Taps Coogan – October 21st, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

About a month ago, the Bank of Japan (BoJ) intervened to defend the Yen for the first time since the Asian currency crisis of 1998. The move came as the Yen continued a relentless ~20% decline against the US Dollar.

At the time, numerous commenters correctly noted that the move to defend the Yen was doomed so long as the BoJ was simultaneously holding short term rates at -0.1% (the last major central bank with negative rates) and continuing its ‘yield curve control’ policy of pegging the 10-year at 0.25%.

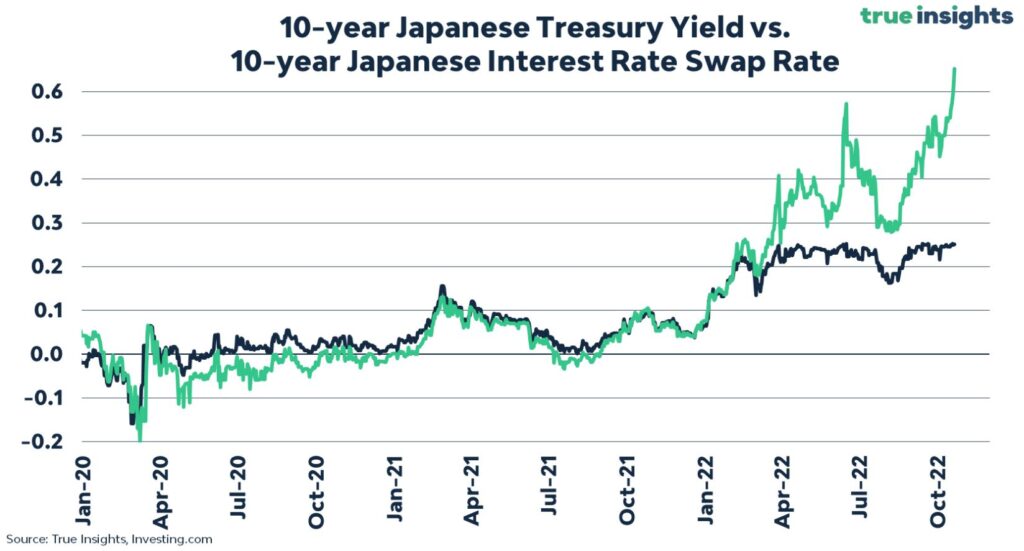

The cognitive dissidence of the BoJ’s current policy stance is best captured in the following chart from True Insights which shows the yield on Japan’s 10-year – still pegged at 0.25% – and the 10-year swap rate.

In this context, the swap rate is best thought of as the risk premium investors would demand to hold a 10-year Japanese government bond if they had to borrow in short-term markets to pay for the bond. In other words, traders are betting that Japan ends yield curve control and yields surge.

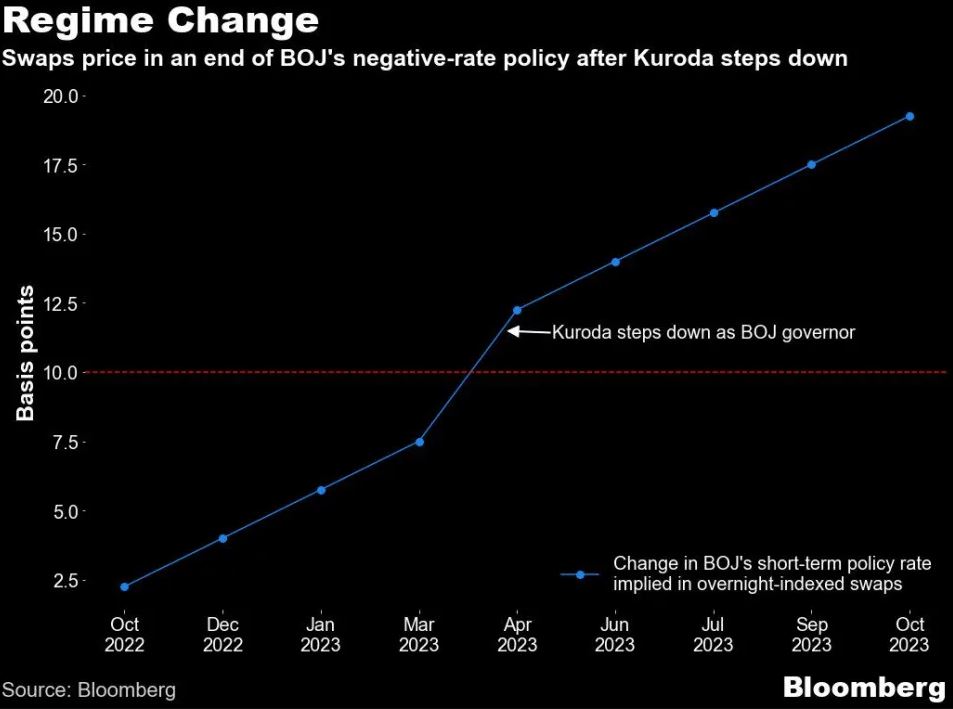

On top of that, short term swaps show that markets are pricing in a 10-basis point rate hike when Kuroda steps down as head of the BoJ in April.

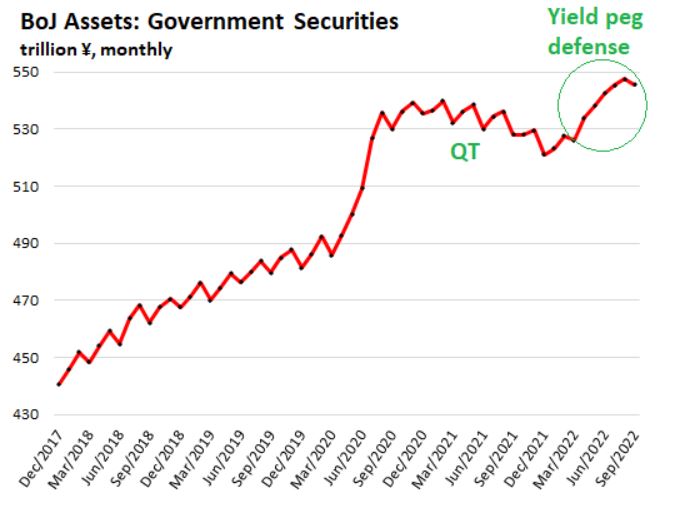

In order to defend yield curve control and its 0.25% peg for the 10-year, the BoJ has bought roughly $118 billion of its own government bonds since March. Just yesterday, it conducted an additional “emergency” purchase of government bonds, offering to buy $1.67 billion.

All these government bond purchases aimed at defending yield curve control are financed by printing money and simply pile more pressure on the collapsing Yen. The Yen has fallen another ~10% since the BoJ’s first attempt to defend it in September. Ironically, the further fall in the Yen then puts more upward pressure on Japanese yields, necessitating yet more bond buying.

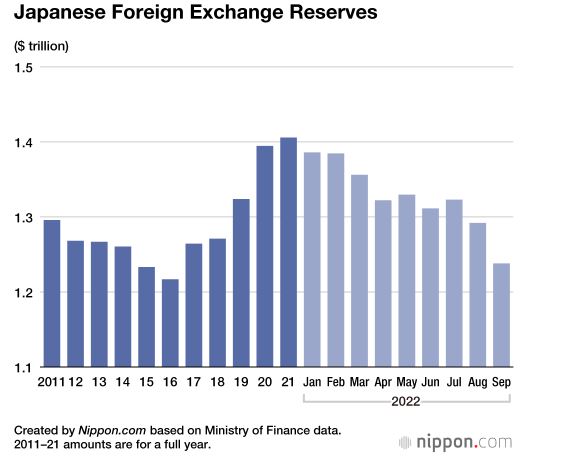

The BoJ’s failed currency intervention burned through $54 billion of the BoJ’s foreign reserves in September, the fastest monthly drawdown on record.

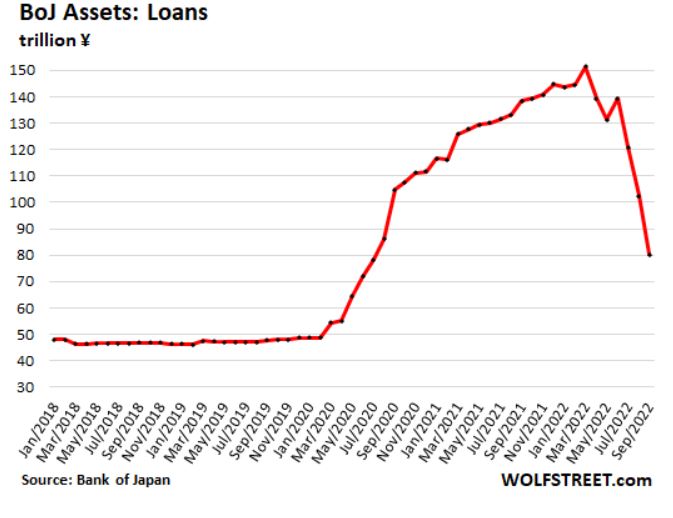

The BoJ is also dumping the non-government loans on its balance sheet to try and offset the increase in its government bond purchases. It has offloaded the equivalent of $470 billion since March. The selling of non-government loans has pushed up corporate bond yields significantly which, ironically, likely puts more pressure on government bond yields to rise as investors seek higher yields elsewhere (if there are still any investors left voluntarily holding Japanese government bonds).

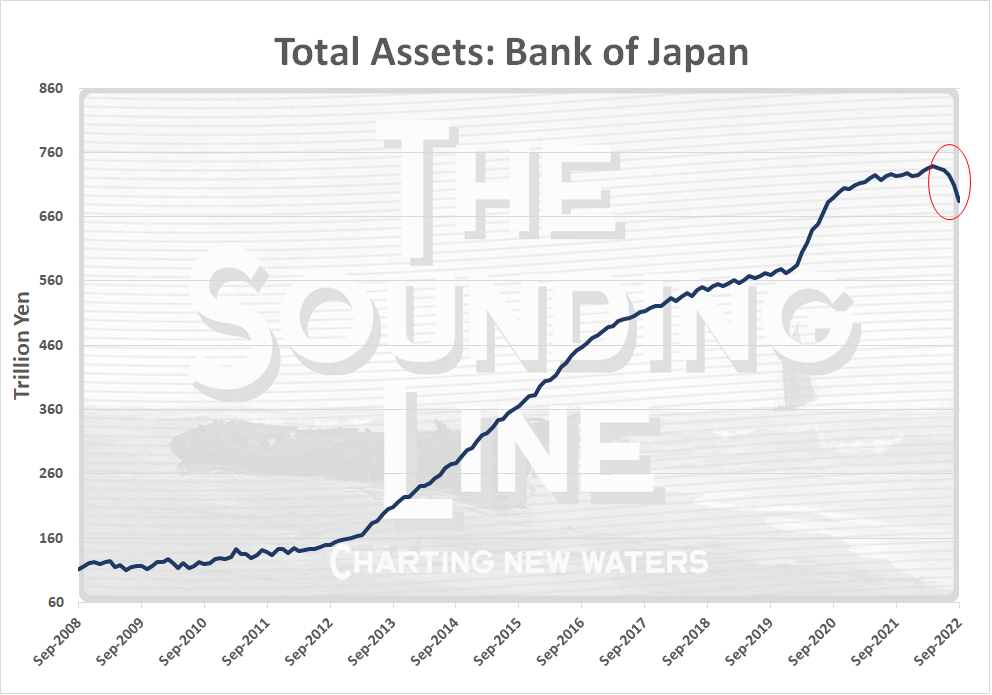

The net result is that, while the fire sale of its non-government loans and foreign currency reserves have led to a small net reduction in its balance sheet, that reduction has not been enough to halt the decline in the Yen, which hit a new 32 year low today and touched the psychologically important ‘150’ level to the US Dollar.

The Yen keeps falling because the market understands that the BoJ’s policy stance is totally unsustainable. It will soon be out of non-government loans to sell and its foreign currency reserves have fallen by more than 15% since the start of the year.

However, the significance of the BoJ trying to defend the Yen at these levels is not that they are failing but that they are trying. At first, the decline in the Yen was not viewed as an entirely bad thing. Japan was a net exporter last year and policy makers likely viewed a cheaper Yen as offsetting some economic slowness. Japan has also struggled to get inflation above zero for decades. As of yesterday, CPI in Japan was ‘just’ 3% and core CPI was ‘just’ 1.8%.

The fact that the BoJ now views the level of the Yen as unacceptable likely won’t change the ineffectiveness of their attempts to defend it until they give up yield curve control. However, that’s precisely the point. Japan must give up yield curve control and may be nearing the decision to do so.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.