Taps Coogan – July 30th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

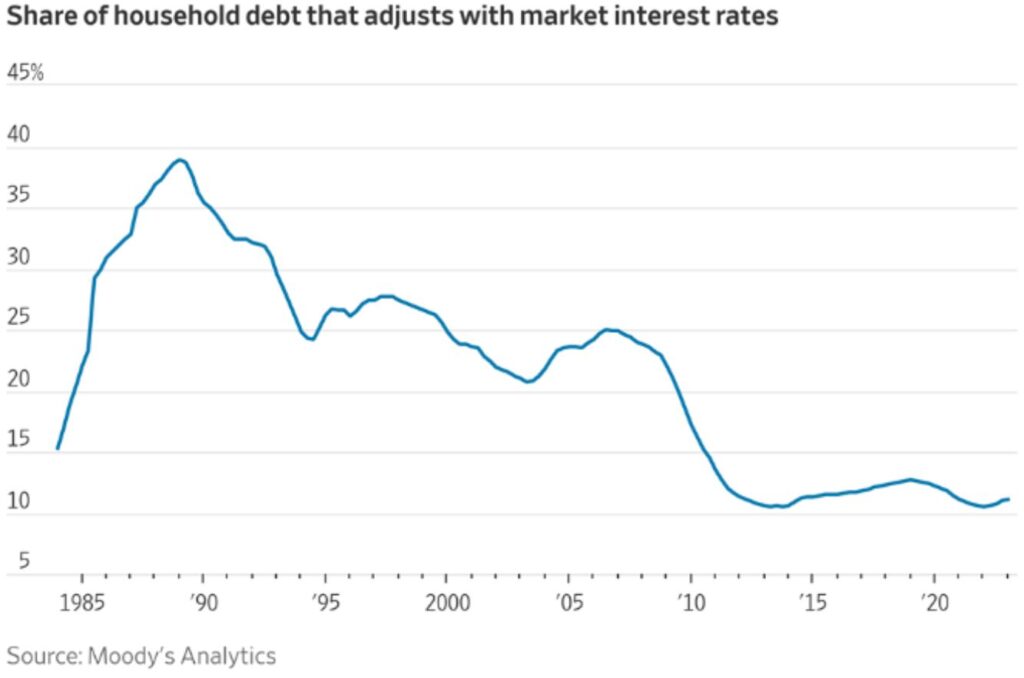

We’ve made this point before and we’re making it again. Unlike in prior recessions, the share of variable rate debt owed by US households is historically low. In other words, most households’ existing debts have been unaffected by the Fed’s rate hiking campaign. Via Charlie Bilello:

In fact, the wage inflation associated with higher inflation has likely caused debt affordability to improve on the large stock of outstanding debt, especially for existing mortgage holders. That means that the contraction in household spending associated with higher interest rates is going to take considerably longer to play out than in prior recessions, as we have already seen.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

“…the wage inflation associated with higher inflation has likely caused debt affordability to improve on the large stock of outstanding debt, especially for existing mortgage holders.”

You may have hit the nail on the head as to why the calls of imminent recession have been consistently wrong, and why Powell’s obsession with 2% appears increasingly Quixotic.

the only folks I see getting wage inflation have been the minimum wage workers. And all of that based on government demands, For the last 5 years here in CA Min wage has gone up $1 a year. So now Min wage is $15.50 an hour. In some cities it’s higher than that. So wage “inflation” has been hitting low wage and “maybe” super hi end wage workers but the mi\ddle class gets the shaft as usual. As an aside, I don’t get fast food all that often and it’s been probably 6 months since the last time I went… Read more »