Taps Coogan – December 14th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

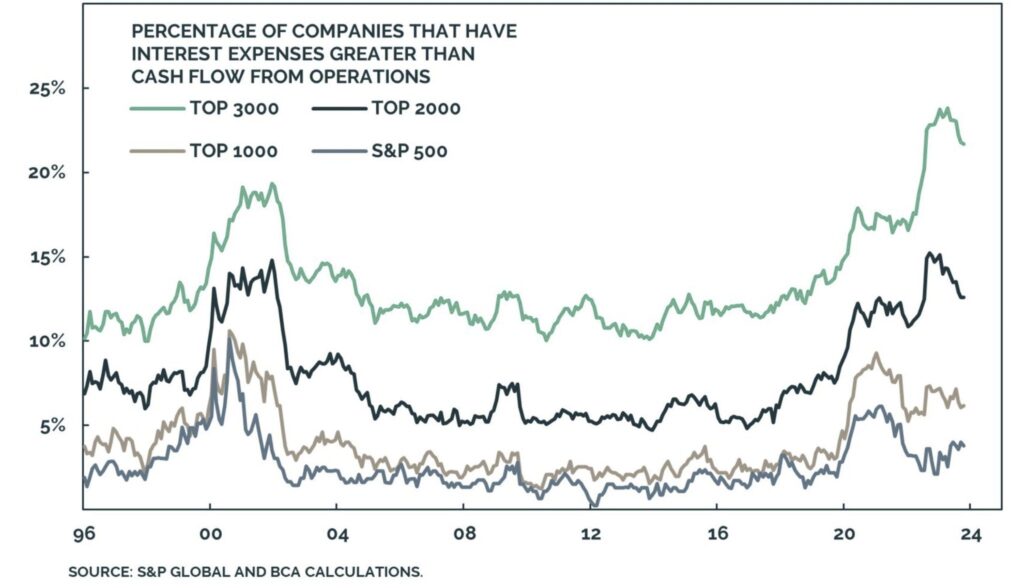

As the following chart highlights, rising interest rates and borrowing costs are starting to consume cash flow for an increasing number of publicly traded companies in the US. Via Win Smart:

Interest is killing companies pic.twitter.com/0vXW3VEzKK

— Win Smart, CFA (@WinfieldSmart) December 13, 2023

Although less than 5% of large S&P 500 companies are seeing their interest expenses outstrip their cash flow, when widening the sample to the 3,000 largest publicly traded companies, the number rises above over 20%.

While the absence of this phenomenon among large cap stocks is good news for Wall Street, the medium sized companies that make up the vast majority of the 3,000 or so publicly traded companies in the US employ overwhelming more people and are responsible for much more economic activity.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.