Taps Coogan – November 11th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

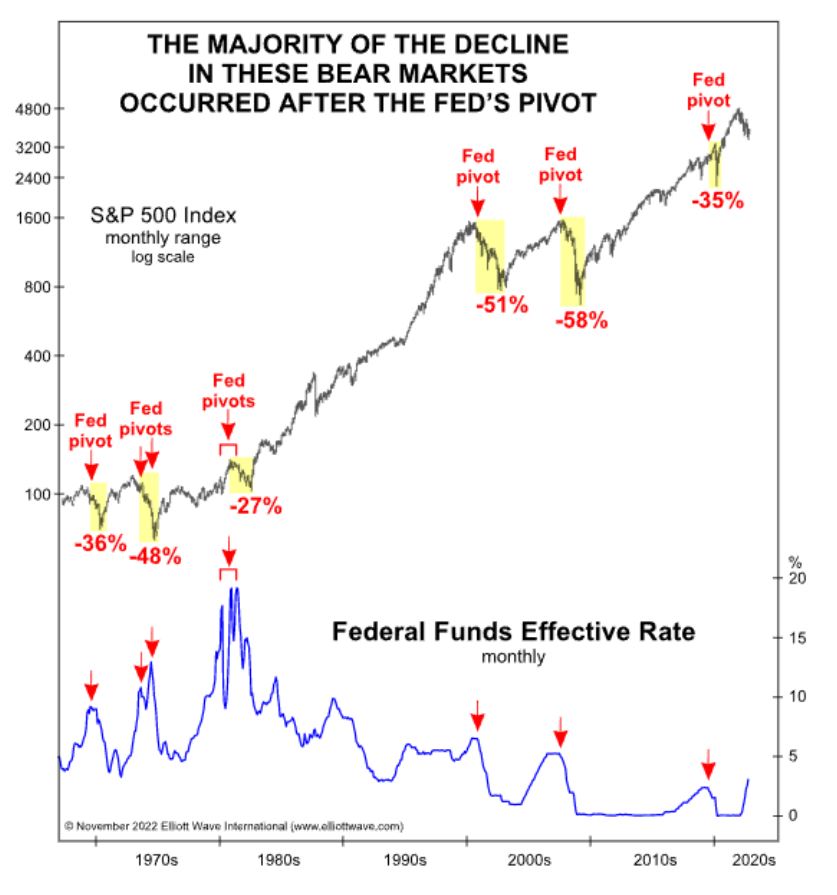

Despite markets’ elation due to yesterday’s better-than-expected CPI print, it’s worth remembering that Fed pivots are almost always harbingers of ‘bad times’ for markets not good times, as the following chart from Elliot Wave via Thomas Thorton highlights.

Slowing the pace of rate hikes and continuing QT isn’t a pivot. A pivot will be when the Fed switches to cutting rates and QE.

Even a rapid decline in inflation would likely still take the best part of year to get back to 2%. During that time the best that can be hoped for is an eventual ‘pause’ on hikes and a continuation of QT.

The Fed hasn’t allowed markets to unwind this much without a pivot in a generation. While a rally on a better than expected CPI print after 11 months of bearish action is entirely reasonable, dropping inflation is part of the progression to recession. The Fed should have started slowing the pace of hikes months ago.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.