Taps Coogan – April 23rd, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

The following is reposted from Visual Capitalist:

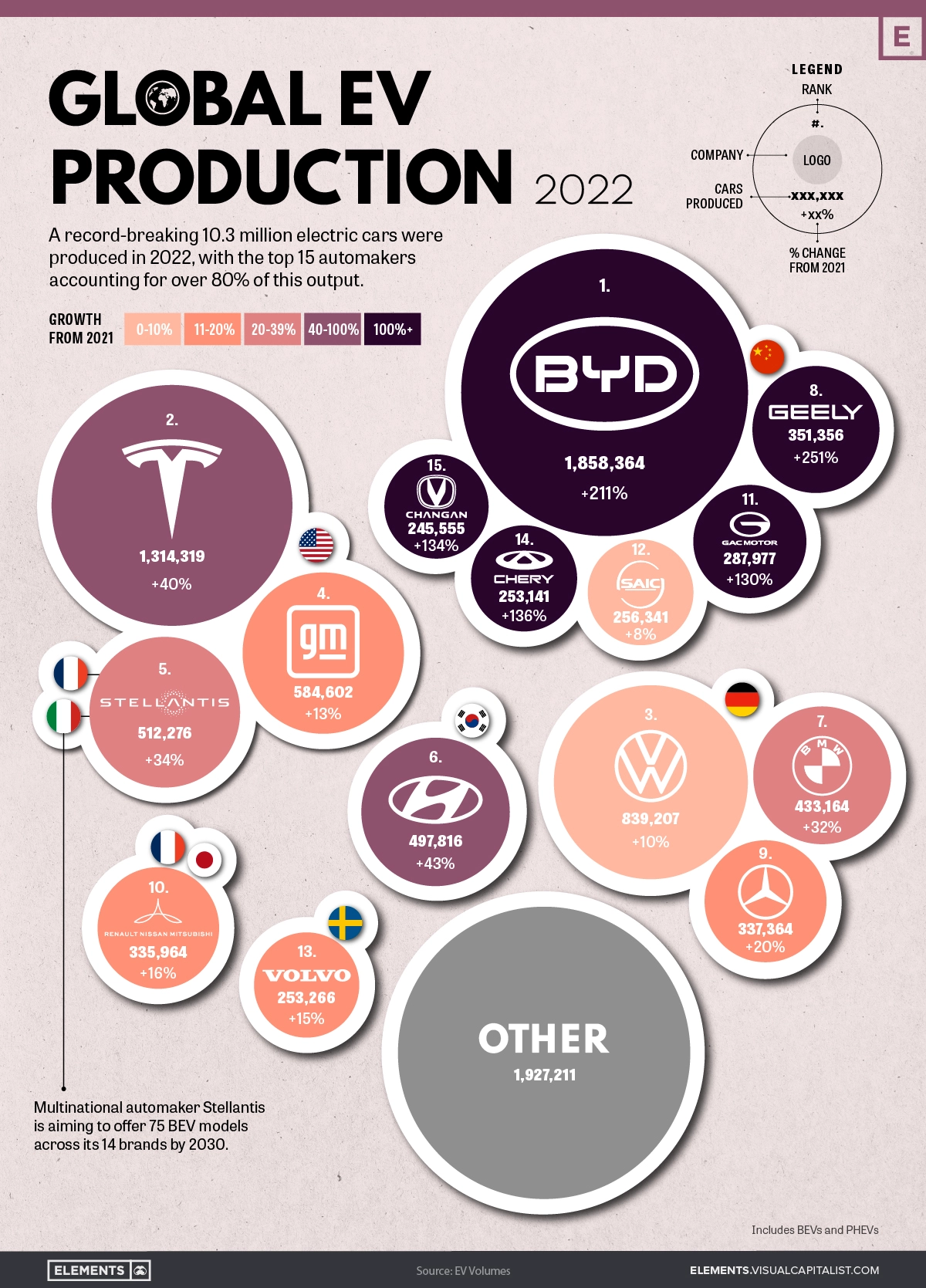

2022 was another historic year for EVs, with annual production surpassing 10 million cars for the first time ever. This represents a sizeable bump up from 2021’s figure of 6.7 million.

In this infographic, we’ve used data from EV Volumes to visualize the top 15 brands by output. The color of each brand’s bubble represents their growth from 2021, with the darker shades depicting a larger percentage increase.

Data Overview and Key Takeaways

The raw data we used to create this infographic is listed below. Volume figures for 2021 were included for convenience.

| Rank | Company | 2022 | 2021 | Growth from 2021 |

|---|---|---|---|---|

| 1 | BYD | 1,858,364 | 598,019 | 211% |

| 2 | Tesla | 1,314,319 | 936,247 | 40% |

| 3 | VW Group | 839,207 | 763,851 | 10% |

| 4 | GM (incl. Wuling Motors) | 584,602 | 516,631 | 13% |

| 5 | Stellantis | 512,276 | 381,843 | 34% |

| 6 | Hyundai Motors (incl. Kia) | 497,816 | 348,660 | 43% |

| 7 | BMW Group | 433,164 | 329,182 | 32% |

| 8 | Geely Auto Group | 351,356 | 99,980 | 251% |

| 9 | Mercedes-Benz Group | 337,364 | 281,929 | 20% |

| 10 | Renault-Nissan-Mitsubishi Alliance | 335,964 | 289,473 | 16% |

| 11 | GAC Group | 287,977 | 125,384 | 130% |

| 12 | SAIC Motor Corp. | 256,341 | 237,043 | 8% |

| 13 | Volvo Cars | 253,266 | 220,576 | 15% |

| 14 | Chery Auto Co. | 253,141 | 107,482 | 136% |

| 15 | Changan Auto Co. | 245,555 | 105,072 | 134% |

| 16 | Other (41 companies) | 1,927,211 | 1,326,262 | 45% |

Includes BEVs and PHEVs

BYD Auto

BYD Auto has leaped past Tesla to become the new EV king, boosting its output by a massive 211% in 2022. Given this trajectory, the company will likely become the world’s first automaker to produce over 2 million EVs in a single year.

BYD has a limited presence in non-domestic markets, but this could change rather quickly. The company is planning a major push into Europe, where it expects to build factories in order to avoid EU tariffs on Chinese car imports.

The company is also building a factory in Thailand, to produce right-hand drive models for markets like Australia, New Zealand, and the UK.

Tesla

Tesla increased its output by a respectable 40% in 2022, staying ahead of Western brands like Volkswagen (+10%) and GM (+13%), but falling behind its Chinese rivals such as Geely (+251%).

Whether these Chinese brands can maintain their triple digit growth figures is uncertain, but one thing is clear: Tesla is facing more competition than ever before.

The company is targeting annual production of 20 million cars by 2030, meaning it will need to keep yearly growth rates in the high double digits for the rest of the decade. To support this initiative, Tesla is planning a multi-billion dollar factory in Mexico capable of producing 1 million cars a year.

Hyundai

Hyundai Motor Company, which also owns Kia, posted a similar growth rate to Tesla. The South Korean automaker was a relatively early player in the EV space, revealing the first Hyundai Ioniq in 2016.

In late 2022, several countries including South Korea expressed their disapproval of the Biden administration’s Inflation Reduction Act, which withdrew tax credits on EVs not produced within the United States.

Hyundai is currently building a $5.5 billion EV factory in the state of Georgia, but this facility will not become operational until 2025. In the meantime, South Korea has revised its own EV subsidy program to favor domestic brands.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.