Taps Coogan – October 23rd, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

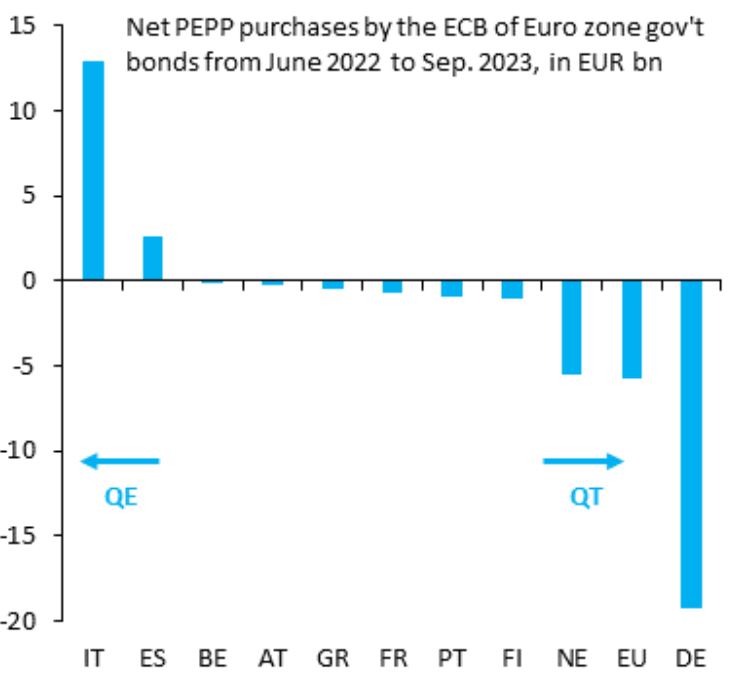

The following chart, from Robin Brooks, highlights how the European Central Bank’s (ECB) monetary policy has become a instrument of fiscal policy, in direct contradiction to its founding charter:

Founding principle for the ECB is separation of monetary and fiscal policy. That's why ECB QE was initially subject to the capital key, so it couldn't favor one country over another. But that went out the window in 2020. Now there's QE for some and QT for others. This must stop. pic.twitter.com/tbILqJabSf

— Robin Brooks (@RobinBrooksIIF) October 22, 2023

As we’ve been arguing since the very first days here at The Sounding Line, the Eurozone’s lack of a single consolidated debt equivalent to US Treasuries makes its monetary policy inherently prone to playing politics. Their charter was overtly structured to try and avoid this via the so called ‘Capital Key’ which requires that the ECB’s capital reflect the population and GDP of its member nations, not their fiscal choices.

The ECB is supposed to be specifically prohibited from buying Italian bonds to shield the nation from its profligate fiscal and economic choices, while selling German bonds. Yet, here we are; the ECB is doing exactly that. As Robin Brooks notes, it’s “QE for some and QT for others.” The ECB’s monetary policy has been captured by member countries’ fiscal policy, a self-reinforcing loop that will drive ever worse fiscal policy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I’m not a finance guy, so some of this is quite confusing. For example, why would the ECB do tightening with Germany? They’re in recession, energy prices are through the roof, & companies are moving manufacturing plants abroad. QE should be the order of the day to lower rates and promote spending, and it would work in Germany given their lower debt levels and reputation for spending prudence. As far as Italy is concerned, if the ECB didn’t buy their bonds, no one would at rates the Italians could afford. They need less dolce vita and more blood, sweat &… Read more »

They know they need to reduce their balance sheet overall, but they also can’t stop buying Italian bonds because they’re basically the only buyer. So they have to sell even more German bonds (or let them run off) so they can keep buying Italian.