Taps Coogan – July 25th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

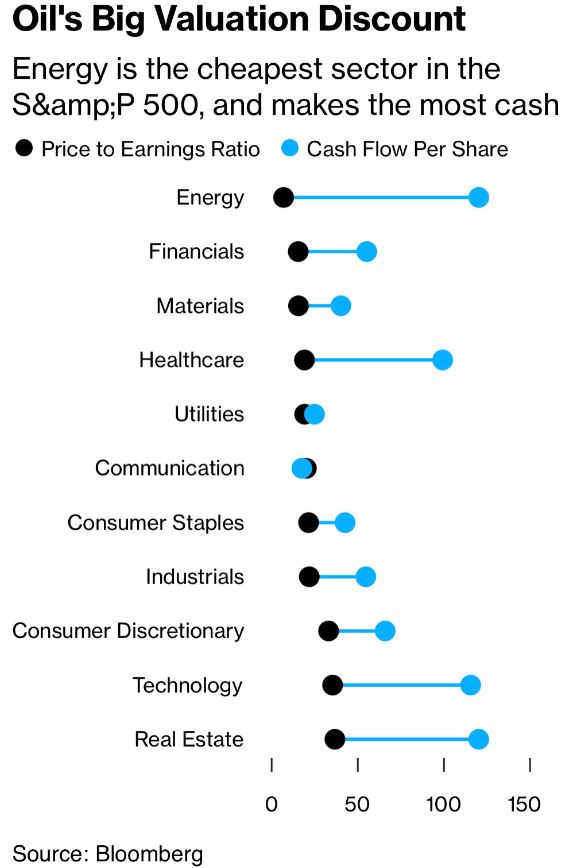

Despite sporting the highest cash flow per share of any sector in the S&P 500, the energy sector has the lowest price-to-earnings ratio, as the following chart from Bloomberg via Art Berman highlights:

Of course, it is very important to note that these PE and cash flow figures are based on trailing earnings that still include last year’s period of much higher oil and gas prices. At current oil and gas prices, Energy Sector financial performance will be much more modest, albeit likely still leaving shares looking somewhat ‘cheap.’

As always, what matters to the Energy Sector will be the future direction of oil and gas prices. In that department, yours truly continues to believe that the Russia oil price-cap scheme remains the single most important factor suppressing oil prices in the short term while leading to an accumulation of production cuts that will eventually be bullish. With signs finally emerging that benchmark Russian Urals is trading above the $60 price-cap, we may have finally reached the inflection point where the price-cap’s downward price pressure is insufficient to overcome tightening supply.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.