Taps Coogan – October 11th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

At the end of September, the Fed’s use of reverse repos to drain liquidity out of the Fed Funds market hit a record $2.4 trillion.

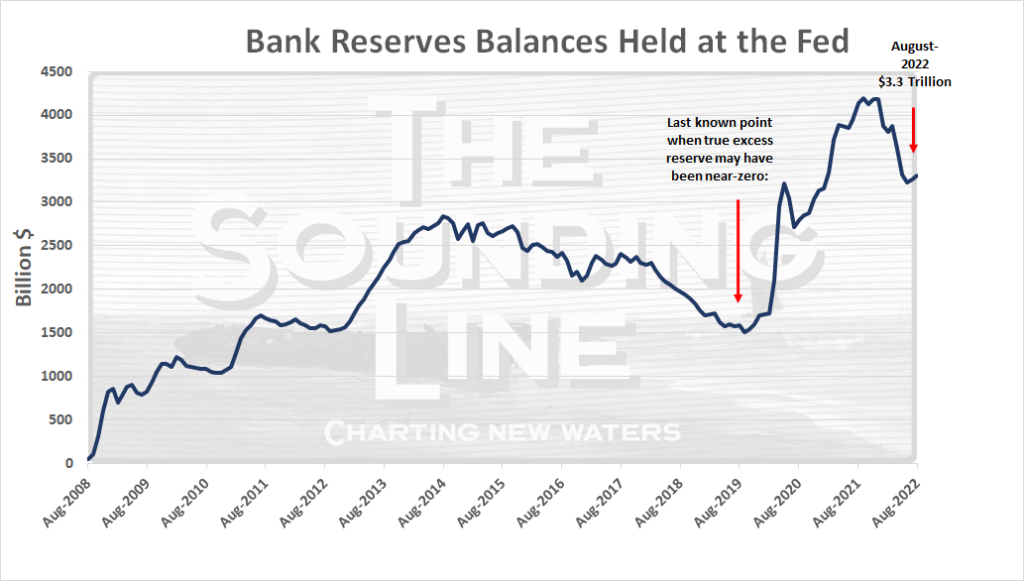

This is happening because commercial banks are still likely holding more than $1.5 trillion dollars of ‘excess reserves.’

We can’t say exactly what the level of excess reserves is because the Fed no longer reports ‘excess reserves’ separately from ‘required reserved.’ That’s because the complicated post-Global Financial Crisis regulatory landscape blurred the distinction between the two.

While nobody knows exactly what portion of bank reserves are in excess of requirements, we can guestimate based on the Fed’s tightening cycle from 2018-2019. Back then, the level of reserves was somewhere around $1.5 trillion when the Fed had to give up its QT program due to liquidity issues.

In the excess reserves regime that the Fed created via way too much QE after the Global Financial crisis, most big banks don’t rely on the Fed Funds market for funding. They already have large excess reserves.

While the distribution of excess reserves is not uniform among financial intuitions, in a big picture sense, the Fed Funds rate is no longer serving as an interbank lending facility. Instead it’s an incentive policy for the Fed to draw liquidity away from bank lending and a duplicative one at that. It is essentially the same thing as the Fed’s policy of paying interest on reserves policy (IORB), both of which offer nearly an identical rate and serve essentially the same function in an excess reserves would.

Instead of raising the Fed Funds rate in order to tighten liquidity conditions, which just pays banks to move excess bank reserves from one risk-free short-term market to another, the Fed needs to eliminate the excess reserves. Doing so will raise the Fed Funds rate all by it self and make the rate a more market determined rate. As an added bonus, it will raise savers’ deposit rates and allow the Fed to end the practice of paying banks to do nothing with money the Fed gave them.

In other words, the Fed should prioritize QT over more rate hikes.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

“allow the Fed to end the practice of paying banks to do nothing with money the Fed gave them”

Is the FED paying interest to those banks on money the FED gave them? If so, how is that legal? Sounds like a crime to my ears.

Yes the Fed pays interest on reserves. Banks got trillions of dollars of excess reserves by selling MBS and treasuries at inflated prices to the Fed via QE and the Fed now pays them the Fed Funds rate or the IORB rate to park it at the Fed or in the Fed Funds market which is, at this point, the same thing.