Taps Coogan – August 25th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Ask a normal, non-central banking person whether inflation is a problem and they are likely to say: ‘Yes, it’s too high’. For years, the costs of large, unavoidable household expenses have risen faster than average wages. Even now, despite the fact that the economy is in recession and broad measures of inflation have fallen, food inflation is currently running at 4.1% year-over-year, medical inflation at 5.02%, education inflation at 2.3%, and housing inflation at 2%. Meanwhile, personal income growth, excluding Covid stimulus transfer payments, is negative.

Ask a central banker if inflation is a problem and they are certain to say: ‘Yes, it’s too low’. The official measures of inflation that central bankers rely on to judge monetary policy work by averaging the large essential household expenses mentioned above with non-essential imports made by slave labor in China like TV’s, phones, and children’s toys. They then apply hedonic quality adjustments to eliminate the actual increase in the price paid for those items because TVs are getting thinner and phones are faster. The result is that a few of the Federal Reserve’s inflation metrics have dipped modestly below their target of 2% inflation at times over the past decade.

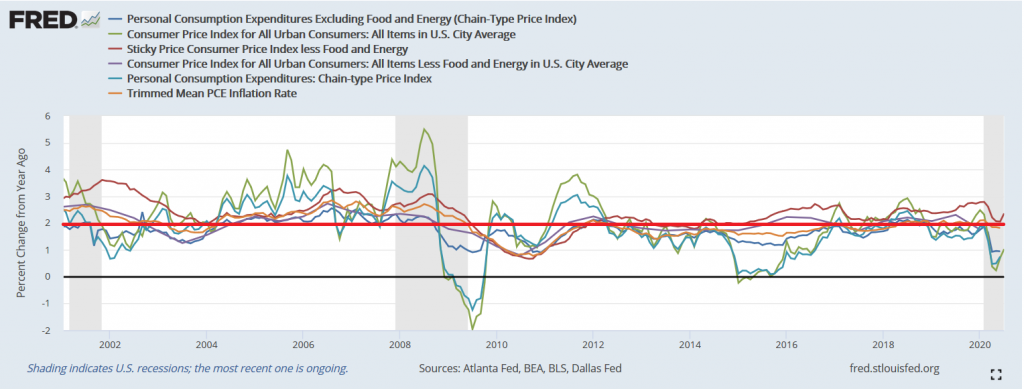

Measures of Inflation Compared to the Fed’s 2% Target

During the Coronavirus pandemic, the official measures of inflation have dipped. Notably however, none have turned negative on a year-over-year basis and all are now trending back up.

Inflation Roulette

The occasional undershooting of inaccurate inflation measures against an arbitrary ‘2% for all-times’ inflation target has been declared the ‘greatest monetary challenge our time‘ by the Federal Reserve.

This coming Thursday, the 27th of August, Fed Chairman Jerome Powell is widely expected to announce a change to the US inflation targeting in light of this ‘challenge’. As Mr. Powell and many other Fed official have already signaled, the Fed will be announcing a new inflation targeting rule: average 2% inflation.

Today, the Fed’s objective is to get inflation to be as close to 2% at any given time. After Thursday, it is widely speculated that the Fed’s objective will be that inflation averages 2% over time. The critical difference being that if inflation dips below 2%, as it is now, the Fed will now allow it to rise above 2% in the future so that the average ends up being 2%.

In other words, the Fed is saying that it is going to keep monetary policy accomodative (0% interest rates and lots of ‘money printing’) even if inflation rises above 2% to make up for the fact that it was ‘low’ in the past.

What will that look like? Imagine official inflation at 3%, benchmark interest rates at 0%, and the Fed still ‘printing’ $1-$2 trillion a year. Imagine the massive borrowing that will be done to arbitrage those deeply negative real rates. Imagine the transfer of wealth associated with the world’s largest net importer actively encouraging high consumer price inflation while attempting to suppress savings rates and interest income. Imagine the social problems of further exacerbating the wealth divide through endless stimulus for financial markets and higher inflation on normal households.

Now imagine what will happen once the Fed realizes it needs to change course and starts raising interest rates.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.