Submitted by Taps Coogan on the 15th of December 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

The term BRIC (Brazil Russia India and China) was first coined in 2001 by former Goldman Sachs Chairmen Jim O’Neill to represent the group of very fast growing developing economies which account for approximately half of the world’s population and a large chunk of world GDP. South Africa was later added rounding out the acronym BRICS. These fast growing economies also share geopolitical and economic interests that, historically, have been counter to traditional western economic preeminence.

Having existed as an unofficial group for a number of years, the BRIC countries first met formally in June 2009. Since then, they have met regularly and have formally outlined their objectives which include replacing the US dollar as the world reserve currency and creating a counterbalance to western dominated economic institutions such as the IMF. By 2011, South Africa was formally added to the group and in 2014 they founded the ‘New Development Bank.’ Headquartered in Shanghai, China and sometimes referred to as the ‘BRICS Bank’, the New Development Bank is an alternative to the IMF.

BRICS has become a household term and the group’s staggering economic growth during the 2000s and early 2010s has given real staying power to idea that the BRICS are a legitimate alternative to the western economic system. To put their remarkable economic rise in perspective consider this:

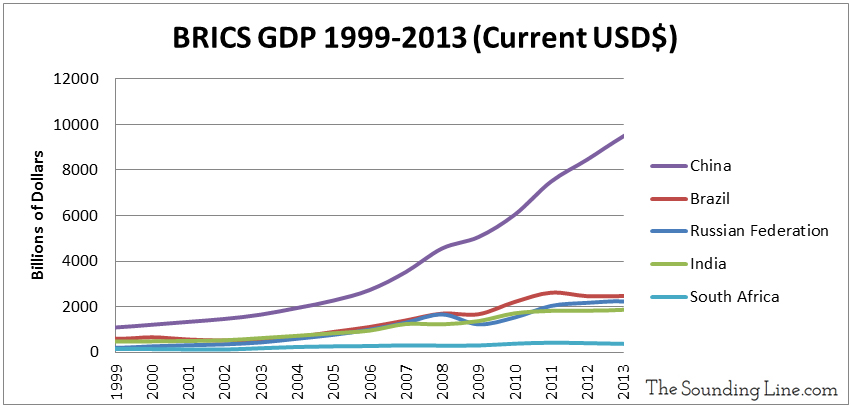

From 1999 until 2013 US and EU GDP nearly tripled in current dollar terms. During the same period Russia’s GDP more than quadrupled, Brazil’s grew nearly six fold, India’s grew over six fold, and China’s GDP grew a staggering 27 fold. South Africa clocked in a more moderate 2.9 fold increase.

Total GDP growth from 1999-2013 of the 28 (by 2013) EU countries a plus the US was $15.5 trillion in current US dollars. Total GDP growth for the five BRICS countries was nearly as high at $13.9 trillion. In other words, 29 of the largest most advanced economies including the US, Germany, the UK, and France barely outgrew five, initially much smaller, emerging markets despite having all of the supposed geopolitical and infrastructure advantages.

Yet for those paying attention, something has been changing and it looks as though the BRICS growth streak is coming to an end.

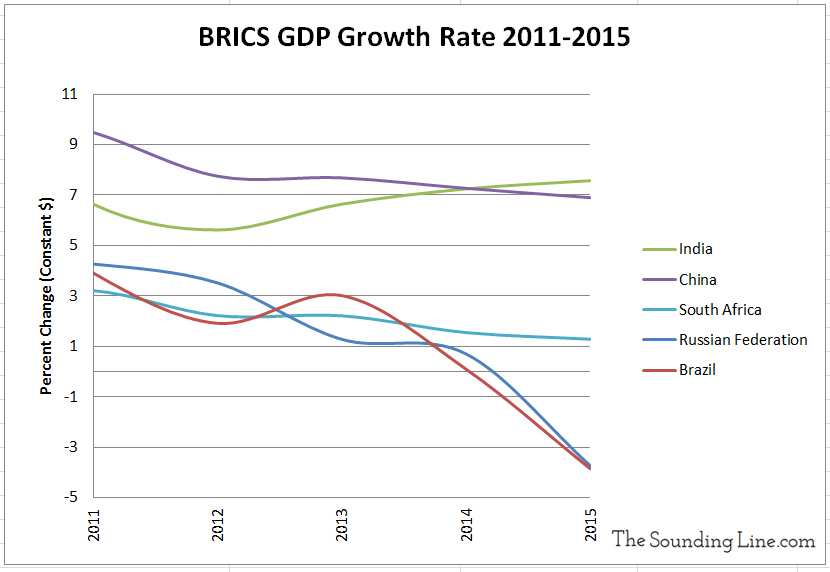

It turns out that the BRICS’ fortune may have peaked precisely when South Africa joined the group in 2011 and commodity prices were peaking. The years since 2011 have seen broad-based declines in commodity prices and this has drastically undermined both the South African and Brazilian economies. The two lost $103 billion and $839 billion in current dollar GDP respectively between 2011 and 2015.

Then energy prices began to collapse in 2014 and took Russia’s economy with them. In current US dollar terms, Russian GDP has fallen over $900 billion from 2013 to 2015 alone. In current dollar terms, Russia’s GDP was a startling 40% lower in 2015 than in 2011. That’s what happens when your currency loses half its value against the US dollar.

The BRICS’s hard knocks don’t stop there. Just a year later, in June 2015, China experienced its largest stock market crash in its history and, despite turning to colossal amounts of private sector debt creation, the Shanghai Composite is still 38% below its highs. Meanwhile, Chinese economic growth has slowed from an ‘official’ rate of 9.5% in 2011 to 6.9% in 2015 and analysts are increasingly skeptical of the accuracy of those figures.

India has been the exception to the trend and its GDP growth is still accelerating, now surpassing China’s. Time will tell what effect their ill-conceived currency ban will have on their economy.

The chart below shows that GDP growth has been decelerating in constant dollar terms for all BRICS countries except India.

All of the BRICS countries expect China have also seen massive double-digit devaluations of their currencies against the US dollar since 2011.

|

Loss of Value Against USD Since January 2011 |

|

| Russian Ruble |

49.6% |

| Brazilian Real |

50.6% |

| Indian Rupee |

33.6% |

| South African Rand |

51.2% |

| Chinese Yuan |

4.3% |

It’s hard to argue for the usurping of the US Dollar as the global reserve currency when BRICS’s currencies are losing 50% of their value in as little as five years.

The point of all of this is not to belittle the economic accomplishments of the BRICS. Instead, it is to point out that, long before the UK Brexit and the election of Donald Trump as US president, the tide of ‘globalization’ had already started to turn. The long held belief that the world is on an inexorable march toward the ‘emergence’ of third world markets and increased globalization remains very much under scrutiny.

In addition to that which is discussed in this article, global trade in general has been languishing (here), and global oil production on a per capita basis actually plateaued decades ago (here). Perhaps, instead of globalization being the forsaken conclusion that it is taken for, the seemingly miraculous and largely peaceful rise of global emerging markets and the explosion in the global middle class that took place in the last few decades is not destined to be a permanent feature of the human experience.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.