Taps Coogan – June 19th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

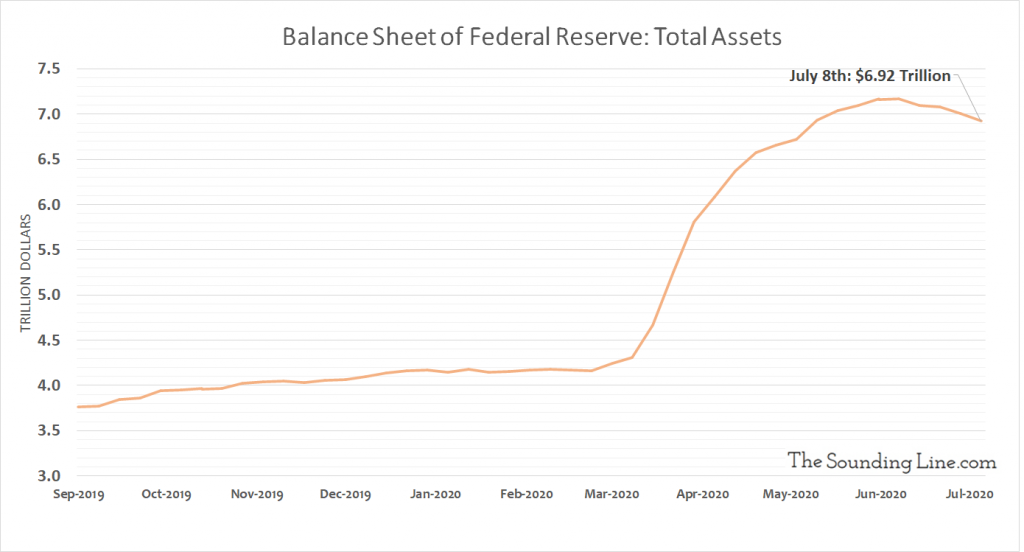

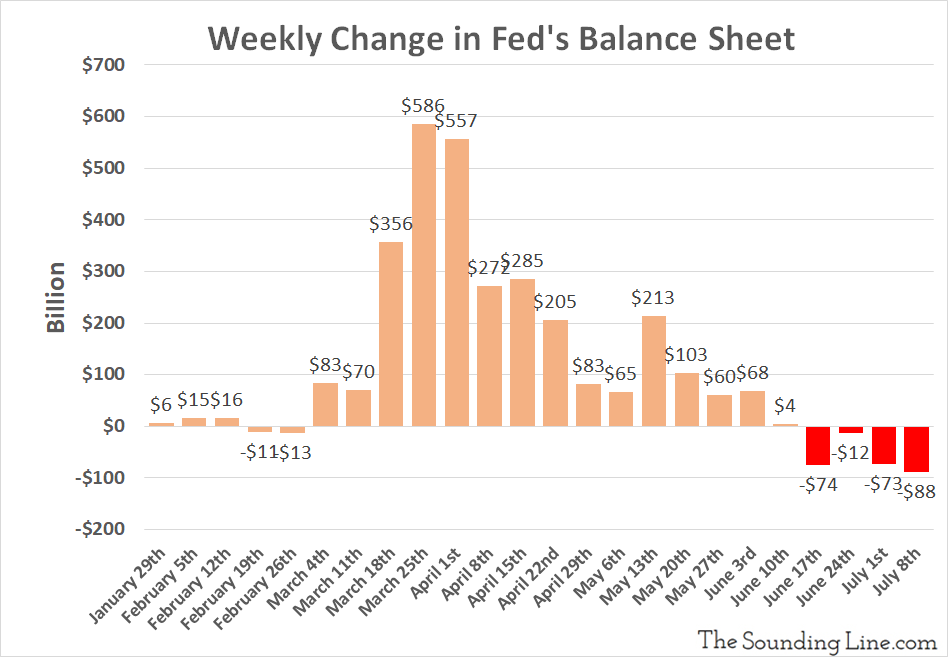

For the seven day period ending July 8th, the Fed’s balance sheet shrunk by $88 billion, the fourth consecutive week of shrinkage. All told, the Fed has now retracted $248 billion of liquidity from financial markets since its balance sheet peaked at $7.17 trillion four weeks ago. Its balance sheet now stands at $6.92 trillion.

The two mainstays of the Fed’s balance sheet, treasury debt and mortgage-backed securities (MBS), remain more-or-less on autopilot. The Fed increased its treasury debt holdings by a standard $18 billion this week whereas its MBS holdings increased by just $20 million. Due to the lumpier nature of MBS repayments and the fact that the settlement of trades takes months, week-to-week MBS levels on the Fed’s balance sheet have been erratic, but are likely to continue to rise. Treasuries and MBS purchases are the bread and butter of the ‘traditional’ QE programs that we’ve seen since the Global Financial Crisis.

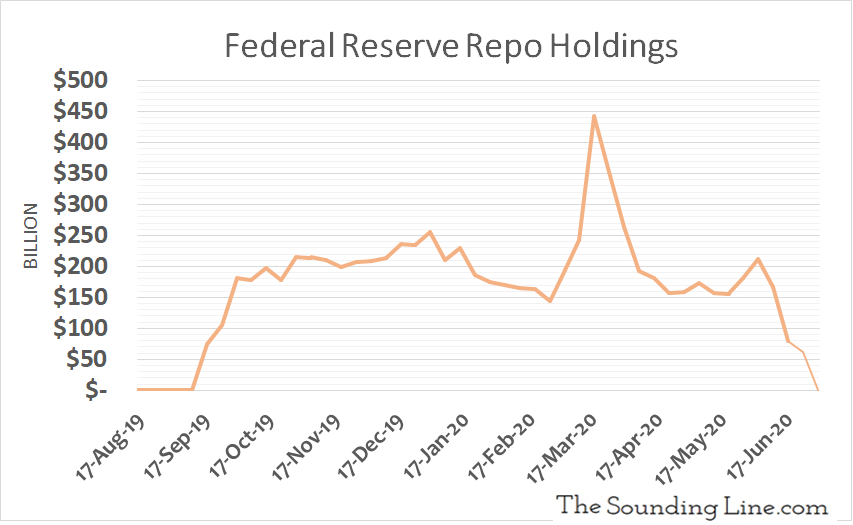

On the other hand, the more crisis-centric assets on the Fed’s balance sheet are rolling off. Remarkably, the Fed has now shed all of its repurchase agreements, which fell from $61 billion to zero this week.

The repo crisis, which started in September 2019 as the Fed tapered its balance sheet and excess bank reserves dwindled amid a torrent of debt issuance, is officially over, at least for now. With bank excess reserves now at a record $3 trillion, they simply don’t need to borrow reserves from the Fed. It’s amazing what a $1.7 trillion liquidity injection can do for bank balance sheets…

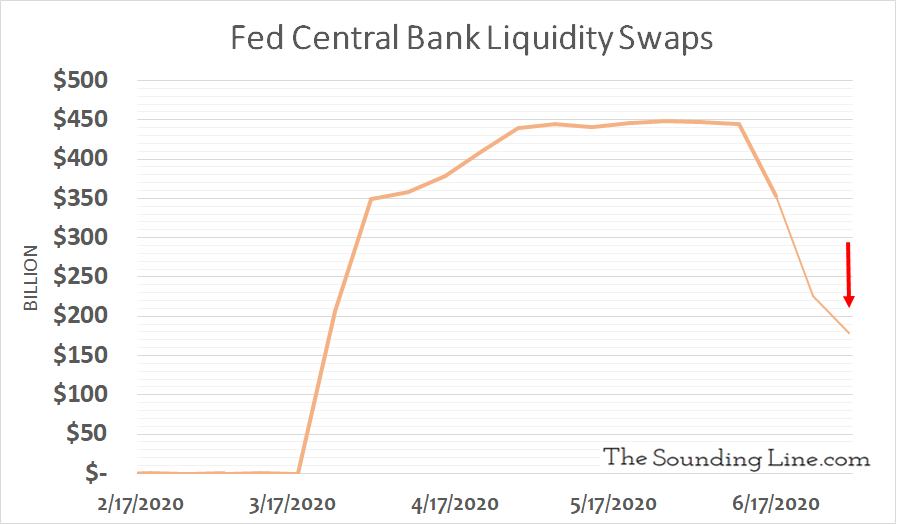

The Fed’s central bank liquidity swaps also fell by $46 billion this week to $179 billion, less than half of their peak level.

The Fed also reduced its loans to its alphabet soup of Special Purpose Vehicles (SPVs) by about $3 billion to $93 billion and bought another $704 million of commercial bonds through its Corporate Credit Facilities.

Where the Fed is heading

The Fed’s approach to this crisis has been to very aggressively front-load its stimulus and throw money at every corner of financial markets quickly, with the hope that doing so will allow it to normalize more quickly and avoid the years and years of QE that followed the Global Financial Crisis. Consistent with that approach, the Fed is now winding down some of the more crisis-oriented assets on its balance sheet.

Here is the rub. With its repo holdings down to zero, there are only $179 billion of liquidity swaps and $93 billion of SPV loans to shed off of its balance sheet before it has to tackle the question of what to do with its truly core assets: treasury holdings and MBS. It is paramount that the Fed keep supporting those markets if they want benchmark interest rates to remain low, especially with the need to finance multi-trillion dollar federal deficits for the foreseeable future. Doing so will likely require a more-or-less permanent traditional QE program. The current pace of roughly $18 billion of net treasury purchases per week amounts to about $80 billion a month or nearly $1 trillion of treasury purchases a year, the equivalent of a full blown QE program. Add on top of that a roughly equal amount of MBSs.

The other problem is that since the Fed’s balance sheet stopped expanding four weeks ago, the face-melting rally in stocks has flattened out completely. Can markets really tolerate another three or four weeks of belt tightening as the Fed sheds the rest of its liquidity swaps and pairs down its SPVs?

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.