Taps Coogan – September 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

After a decade of markets writing off seemingly every risk scenario, it’s a funny thing that after six months of bearish market performance, investors may now be skewing towards the ‘worst case’ scenario, at least via Europe’s natural gas shortage.

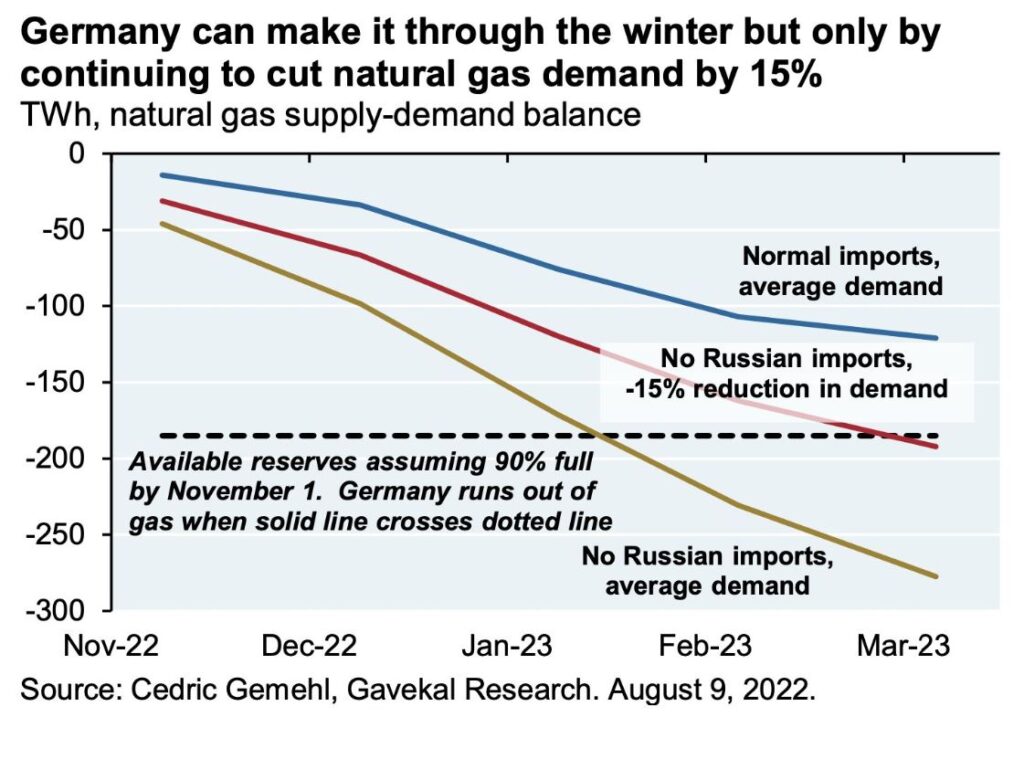

One such example is whether Germany and other European nations run entirely out of natural gas this winter. While it’s entirely possible, and that in-and-of-it-self is remarkable, it probably shouldn’t be the base case, as the following chart from JP Morgan via Acemaxx Analytics highlights.

Despite some misleading articles, Russia has not entirely stopped selling natural gas to Europe. Yes they have halted the Nordstream 1 pipeline for now, but gas continues to flow through pipelines traversing Ukraine and through the ‘Turkstream’ route.

There is a simple reason for this. Russia makes a lot of money by threatening to stop supplying gas to Europe (and throttling supplies to make those threats look credible) while still selling Europe some gas. Russia makes nothing in the scenario where they completely stop selling gas to Europe. Despite aspirational claims that they could instead sell the gas to Asia, they don’t have the LNG or pipeline capacity to reroute their Europe-bound gas supplies in very large quantities.

Of course, Russia could still choose to stop selling gas to Europe at any point for non-economic motivations. That Russia now appears to be suffering fairly consequential defeats in Northeastern Ukraine raises the likelihood of unpredictable behavior. However, as the chart above highlights, even with a total shutoff of Russian supplies, Germany can probably make it through a normal winter with 15% gas demand curtailment. While that won’t be fun and almost certainly involves a recession, they’ve already implemented some elements of that curtailment. That’s the price for years of inexplicably terrible policy decisions.

Meanwhile, Germany and other European nations are sprinting to install the LNG import terminals that they should have built years ago. While small capacity wise, one such terminal is expected to come online in September and half a dozen should come on line this winter. The US and many others countries are also building additional LNG export capacity to supply those new import terminals. The damaged Freeport LNG terminal in the US should come back online in November, boosting US LNG exports by roughly 20%. Of course, production of natural gas will need to rise too.

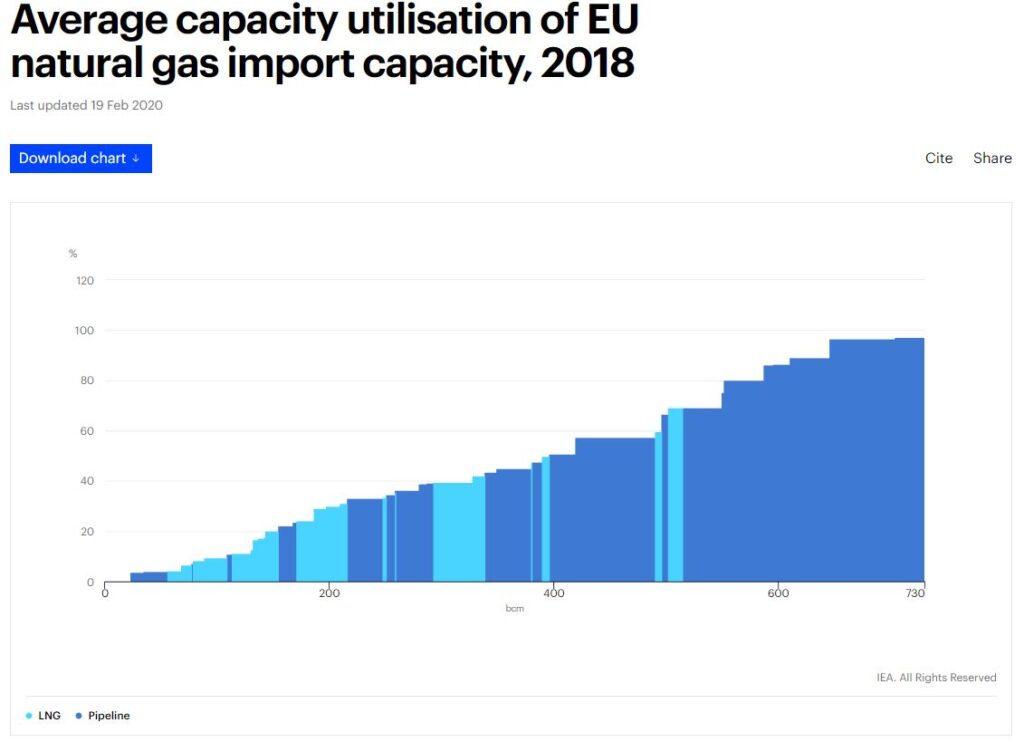

Prior to the Ukraine invasion, more than half of the EU’s import capacity (mostly pipelines) was operating below 50%. US benchmark gas prices are roughly $7 per MMbtu compared to $64 in Europe. Europe’s natural gas problem has never been about a lack of pipeline capacity but a lack competition between suppliers, a point we’ve been making for years. That’s why Germany’s prior decision to go all in on Russian supply via NordSteam 2 while blocking every single proposed LNG terminal was so incredibly dumb.

In additional to the decision to block LNG terminals in Germany, the anti-pipeline-unless-it’s-Nordsteam2 movement has meant a lack of interconnector pipelines to bring gas from existing LNG terminals in Spain, France, and the UK to where it’s needed in Germany and Italy. That has left them under-utilized, at least until recently.

When Germany was debating LNG terminals or Nordstream 2, Russia argued that it could always deliver gas cheaper via pipelines than LNG operators could due the advantages of pipelines over LNG. True, they could have, but it turns out they didn’t.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.