Submitted by Taps Coogan on the 19th of December 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

As we have discussed on several occasions, the US federal deficit and the national debt are rising to historic levels. Case in point, for the last two years, the national debt has grown by roughly as much as the entire Congressional discretionary budget. That means that, without entitlement reform or large tax increases, all non-entitlement spending would need to be eliminated to halt the growth in the national debt. Yes, that means that nearly the entire Executive, Legislative, and Judicial branches of government, as well as the entire military, would need to be eliminated to halt the debt growth without entitlement reform and/or large tax hikes. To give a sense of the scale of the tax hikes that would be required, a 100% marginal tax rate on income that qualifies as the top 1% would not halt the debt growth.

Since there is very little chance that Congress will enact any meaningful spending cuts, entitlement reform, or tax hikes, the only remaining way to for the US to avoid reaching the debt levels of Italy or Greece would be to try and outgrow its debt (the IMF forecasts the US will be more indebted than Italy, relative to GDP, in just three years).

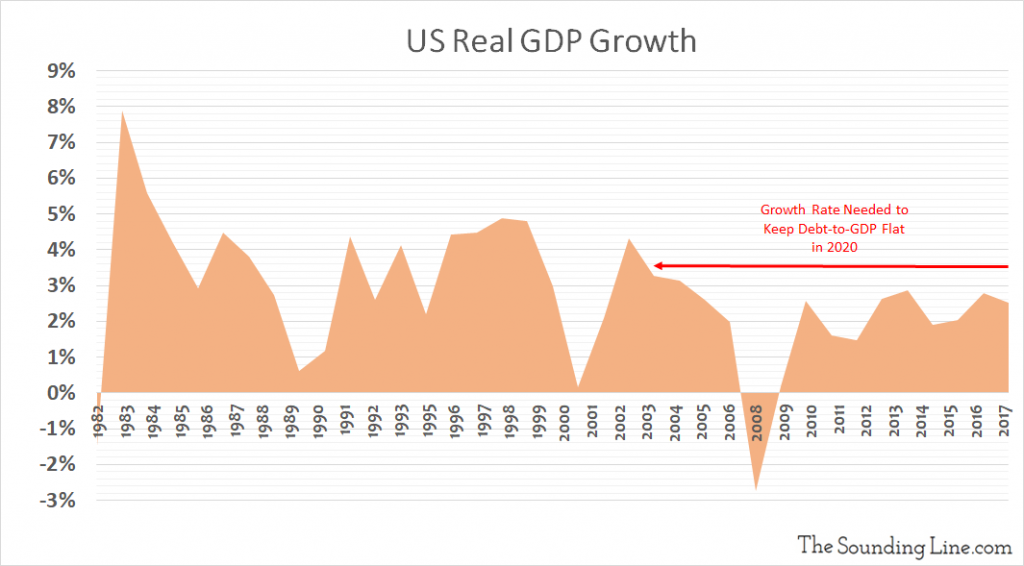

So, how fast would the US need to grow, to keep the debt-to-GDP ratio flat?

During federal fiscal year 2019, which ended September 30th, the national debt increased by slightly more than $1.2 trillion to reach $22.7 trillion, a 5.5% increase. During the same period, nominal US GDP grew by $793 billion to reach $21.5 trillion, a 3.8% increase. Nominal GDP is not adjusted for inflation.

Assuming that the national debt continues to grow at its current pace, a conservative assumption, it will likely increase by at least $1.25 trillion in fiscal year 2020. That means that, in order to halt the growth in the national debt-to-GDP ratio, nominal GDP would need to accelerate from a growth rate of 3.8% to roughly 5.6%.

Real GDP, which is adjusted for inflation and is the number most commonly cited in media, grew by $390 billion in FY 2019 to reach or roughly $19.1 trillion (a 2% increase). That means that, in order to halt the rise in the national debt-to-real GDP ratio, real GDP growth would need to rise from 2% to 3.6% in FY 2020, assuming that inflation remains at roughly 2%.

The last time the US saw a full year of over 3.6% real GDP growth was 2003. However unlikely a return to 3.6% growth may be, it is probably quite a bit more likely than any meaningful reform from Congress.

If you enjoy reading The Sounding Line, please consider recommending it to others so that we can grow our readership. To be notified when we publish a new article, click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.