on their own balance sheet will not be.

Welcome to the perpetual bailout of Corporate America.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.