Taps Coogan – December 1st, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

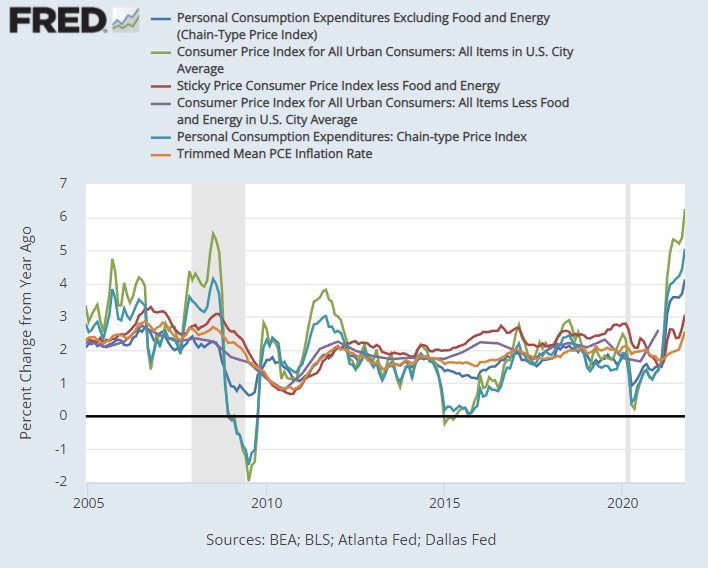

Only a handful of months ago, the Fed was dismissing rising inflation as a ‘base effect,’ a transparently flawed argument considering that not one official inflation metric went negative last year and considering that inflation was rising at a break-neck pace month-over-month, had exceeded the pre-Covid trend line by early Spring of this year, and the money supply had expanded by over 30%.

What a ‘Base Effect’ Doesn’t Look Like

As the ‘base effect’ argument fell apart, the Fed pivoted to ‘transitory’ inflation, implying that, even if inflation wasn’t a ‘base effect,’ it would go away on its own while the Fed continued to execute the most accommodative monetary policy stance in its history and Congress pumped out a new multi-trillion dollar spending bill every few months.

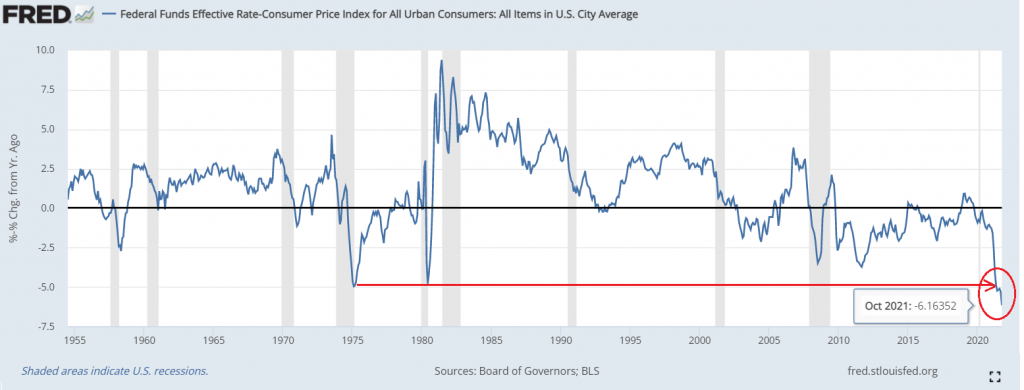

‘Real’ Fed Funds Rate Is the Most Negative on Record

Yesterday, during congressional testimony, Fed Chair Jerome Powell stated that it was time to “retire” the term transitory when referring to inflation. It’s the closest we’ll ever get to the Fed admitting that the narrative it pushed for the last year, and its resulting policy choices, were wrong.

Implicit in dropping the ‘transitory’ qualifier on inflation is an acknowledgment that inflation will only moderate when the Fed, the institution charged with preserving price stability, actually takes steps to preserve price stability.

Of course, during the period when the Fed insisted that it could continue to ‘print’ $120 billion a month to buy financial assets, keep rates pegged at zero, and encourage Congress and the Whitehouse to pass as many multi-trillion dollar deficit spending bills as possible, markets went through the roof.

So where does that put us now?

We’ve been stating for the best part of two years that whenever the Fed finally started to really worry about inflation was the time to start worrying about markets.

The good news for investors, at least in the medium term, is that the Fed is famously weak-willed when it comes to enduring market pain in order to ‘do the right thing.’ A 10% decline in the S&P 500, and who knows what excuse the Fed will use to justify more accommodation.

Furthermore, excessive debt and our aging demographics are deflationary. If the Fed ever gets around to seriously tightening policy, i.e. positive real benchmark rates, inflation will nosedive, giving the Fed space for a whole new round of accommodation.

So for now, the Fed is just going to quicken the pace at which it slows the pace of further accommodation. They are still going to ‘print’ $90 billion this month, and probably something like $60 or $70 billion next month, and probably something like $30 or $40 billion the month after that, and so on, and benchmark interest rates will still stay near zero for a long time. It’s hardly the end of the world. But make no mistake, this is the beginning of the end of the wildly reckless period in markets and monetary policy that we all just lived through.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

“But make no mistake, this is the beginning of the end of the wildly reckless period in markets and monetary policy that we all just lived through.”

Narrator: But as we know it was not the end. The accomidative madness of the 2020’s went on and on, until events forced the Fed to end it. The rest was mere jawboning….