Submitted by Taps Coogan on the 30th of June 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

This post will be short as there are only two number to keep in mind.

The first is $204 billion.

That is the total amount taxpayer ‘bailout’ money provided to all the US banks during the 2008-2009 financial crisis (see here). That crisis was proclaimed to be the worst since the great depression and its effects linger today. Nearly eight years later and most central banks still refuse to normalize their monetary policy.

The second number is $166 billion (€150 billion).

That is the amount of ‘precautionary liquidity guarantees’ extended to Italian banks today by the European Commission on behalf of European taxpayers (see here).

While Italian banks may choose not to access all of the €150 billion, it’s all but guaranteed that they will, making this a massive bailout of the Italian banking system. Italian banks, which are far smaller than their US counterparts, have thus received a bailout nearly as large as the the one provided to the entire US banking system in the midst of the worst recession in nearly a century.

What’s more, with €360 billion in non-preforming loans logged in Italian banks, this €150 billion bailout is likely the first of many. It was also revealed today that Deutsche Bank and Santander failed US stress testing for the second and third year respectively.

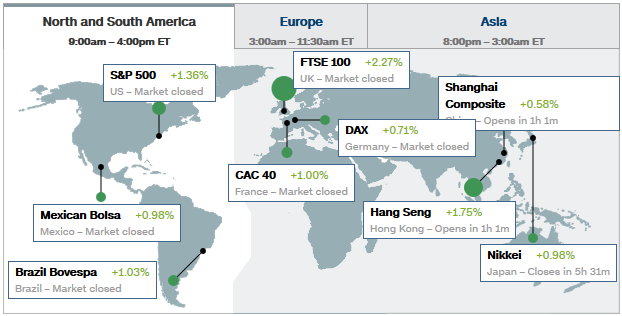

That news should have investors extremely concerned about the fragility of the European financial system, yet despite this markets rallied today. Not only did Italian stocks advance, so did every major stock market index in the world. When markets behave this irrationally, it is a sure sign that they are approaching their high water mark.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.