Taps Coogan – January 11th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

For the past year and a half we’ve repeatedly brought up two ideas. The first was that inflation was going to overshoot the Fed’s dreadfully bad base effect/transitory inflation call due radical changes in the size and structure of monetary and fiscal stimulus. That’s now history.

The second was that we live in an historically interest rate sensitive economy dominated by too much debt and over-financialization that is premised on excessively accommodative policy. In other words, the moment the Fed got serious about raising interest rates and reducing its balance sheet, inflation would peak. That’s now.

Simply put, so long as the Fed viewed inflation as transient it would be persistent, but once it viewed it as persistent it would prove transient.

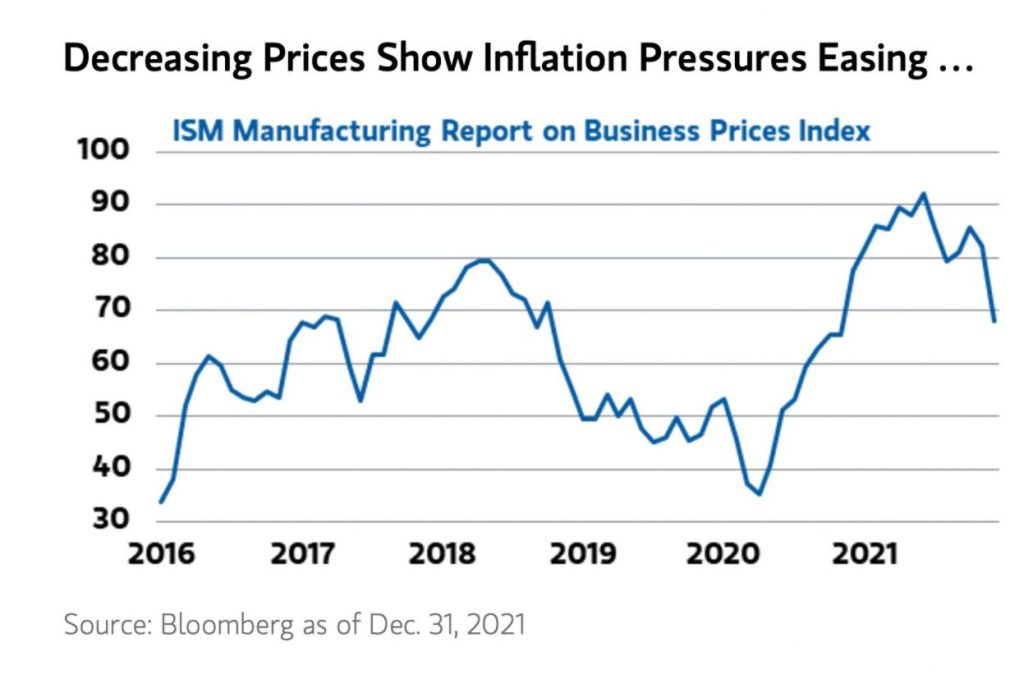

Well, right one cue, one of the leading indicators that inflation was going to exceed the Fed’s laughable base effect argument, manufacturing prices paid, looks like it has peaked, via Acemax Analytics.

Because the CPI/PCE numbers lag reality, inflation may keep rising for another print or two, but the notion that we were at the start of a 1970s era of persistently higher inflation despite rising interest rates and a bear market never really held up to scrutiny. Debt, demographics, financial assets, etc… are in many ways in the exact opposite place as the early 1970s and much closer to the setup in the late 1920s.

The Fed’s policy mistake of keeping QE and ZIRP on full blast all year despite high inflation, resulting in an obvious financial bubble, was amateurish. Now under-estimating the sensitivity of that financial bubble to tightening, and the sensitivity of the economy to financial markets, would be a much more serious mistake.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Inflation on my planet has been raging for decades. I have no clue what this “transient” shit is all about all I know is a f’ing fixer upper in a shit hood is close to $1,000,000.

The local restaurant in 2000 had a banner: 4 burgers, 4 fries, 4 sodas, for $11.99 and today it’s $29.99, is that the “transient” inflation?

I don’t know a single person that is making ~3X what they did in 2000. most in my industry are making the same.

I’m not going to make every single inflation article a piece about how CPI isn’t accurate in an absolute sense. So just imagine that every article starts with some sentences about that.

Transient inflation is where the rate at which our purchasing power is deteriorating goes from fast to slower, not the other direction.

Is it okay to express the view that perhaps the rate at which our purchasing power decreases might go from very fast to less fast? Or are we only allowed to think that it is constantly accelerating?

There is push back on the idea inflation is about to run rampant. In my mind, what happens to the value of the dollar and the three other major fiat currencies remains the wild card. As of yet, their fate is still up in the air.

Fiat currencies have the potential to play a much larger part in the “end game” than most people imagine. The short article below takes a hard look at this topic

https://brucewilds.blogspot.com/2022/01/arguing-un-consensus-on-todays-macro.html