Submitted by Taps Coogan on the 29th of May 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

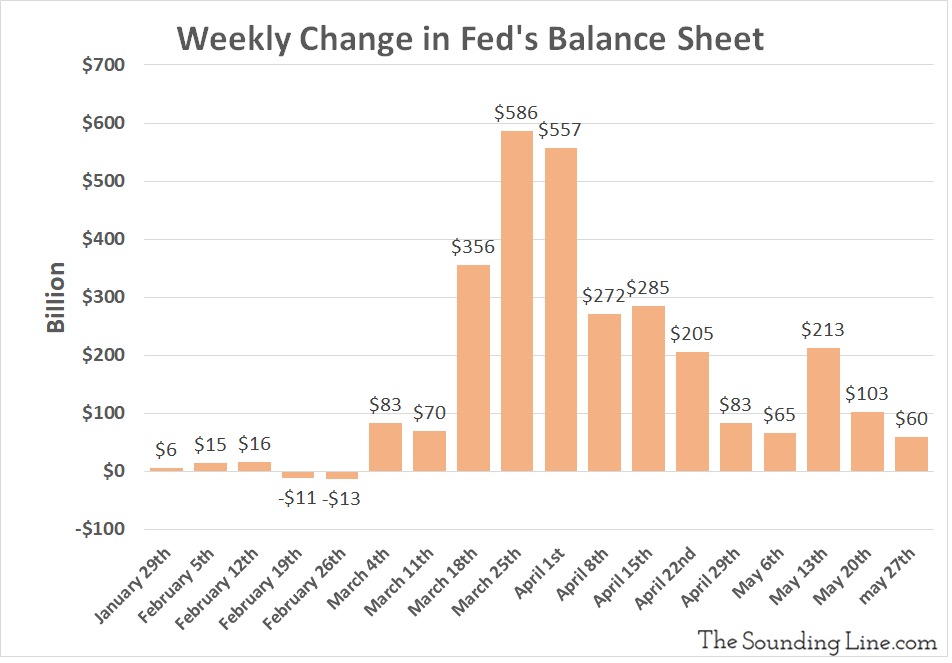

The past seven days (ending Wednesday the 27th) have seen the first truly large scale funding of the Fed’s corporate bond buying facilities. This week, those facilities were funded to buy roughly $33 billion of corporate bonds (and bond ETFs), compared to just $1.4 billion in prior weeks. The Fed also increased its commercial paper facility holdings by $8.5 billion to a total of $12.8 billion.

The $33 billion of corporate bond and bond ETF purchases constituted the single largest component of the $60 billion increase in the Fed’s balance sheet this week, eclipsing treasury securities (+$20 billion) for the first time. The Fed also increased its repo holdings by $23 billion, the biggest weekly jump since March 18th.

Between corporate bonds, commercial paper, and additional repos, the Fed provided a stunning $87.5 billion in new liquidity to Corporate America in just one week. If you are wondering why markets are surging, there’s your answer.

Meanwhile, mortgage-backed security (MBS) holdings fell by nearly $28 billion. MBS holdings had surged by over $200 billion over the prior two weeks.

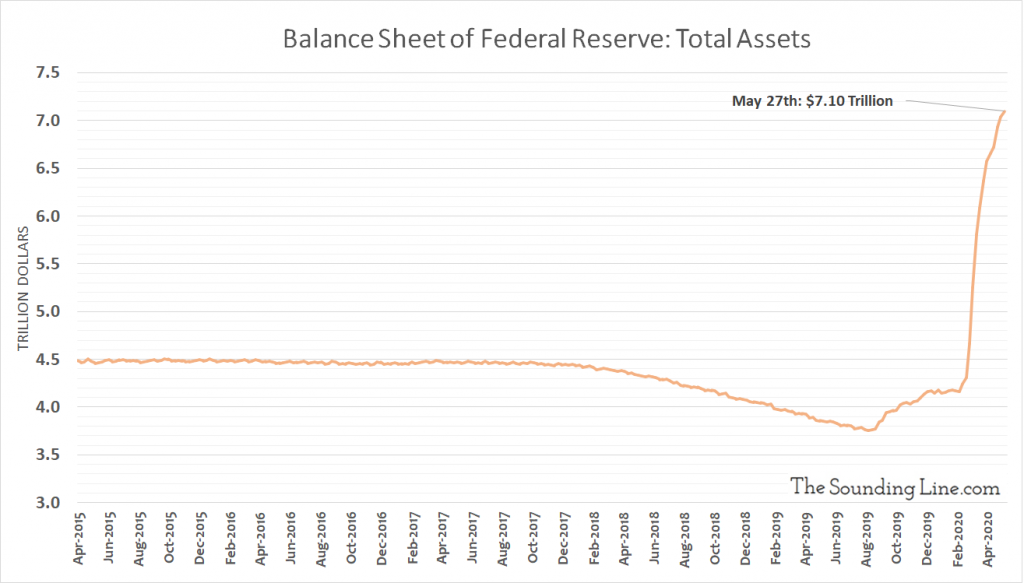

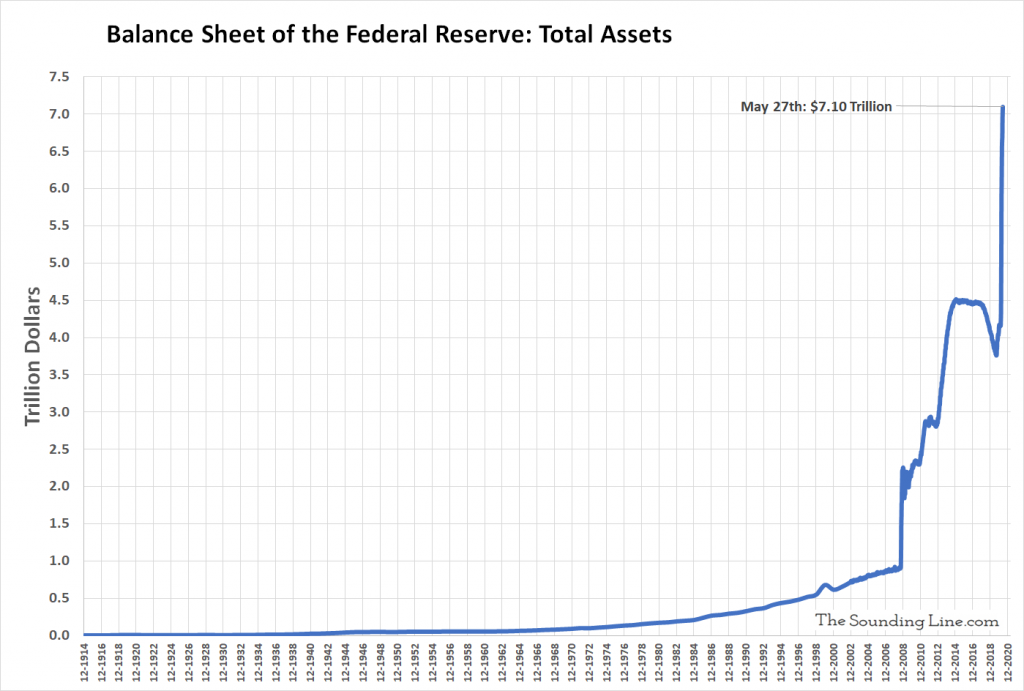

All told, the Fed’s balance sheet jumped to $7.1 trillion dollars this week, continuing its seemingly endless march higher.

Over the past five weeks, the Fed has added an average of $104 billion to its balance sheet every week. Annualized, the Fed is ‘printing’ at a pace of about $5 trillion a year (roughly a quarter of GDP).

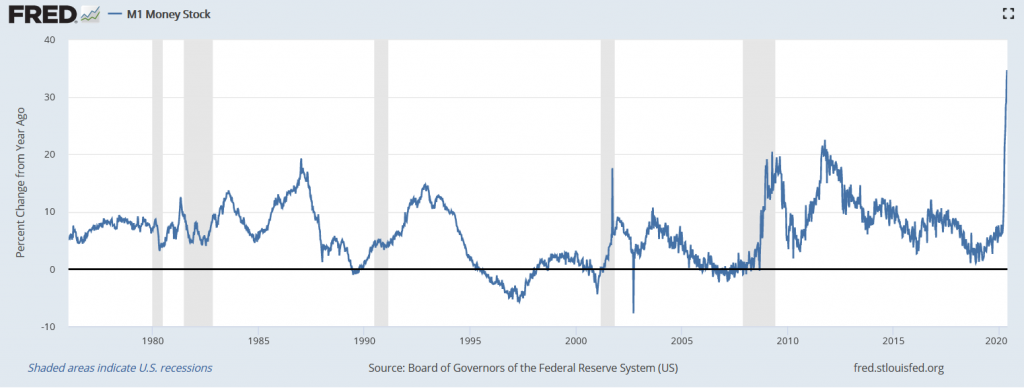

As we keep pointing out, the Fed’s QE-Infinity program, combined with expanded unemployment benefits, stimulus checks, mortgage forbearance, and the Payroll Protection Program, is having a profoundly different effect on the nation’s money supply than prior stimulus and QE programs.

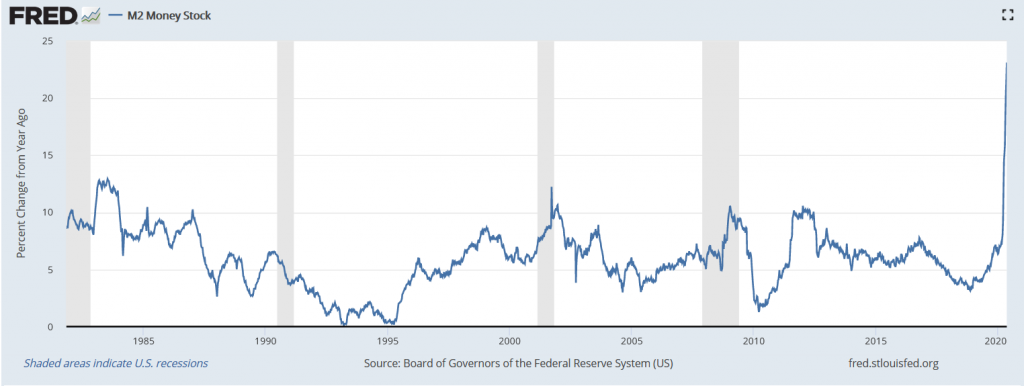

Both M1 and M2 money are surging in ways never before seen. It’s not even close.

Those who are unworried about inflation because of the relatively muted inflationary effects of prior QE programs are encouraged to examine the prior two charts. Inflation is unlikely to rise until economic activity recovers, but after that, all bets are off.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

We are doomed.

It’s never too late to stop digging, for whatever that’s worth…