Submitted by Taps Coogan on the 3rd of June 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

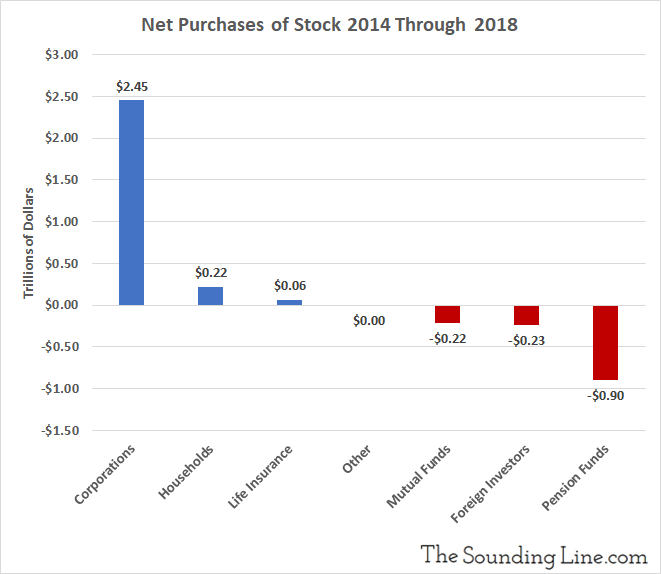

As we first discussed here, corporate stock buybacks have become the dominant force in US equity markets. From 2014 through 2018, corporations themselves were the only significant net purchasers of US equities, with S&P 500 buybacks during the period being equivalent in size to 87% of the increase in total S&P 500 market capitalization.

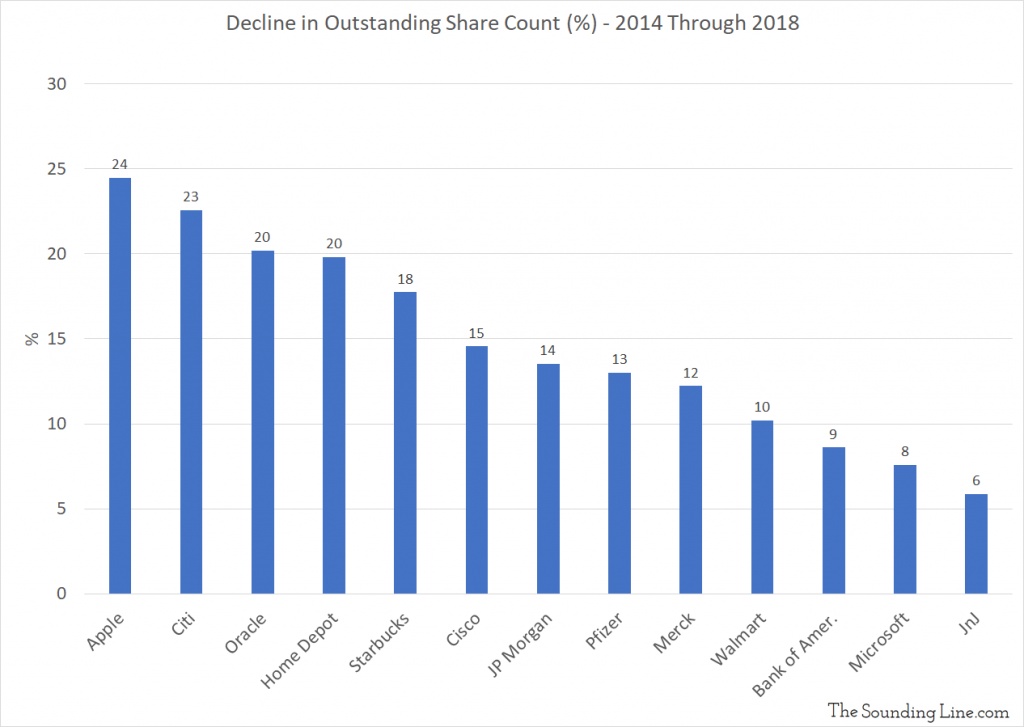

The following chart shows the rough percentage of outstanding shares that have been repurchased by some of the top ‘buyback companies’ from 2014 through 2018.

Double digit declines in the outstanding shares of many of the largest companies in the world are exaggerating, and in some cases entirely creating, bullish trends that mask a deeper weakness in market technicals.

Take Apple as an example. It’s share price went from over $79 at the start of 2014 to over $157 at the end of 2018, a roughly 98% increase. Yet during that period, Apple spent over $229 billion buying back almost a quarter of its outstanding shares. While the share price rose 100%, Apple’s market cap ‘only’ grew by 54%.

Then there is Citi Group. Citi’s share price rose from $52.02 at the start of 2014 to $52.12 at the end of 2018, a minuscule sub 1% return. Meanwhile, Citi spent nearly $47 billion buying back almost 23% of its outstanding shares. Doing so kept Citi’s share price positive, just barely, while its market cap actually fell from $150 billion to $128 billion.

Recall that, as a group, S&P 500 buybacks were 87% as large as the total market cap growth from 2014 through 2018. A meaningful portion of the bull market in US equities has nothing to do with rising corporate valuations and everything to do with a corporate balance sheet parlor trick enabled by plentiful and cheap credit.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.