Taps Coogan – February 4th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

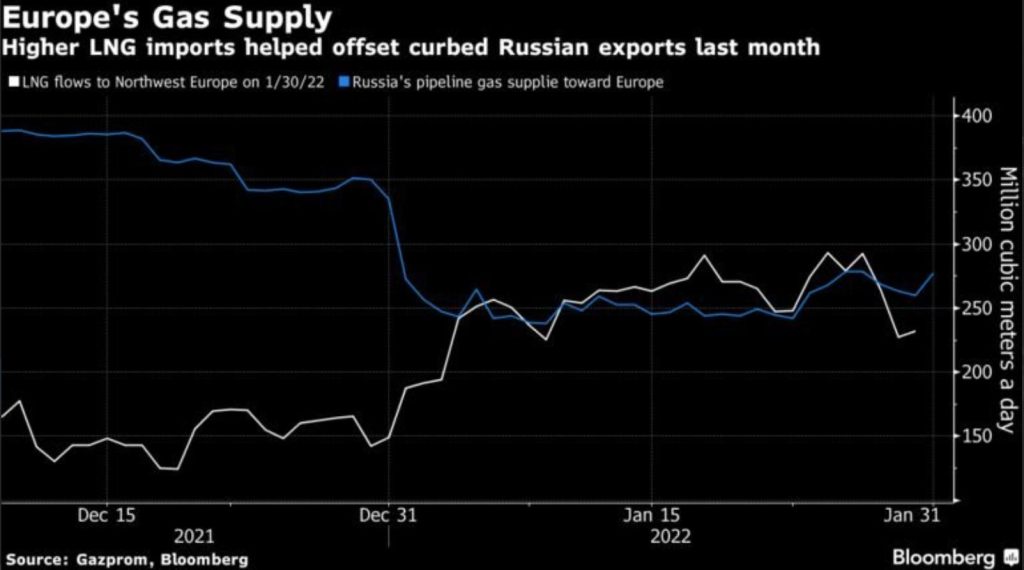

The Russian strategy to suspend spot auctions for natural gas flows to Europe in order to create motivation to approve the Nord Stream 2 pipeline – and cut Ukraine out of the gas transit business – has run into a problem. As the following chart from Bloomberg via Daniel Lacalle highlights, LNG – most of it from the US – has made up for nearly the entire shortfall of Russian gas since last December. LNG flows into Europe have even exceeded Russian pipeline flows at times in January.

With US natural gas prices still trading at huge discounts to European and Asian benchmark prices even after shipping costs, more LNG export capacity is expected to be greenlit in 2022.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

European countries decided to source their gas on the spot market as a policy to work towards zero carbon. They therefore stopped signing contracts with gazprom. Gazpron cannot deliver gas if it is not contracted for. It was not the Russians squeezing supply. The Us was squeezing Europe to stop buying Russian gas and for them to buy their more expensive Freedom Gas delivered by ship.

That sounds nice and European energy policy is terrible, but there is the long term market and the spot market. Gazprom has repeatedly stopped holding auctions for spot gas on the Yamal pipeline. If that’s because they don’t have enough gas, then what’s the need for Nord Stream 2 and the long term contracts? If they do have enough gas why aren’t they offering it on the spot market?

https://uk.investing.com/news/stock-market-news/gazprom-says-it-will-not-sell-gas-on-its-spot-platform-this-week-2549537

https://biznesalert.com/gazprom-decided-not-to-book-the-yamal-pipe-but-it-doesnt-mean-it-will-abandon-it/

Well now you know why