Submitted by Taps Coogan on the 6th of January 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

As we have discussed on numerous occasions here at The Sounding Line, the concept that inflation has become ‘persistently and worryingly’ low has become embedded in virtually every communication from the Federal Reserve, as well as in the broader economic discourse in the US. The sentiment was perhaps best encapsulated by Jerome Powell’s June 2019 ‘Greatest Challenge’ speech in which he declared low interest rates and inflation to be the “preeminent monetary challenge of our time,” ominously warning that “the next time policy rates hit the lower bound (0%)– and there will be a next time – it will not be a surprise.” Just a couple months earlier, Businessweek’s front page article was titled “Is Inflation Dead?,” declaring that “capitalists killed inflation” featuring the image of a deflated dinosaur.

What makes the current obsession with low inflation so perplexing is that most measures of inflation are not exceptionally low. When Jerome Powell gave his ‘Greatest Challenge’ speech in June 2019, Core CPI was 2.1%. In fact, Core CPI inflation has been above 2% every month since March 2018 and is currently 2.3%.

Core PCE inflation, the measure that the Fed uses to set monetary policy, is currently 1.6%, only modestly below the Fed’s 2% target. While it has tended to be lower during this expansion than during past expansions, it was over the Fed’s 2% target as recently as November 2018. Furthermore, Core PCE inflation has dipped this low, and lower, during most post-war expansions. In fact, Core PCE inflation was just 1.3% in early 1966. It ended that year over 3% and was on its way to 10% by the early 1970s. It wouldn’t get back below 2% for 30 years and when it did, it was considered a major accomplishment.

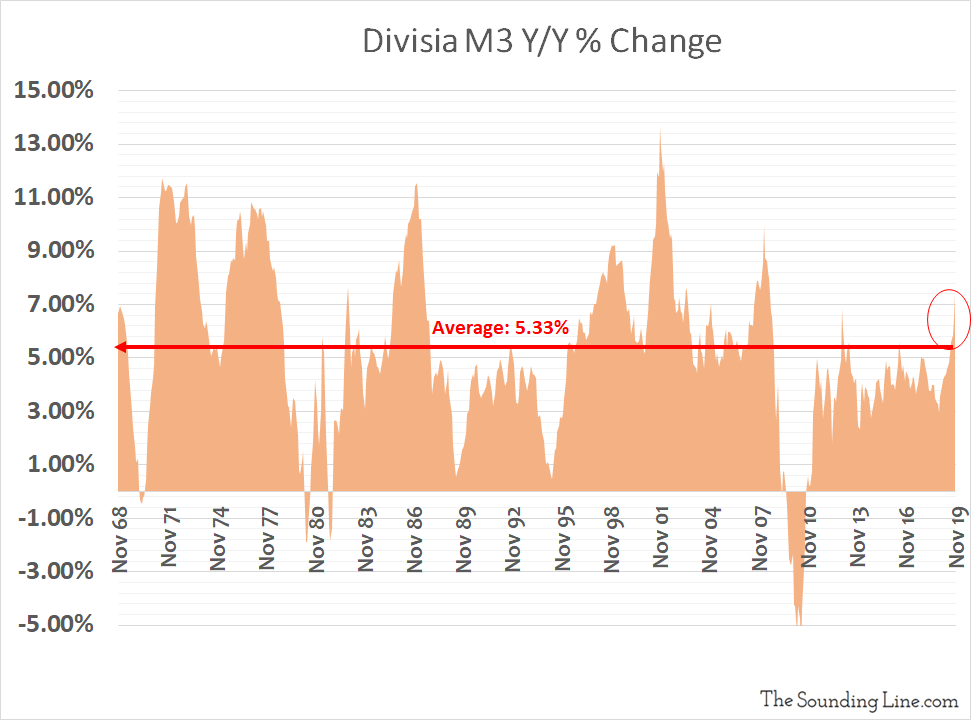

It is within such a context that we note that the growth of the money supply in the US (Divisia M3 Broad Money) has accelerated to an annualized pace of nearly 7.5% as of November 2019 (the most recent date for which data is available). That represents the highest growth rate in the money supply since early 2008 and over 40% faster than the average pace since 1968.

Back in October 2019, I wrote an article titled “My Recipe for Destroying the Global Economy in One Easy Step” in which I stated that by far the greatest risk to today’s economy, given the market’s vulnerability to higher rates, would be continuing to deliver unduly accommodative monetary policy. It is exactly what was, and is, unfolding.

Given subdued global growth rates, it will likely take a long time for inflation to rise to destructive levels in the US, probably years. However, the greatest monetary challenge of our time is not the condition (low inflation) that permitted accessible and cheap credit, endless stimulus, the longest bull market in history, and full employment over that last decade. It is what happens when inflation eventually returns and central banks cannot combat it without destroying the financial bubbles that they have engineered in its absence. That is the question that I fear will define the next decade.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.