Taps Coogan – January 31st, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

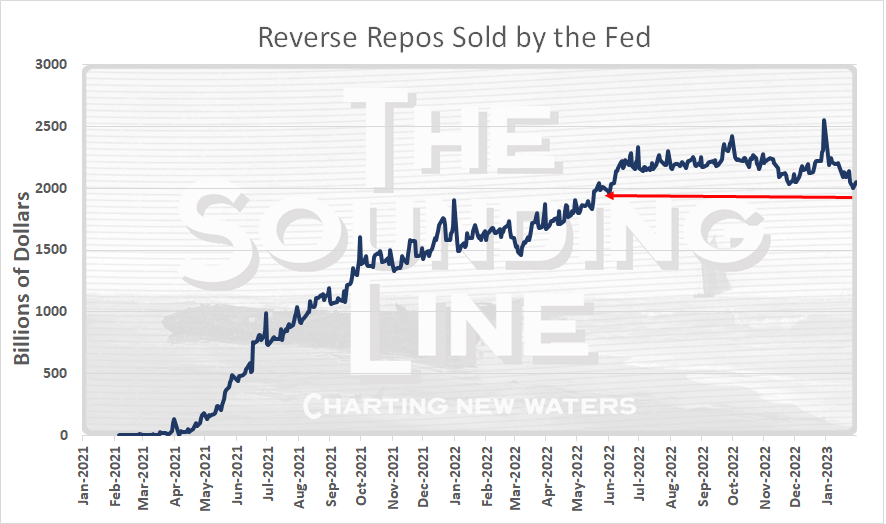

The quantity of Reverse Repos sold by the Fed is the vantage point we most prefer to judge how much excess liquidity the Fed has succeeded in draining out of overnight markets via quantitative tightening (QT).

The true level of ‘excess’ bank reserves has becoming hard to ascertain in the post-Global Financial Crisis regulatory environment, so watching reverse repos is the simplest way to know if QT has drained sufficient excess liquidity to have a tangible impact in overnight funding markets.

Judging by the chart above, which shows that the amount of reverse repos being sold by the Fed remains near its all time highs, QT still has a very long way to run.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.