Taps Coogan – October 26th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

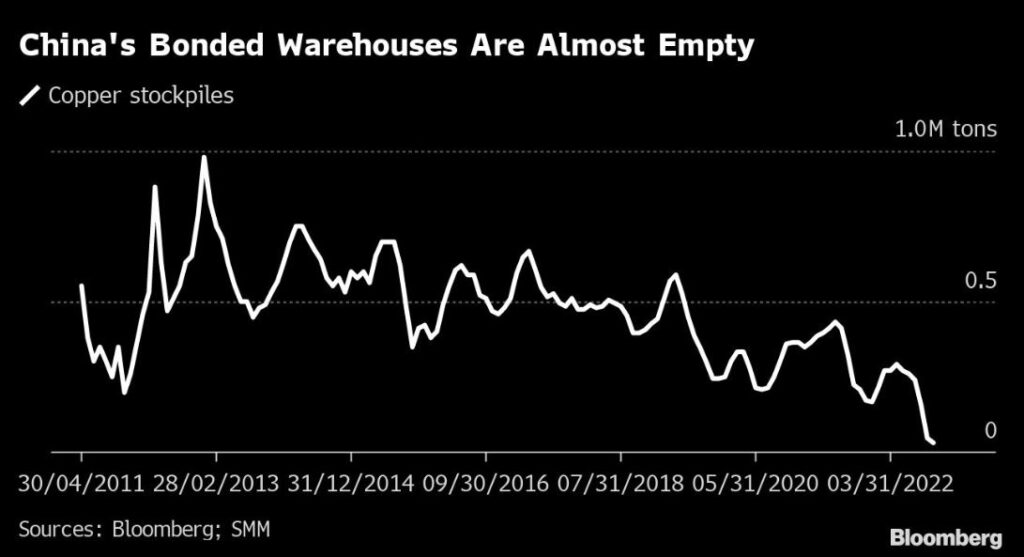

Copper prices have fallen about 30% since its intraday high of $5 back in March and yet global copper inventories have fallen to their lowest levels since at least 2001, as the following chart from Bloomberg highlights.

Based on inventories at Comex, the LME, the Shanghai Futures Exchange, China’s bonded copper stockpile, etc… there are just 1.6 weeks of global inventory left.

Indeed, China’s infamous bonded copper stockpile is essentially empty. The combination of fraud, real-estate market weakness, deleveraging, and rolling liquidity crises at various financial institutions in China have killed the bonded copper market.

However, despite all the economic gloom in China, copper imports remain at more-or-less healthy levels. Those imports make China’s tolerance of near-zero copper inventories uncharacteristically risky. Are Chinese copper buyers so unshakably bearish on copper demand that they don’t feel the need to maintain any inventories?

Meanwhile, contracts for immediate delivery of copper are trading at the highest premium to 3-month delivery since 2005, confirming the tightness of inventories and, at least for the time being, that copper demand remains strong relative to immediate supply.

If the global economy rapidly deteriorates, the extreme tightness of copper inventories presumably won’t matter. That seems to be what the copper market is betting on in a big way. However, if there is any upgrade to growth expectations, fleeting as it may be, somebody is going to notice that copper inventories are running out.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.