Taps Coogan – July 26th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

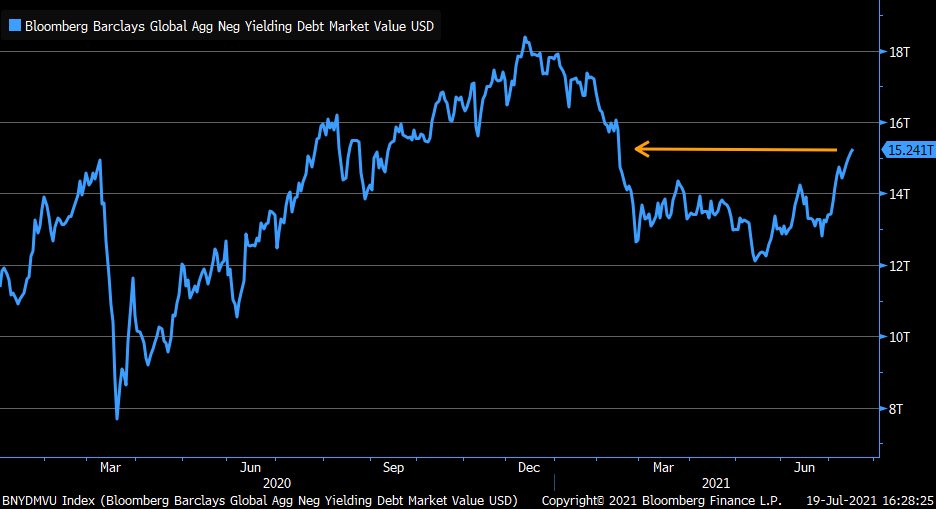

As the following chart from Win Smart attests to, the global pile of negative yielding debt is on the rise once again.

Negative yielding debt, debt where the yield to maturity is less than zero, hit an all time high of just over $18 trillion last December. With reopening optimism this Spring and the deluge of stimulus money, benchmark rates rose and the negative yielding pile shrunk.

As the reopening runs its course and we settle into the new ‘New Normal,’ the pile of negative nominal yielding debt is growing once again.

Simply put, there is too much money chasing too few productive assets and it’s crushing yields on everything down to zero. Unless we see an even bigger jump in growth or a massive destruction of money, it’s hard to see any of this changing.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.