Submitted by Taps Coogan on the 7th of February 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

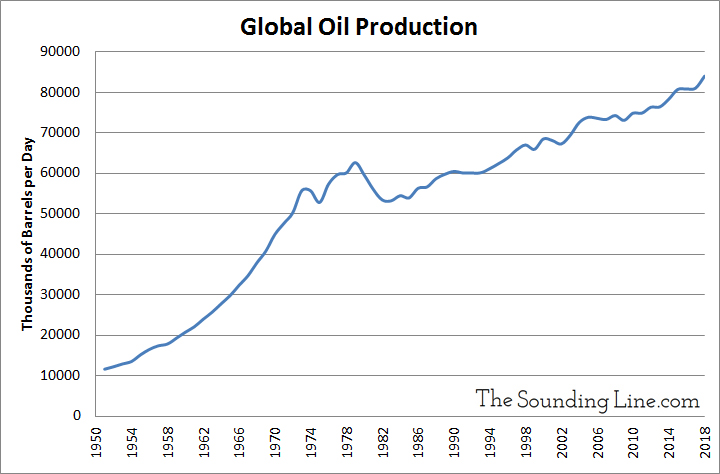

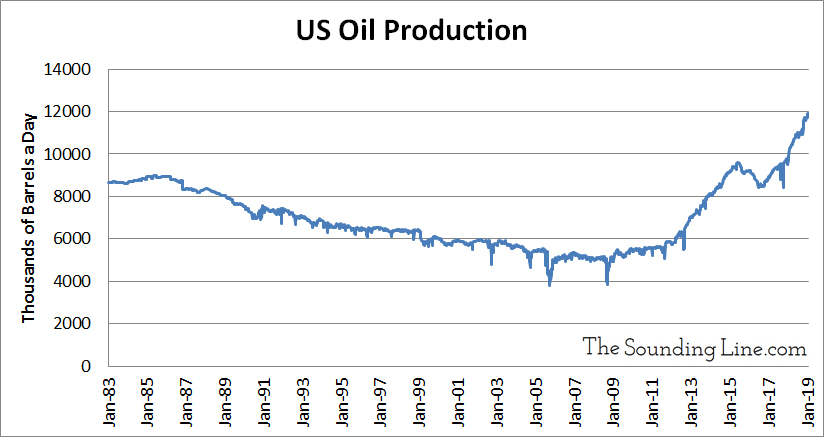

With the shale oil revolution pole-vaulting the US from the world’s largest oil importer to an exporter (of sorts) in 12 short years, once popular theories of ‘peak oil‘ are all but dead. Such theories, which warned that global oil production was nearing its absolute maximum and that ensuing shortages would send prices through the roof, were wrong. It turns out there is a lot more oil in the ground than people realized just ten years ago.

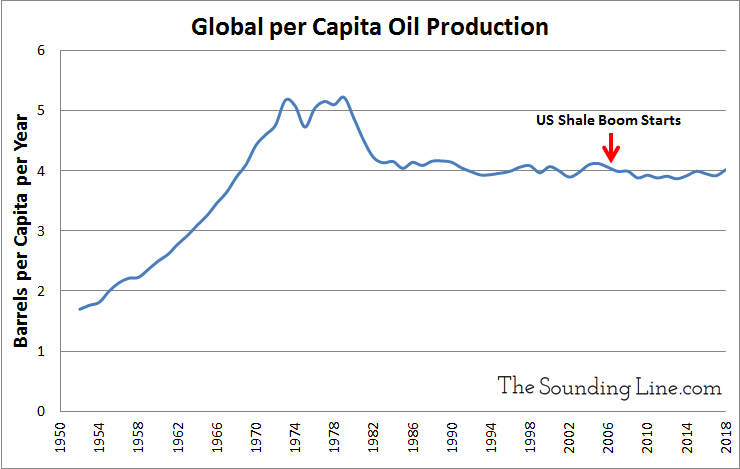

Yet, as important as the amount of oil being produced is the population of people consuming it. Since we first wrote about this subject two years ago, US oil production has surged a mind-boggling 38%. However, global per capita oil production has barely budged. As of October 2018, the most recent date for which data is available, global per capita oil production is lower than it was in 2006, when the US shale oil boom was in its infancy and US oil imports were peaking. In fact, global per capita oil production has been trending lower since its peak in 1979.

On a per-capita basis, growth in US oil production has barely offset declining production in most other parts of the world. Meanwhile, emerging markets have been working furiously since the 1980s to raise hundreds of millions of people out of poverty. With a rise out of poverty comes increasing demand for cars and transportation that is still overwhelmingly powered by oil. From the 1990s to today, global automobile sales have nearly doubled from about 40 million to 75 million units per year.

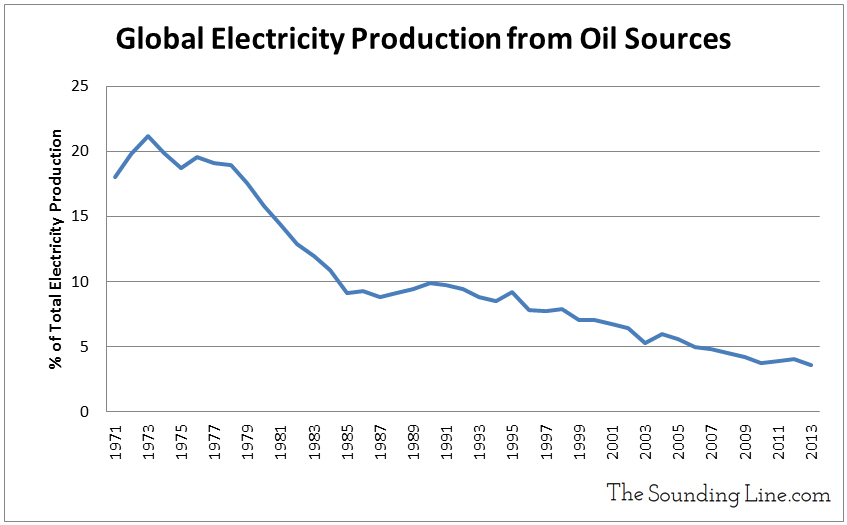

As we have previously noted, oil being consumed by the burgeoning global consumer class has been freed up by nearly eliminating oil based electricity production that is easily replaced by cheaper coal and natural gas. Globally, electricity production from oil fell from 21% in 1973 to less than 4 % today.

If increases in US shale production cannot be sustained, either due to the higher depletion rates of shale plays or due to the tightening financial liquidity available to capital intensive shale companies, global oil supply may become tighter than many people are currently forecasting. The rise of electric cars may mitigate the problem, but in doing so, will transfer the energy burden to electric grids. Despite over $2.9 trillion dollars of global investment over the last 14 years, renewable power still represents less than 5% of total global primary energy consumption. So while electric mobility could become a solution, unless electric grids can grow capacity dramatically while simultaneously eliminating fossil fuels, it is not one yet.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The massive grids we have today are outdated and massive liabilites (PG&E anyone), I do not see them growing much capacity with current incentives in place for the quasi monopolies. The numbers say we’ll see some stagnation, how long is anyones guess. I agree though that we’ll be reliant upon coal/natural gas for power generation(you should get those charts, as well as for nuclear) untill more renewable capacity comes online, and any politcal movent that isnt based in sound economics will quickly realize the limits of wishful thinking when other peoples money runs out. In the long run though, solar… Read more »

Agreed

Per capita energy consumption seems to be the best way to judge how the world economy is doing since growth in energy use translates into growth in the economy. So-called renewable energy is mostly an energy sink since it takes more energy to make and get the panels and windmills into operation than they provide over their lifetime. In addition, when added to the grid, the whole system becomes unstable. Hydrocarbon driven turbines need to be kept online to fill in periods where panels and windmills don’t generate electricity. This causes prices to skyrocket because you need to keep two… Read more »

For a period of time I worked for a diesel-fired utility of giant 10MW slo-ro diesels. Then they got Obama-grants for a 25MW solar farm. Politicians made lots of promises about ‘energy freedom’s and ‘lower utility rates’. The solar came on around 8AM, long after peak AM demand, and was mostly gone by 4PM, well before PM demand. Worse, every cloud bank or squall line would suddenly drop supply, and the diesels would groan coming up to speed, then whine down as the sun came out again. It became a maintenance disaster for the old plants, revving up then down,… Read more »

Very well said. Thanks for the comment