Submitted by Taps Coogan on the 27th of March 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

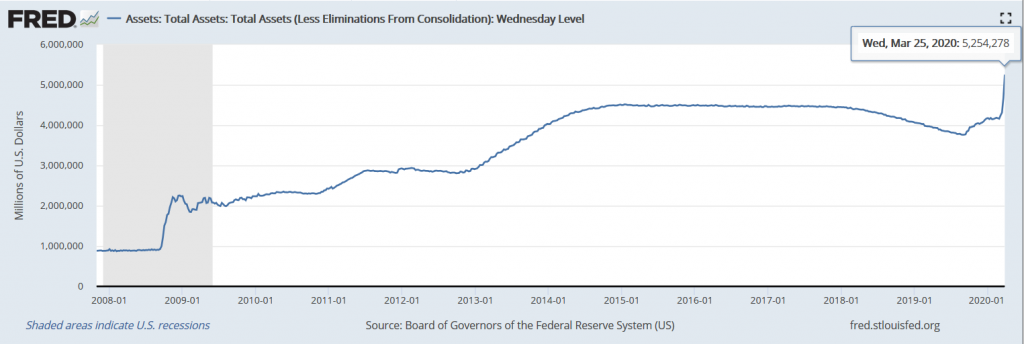

The Federal Reserve’s balance sheet has rocketed above $5 trillion for the first in history as it accelerates its largest liquidity injection ever.

As of Wednesday the 25th of March, the Fed’s balance sheet stood at $5.25 trillion, up roughly $580 billion in just one week, up $940 billion in the last two weeks, and up nearly $1.5 trillion since repo markets first blew out in September 2019.

Over the last week, the Fed has bought a whooping $337 billion of treasuries and $17 billion of mortgage backed securities (plus much more that haven’t settled yet). The Fed also made $80 billion in additional loans through its alphabet soup of special purpose vehicles which are busy buying corporate bonds and generally extending credit throughout Wall Street. It also made roughly $206 billion in central bank currency swaps.

As a point of comparison, during the worst part of the Global Financial Crisis, when the US had already been in deep recession for nearly a year and every large financial institution in the US was being bailed out, it took the Fed three months to grow its balance sheet by ‘only’ about $1.3 trillion.

How the Fed plans to walk back all this liquidity when the Coronavirus crisis eventually passes is a complete mystery. This is particularly true considering that it failed to meaningfully walk back the liquidity that it injected after the last crisis and it had a decade to figure it out.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Whether Powell succumbed to pressure from the President for not acting immediately or fear the coronavirus would take a toll on the economy is not clear. Regardless of what he says Fed Chair Powell has confirmed the Fed plans to continue its role as the great enabler. The ramifications of his actions show the Fed is a flawed institution at best. the article below argues that a rate cut is uncalled for at this time and it will also do little to strengthen the economy. What it will do is continue to prop up asset prices and encourage more risk-taking… Read more »