Submitted by Taps Coogan on the 18th of March 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

It’s been less than a month since the S&P 500 last hit an all-time high but already the Federal Reserve has cut interest rates to zero, launched a massive $700 billion QE program, announced up to $4.5 trillion of subsidized repos offerings over the next month, backstopped the commercial paper market, and completely suspended bank reserve requirements. The federal government has postponed April tax collections and announced billions of dollars of additional spending. Now there is talk of a $850 billion federal stimulus & bailout package that would include a $50 billion bailout of the airline industry alone.

Just one month into this crisis and some of the largest companies in America are already lobbying for a massive taxpayer funded bailout. As a point of reference, it took a year of deep recession to get to this point during the Financial Crisis.

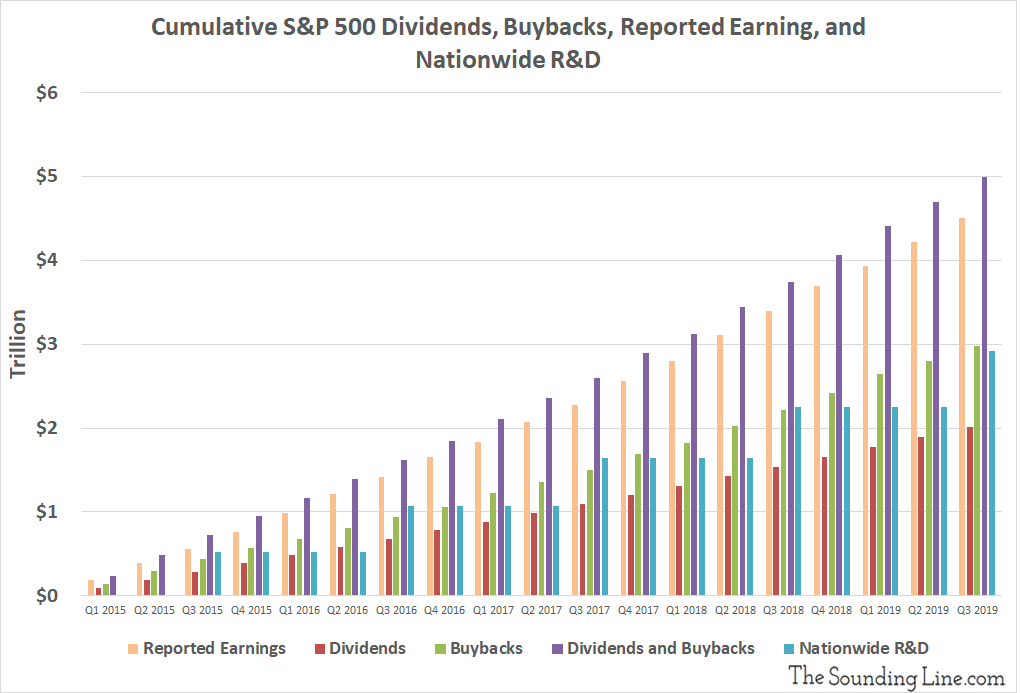

From the start of 2015 through the third quarter of 2019, the most recent date for which complete data is available, the companies that comprise the S&P 500 spent $2.9 trillion on stock buybacks and $2 trillion on dividends. As we have noted before, not only are these companies spending more on buybacks than the entire US spends on R&D (including universities and federal research), they have spent more on dividends and buybacks than they have actually earned.

Indeed, dividends and buybacks by S&P 500 companies since the start of 2015 amount to roughly $5 trillion compared to cumulative reported earnings of just $4.5 trillion. Instead of investing in better products and people, paying down debt, or saving for an inevitable rainy day, Corporate America has been blowing trillions of dollars on buybacks to boost share prices and executive bonuses. In many cases, they have been borrowing money to do it.

As Wolf Richter recently noted, the four largest US airlines, the same companies that are now seeking a $50 billion taxpayer bailout, have spent $43.7 billion on buybacks since 2012. Boeing, which is asking for a $60 billion aerospace bailout, has spent $43 billion on buybacks over the same period.

Prior to 1982, stock buybacks were considered market manipulation and were illegal under SEC rules. Whether buybacks should be outright illegal or not, they are a sign that a company thinks so little of its own products, services, and market potential that its capital should be diverted from growth and towards financial engineering.

The appropriate course of action for distressed companies that have engaged in share buybacks is that they should issue new shares to raise capital. If they can’t raise enough capital through share issuance, they should enter Chapter 11 bankruptcy and be restructured. If they cannot pull through a restructuring, they should go out of business. That’s how capitalism works.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The crisis is really exposing the weaknesses in the current model. Corporations are run by a class of managers who extract maximum short term value for themselves and shareholders while ignoring longer term R&D and financial sustainability. They have off-shored jobs and invested little in skills. Government has been complicit. All of the above is morally wrong (remember morals?) and puts the hegemony of the West at risk. Now these same corporations approach the state for bailouts. Bailouts must come at the expense of total dilution of bondholders and equity holders. Current valuations are only held up by the prospect… Read more »

Spot on and the more or less the point this whole website has been trying to make for four years

Lock Step Scenario / novel #coronavirus epidemic are familiar with Event 201, the pandemic

https://www.youtube.com/watch?v=uZsl9v3189Q

WALKS WITH GIANTS

May 2010 -Scenarios for the Future of Technologyand International Development

https://ia802609.us.archive.org/12/items/pdfy-tNG7MjZUicS-wiJb/Scenarios%20for%20the%20Future%20ofTechnology%20and%20International%20Development.pdf – See Page 18

WALKS WITH GIANTS

The first line of the article has a grammatical error; it appears there is an omission of “high, ” after “all-time.”

I couldn’t continue past that.

Thank you for pointing out the mistake. I have fixed it. Maybe you can bring yourself to read the article now