Taps Coogan – June 1st, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

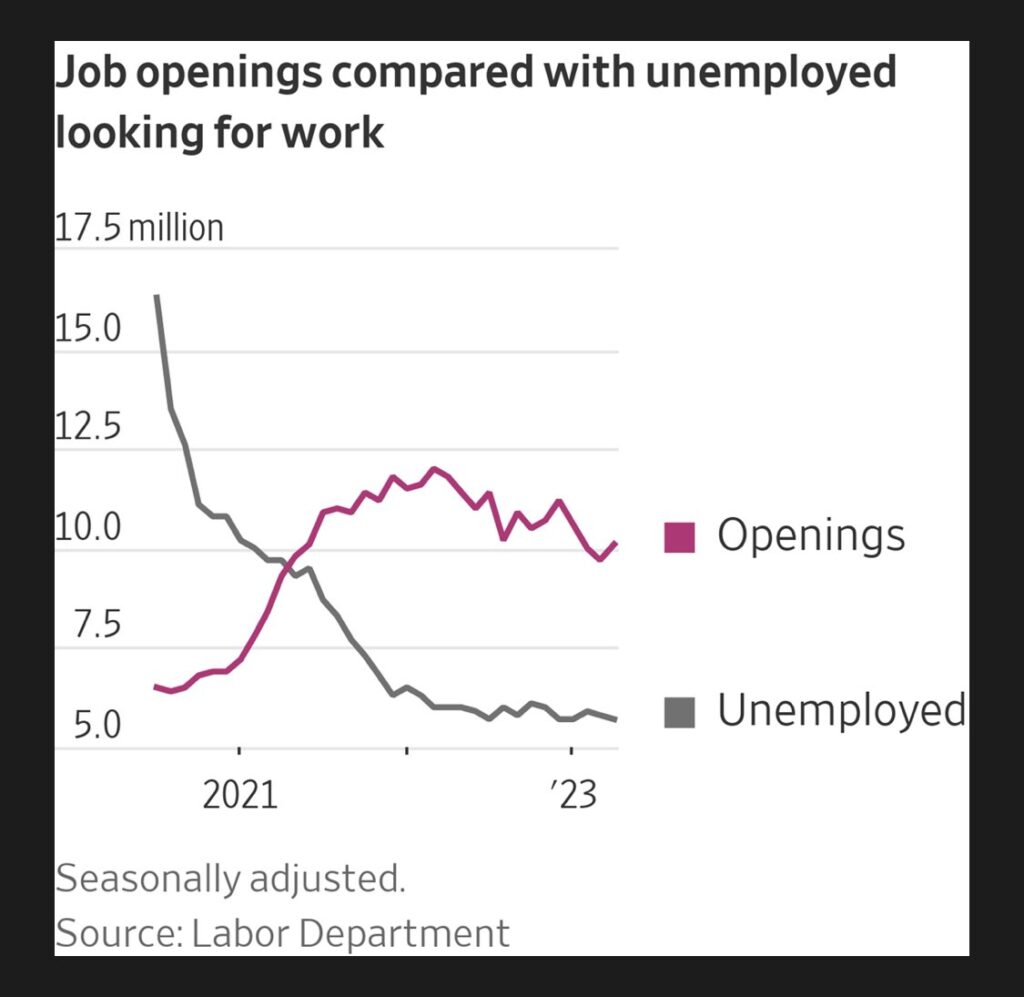

The following chart, from the Wall Street Journal via Mohamed El-Erian, highlights the better than expected job openings number for April. That April reading saw the number of job openings increase from 9.8 million in March to 10.1 million, more than expected and twice the number of job seekers (unemployed).

The chart above is further indication that tightness in the labor market continues.

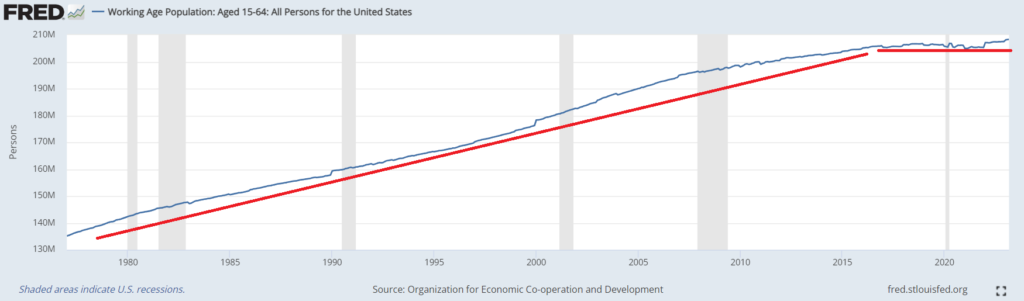

There is likely not a single explanation for such persistent labor tightness. The labor market was quite tight before Covid and, baring the lockdowns, it has become even tighter since Covid. Certainly some of the liquidity from the free-money giveaways of 2020 and 2021 is still creating excess demand and the money from the $2 trillion of stimulus spending that Congress approved after Covid (the IRA, infrastructure, and CHIPS bills) is just starting to hit the economy now. On top of that, Baby Boomers are hitting retirement age as growth in the working age population in the US grinds lower.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The next inflation wave will be in wages. Coming soon.

The youngest Baby Boomers are now 59 yrs old and about half their generation has left the workforce. They were the beneficiaries of the post WWII economic expansion that provided them with low-cost housing, college and more secure jobs.

With their passing I doubt these labor shortages are going to disappear absent a major recession/depression. Under a “normal” recession I wouldn’t expect unemployment to go up very much so upward pressure on wages will continue, esp. given the efforts to diversify supply chains out of China. Get used to the weirdness.