Taps Coogan – November 30th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

One of the innumerable bullish arguments being made for ever higher stock valuations is the belief that super-sized government deficits and stimulus may lead to higher inflation and that higher inflation will translate into higher share prices.

In the extreme, there are many examples of hyper-inflation doing just this. Iran and Venezuela’s stock markets have skyrocketed higher over the past decade, often times making them the best performing indices in the world. The German stock market during the hyper-inflation of the Weimar Republic rocketed exponentially higher as well.

Most of the gains in these examples are a simple reflection of the destruction of the purchasing power of the local currency and, although all three countries’ gains remained positive when converted back into to US dollars at the official rates, official conversation rates greatly understated the true rates of inflation.

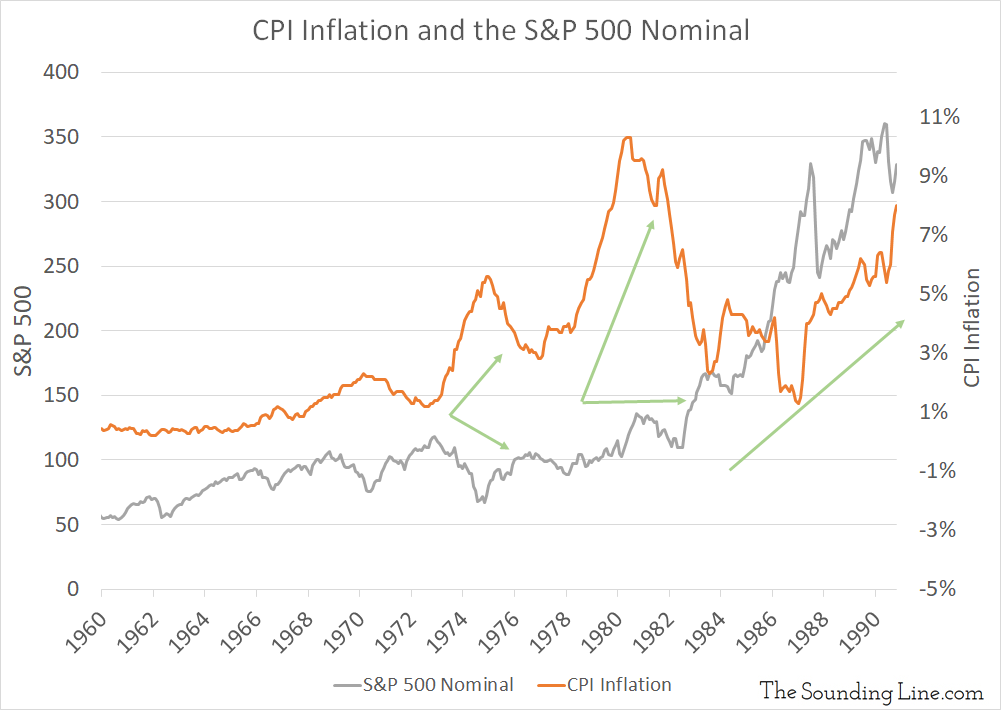

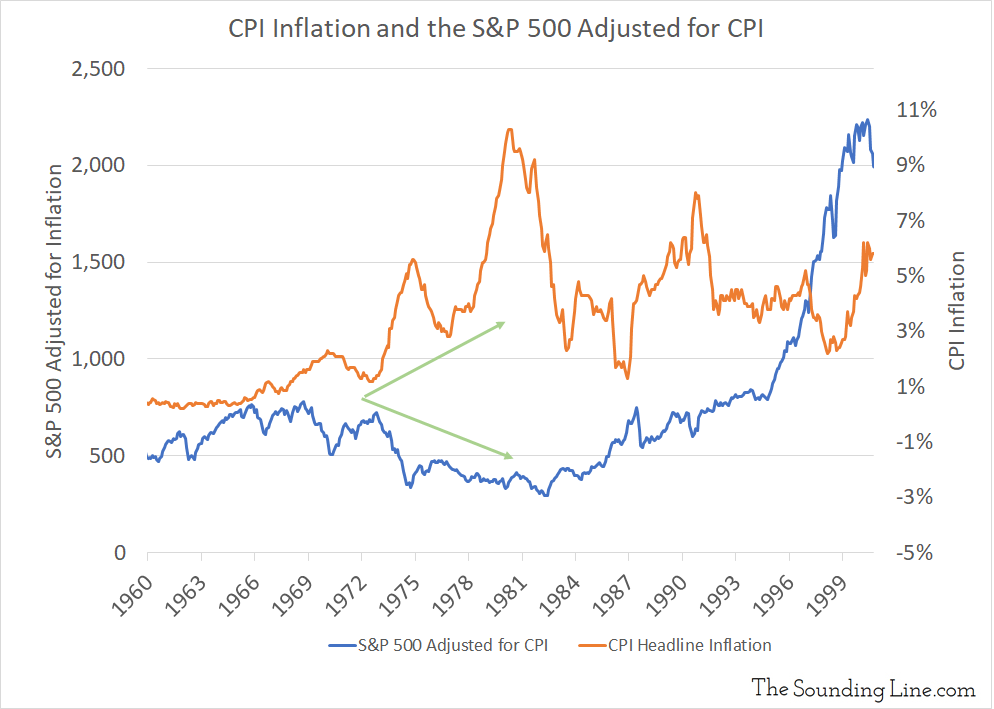

Fortunately, we don’t need to look to the Weimar Republic to see how more normal ‘high’ inflation affects the market. As the following charts show, the rising inflation of the 1970s corresponded to a plateau in the S&P 500 and a decline in the S&P 500 adjusted for inflation. It was only in the mid 1980s that inflation started to become more positively correlated with stocks.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Weimar, not Wiemar

Thank you very much. Corrected