Submitted by Taps Coogan on the 8th of May 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

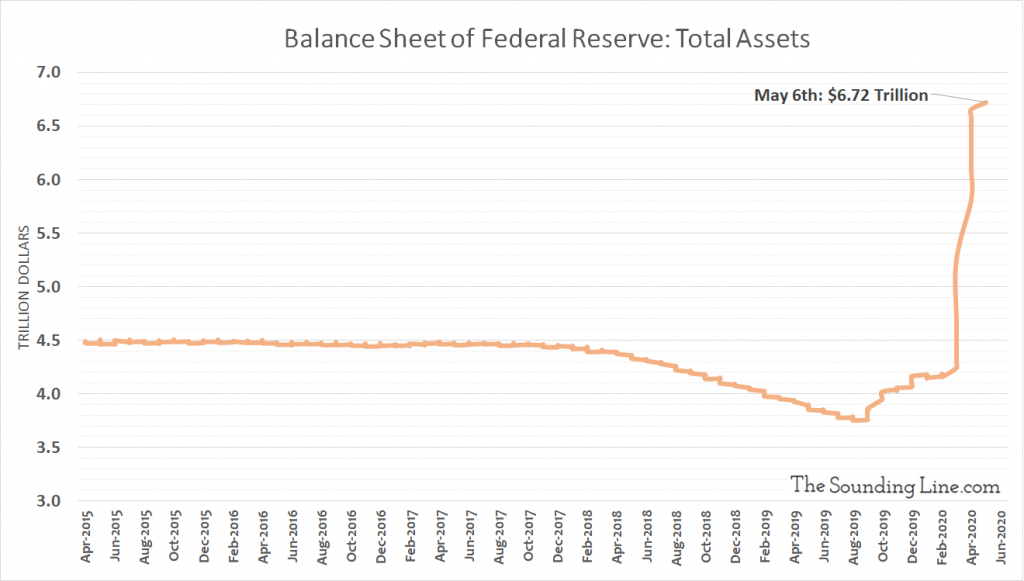

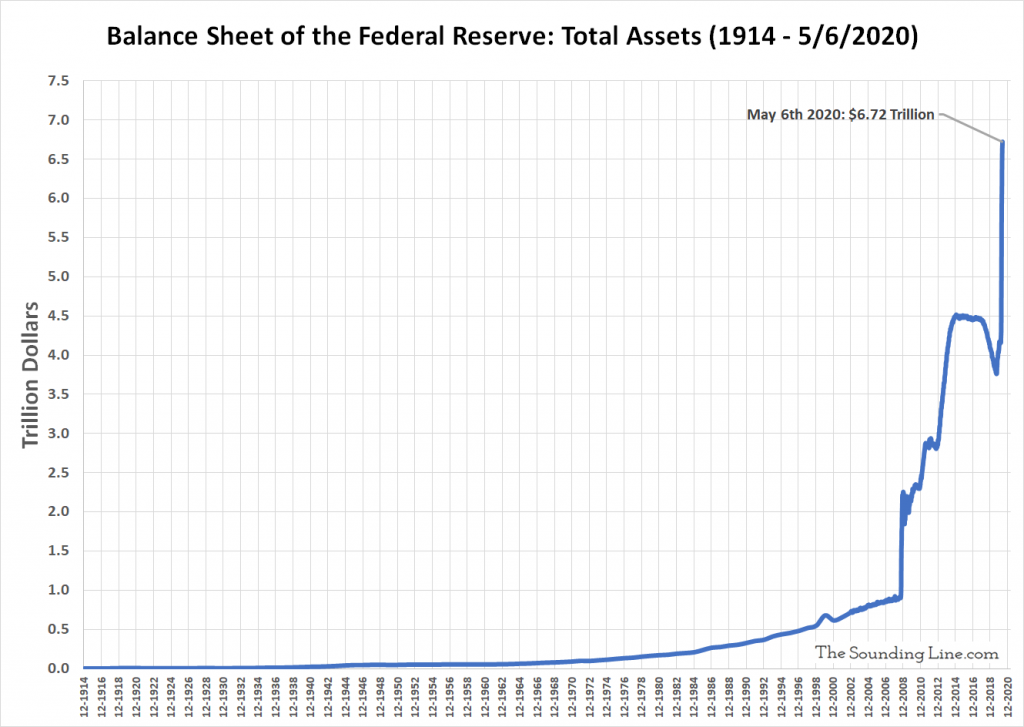

Data released last night (May 8th) reveals that the Federal Reserve’s balance sheet grew by another $65 billion over the past seven days. That growth represents a continued slowdown compared to the pace of recent weeks. Nonetheless, the Fed’s balance sheet still grew faster during the last seven days than it grew during a typical month of ‘Not-QE‘ prior to the Coronavirus crisis.

The bulk of the growth in the Fed’s balance sheet is a result of buying roughly $48.7 billion of treasury securities, another $14.5 billion of repos, and another $5.9 billion of central bank liquidity swaps.

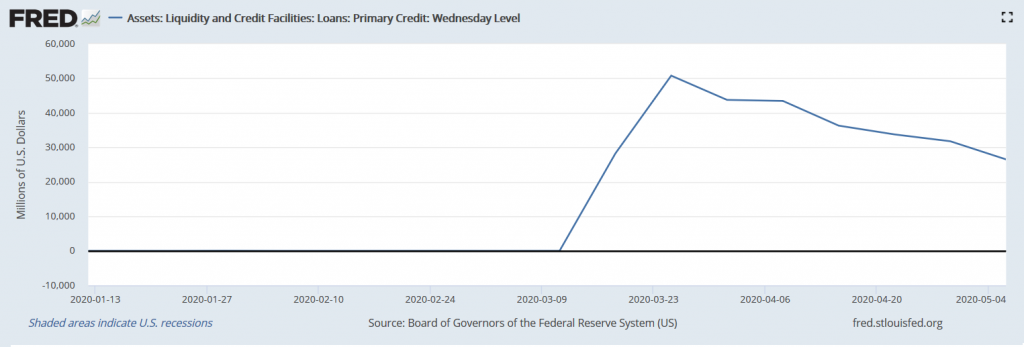

On the other hand, the Fed reduced its loan balance to its alphabet soup of special purpose vehicles (SPVs) by $9.6 billion. Of those SPVs, the Primary Market Corporate Credit Facility balance shrunk by $5.4 billion, as some of its loans were repaid. The Primary Credit Facility (PMCCF) has bought corporate bonds and syndicated loans directly from issuers.

The Fed is yet to fund the Secondary Credit Facility (SMCCF), which was designed to buy corporate bonds, bond ETFs, and junk bond ETFs in the secondary market.

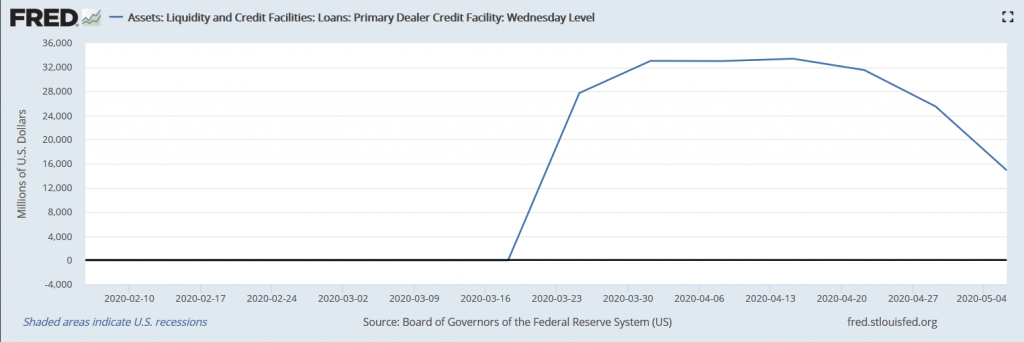

The Primary Dealer Facility, which lends money to primary dealers, has seen its balance shrink by roughly $10.9 billion over the past week as dealers have repaid loans.

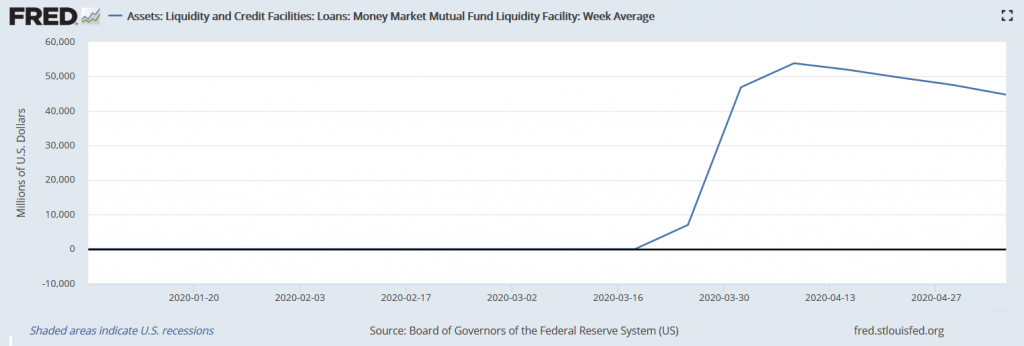

The Money Market Mutual Fund Liquidity Facility, which has bought commercial paper in order to backstop money market funds, has seen its balance shrink by about $2.8 billion over the past week.

The Payroll Protection Liquidity Facility, which was designed to let banks facing lending restrictions pass their Payroll Protection loans on to the Fed, has seen its balance grow by about $9.6 billion.

All-in-all, it appears that the Fed is starting to moderate its massive monetary response to the ongoing economic crisis and is reverting back to a more ‘traditional’ form of QE: buying large amounts of Treasury securities and funding the massive federal deficit.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.