Taps Coogan – July 23rd, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe

In yet another crazy milestone for 2020, the four biggest tech companies in the US (Apple, Microsoft, Amazon, and Alphabet) are now worth more than all publicly listed stocks in Japan combined.

🇺🇸 🇯🇵 Four U.S. #Tech Giants Worth More Than Entire #Japan Market – Bloomberg

— Christophe Barraud🛢 (@C_Barraud) July 21, 2020

*Apple, Microsoft, Amazon and Alphabet Inc. were worth $5.97T as of Monday, versus $5.84T for all Japanese stocks, according to data compiled by Bloomberg.

*More charts: https://t.co/flWYoeto4Y pic.twitter.com/7AnppKntGe

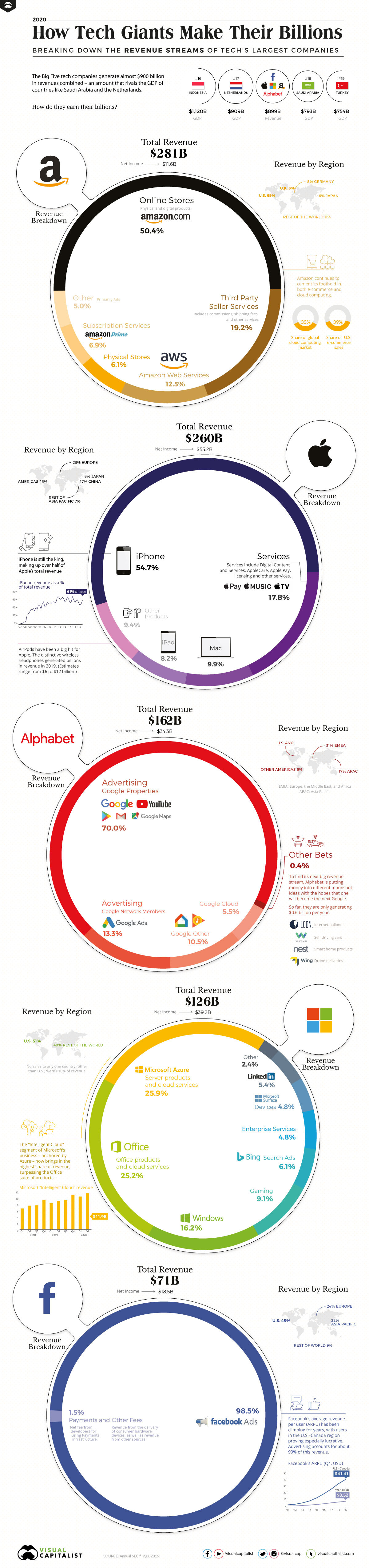

How is this possible, you might ask. Forgetting for a moment the structural issues at play and massive premiums investors pay for trendy tech shares, the reality is that the tech giants earn staggering amounts of money. The following info-graphic, from Visual Capitalist, details the diverse sources of revenue for Apple, Microsoft, Amazon, Google, and Facebook.

All told, the five biggest tech companies in the US earned just shy of $900 billion in 2019, comparable to the GDP of the Netherlands and more than the GDP of Saudi Arabia.

In terms of net earnings (profits), they pulled in just short of $159 billion in 2019.

Not only are the ‘Big Five’ revenues and earnings massive, but they are growing rapidly. As Visual Capitalist notes, four of the five saw double digit revenue growth in 2019 with only Apple seeing revenue shrinkage:

Big Tech Revenues (2019 vs. 2018)

| Company | Revenue (2018) | Revenue (2019) | Growth (YoY) |

|---|---|---|---|

| Apple | $265.6 billion | $260.2 billion | -2.03% |

| Amazon | $232.9 billion | $280.5 billion | 20.44% |

| Alphabet | $136.8 billion | $161.9 billion | 18.35% |

| Microsoft | $110.4 billion | $125.8 billion | 13.95% |

| $55.8 billion | $70.8 billion | 26.88% | |

| Combined | $801.5 billion | $899.2 billion | 12.19% |

Of course, the answer to the question ‘How do the tech companies make their billions?’ isn’t answered with a breakdown of their sources of their revenues. There is also the reality that they are allowed, to varying degrees, to operate unrestricted monopolies. Google has 90% of search traffic and three-quarters of all online ad spending, Amazon controls half of online shopping in the US, Facebook dominates social media, etc…

The good news is that you can avoid some aspects of these tech companies with minimal effort. Use DuckDuckGo instead of Google. Buy directly from stores and manufacturers (or their websites) instead of using Amazon. Have a conversation with a real human being instead of using Facebook or Instagram. For the more adventurous, a Linux phone may soon be a feasible alternative to Apple and Android.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

It is difficult to deny that in our modern world many large companies already have more power than most nations and their power continues to grow at an alarming rate. In the past, it was large oil conglomerates that held the power but today much of it has shifted to technology companies. Knowledge is power and this means is not just about large conglomerates that produce products or energy but extends into how internet companies, in particular, have placed themselves in the position where they control the communication networks collecting and storing data on all of us putting them in… Read more »