Taps Coogan – September 4th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

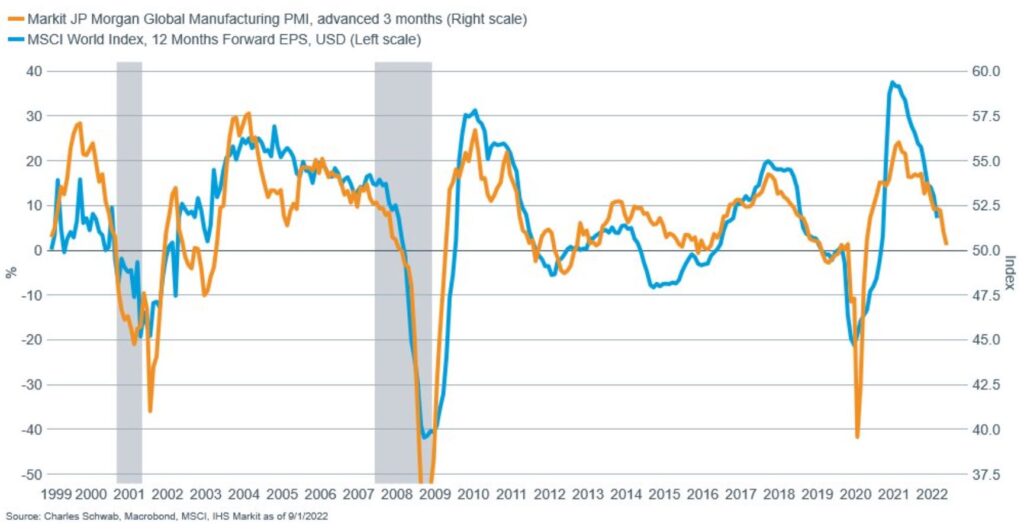

The following chart from Charles Schwab’s Jeffrey Kleintop shows the Markit Global Manufacturing PMI (purchasing managers survey index) against a measure for global earnings per share growth.

The PMI dataset is advanced by three months to make the correlation work and the punchline is that the very rapid expansion in manufacturing activity of the year prior is coming to an end. That has typically been associated with a decline in global corporate earnings growth.

While that’s bad, it’s hardly unprecedented and we spent much of the 2011 through 2016 period in exactly such a no-to-low earnings growth environment and it turned out just ‘fine’ for financial markets. That’s because monetary policy is more important to financial markets than economic activity or earnings. This time the outlook for monetary policy is hardly constructive for financial markets so the ‘bull’ arguments about a mild recession should be taken with a giant grain of salt.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.