Taps Coogan – February 12th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

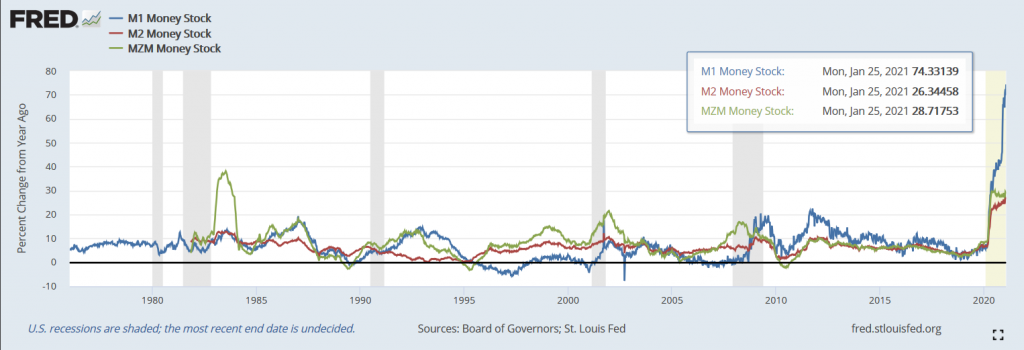

M1 money supply growth just keeps surging. It has now hit roughly 75% year-over-year, more than triple the previous all-time high from 2011.

Two well worn arguments get made to justify why this unprecedented increase in the money supply won’t eventually cause inflation. Neither argument holds up to scrutiny.

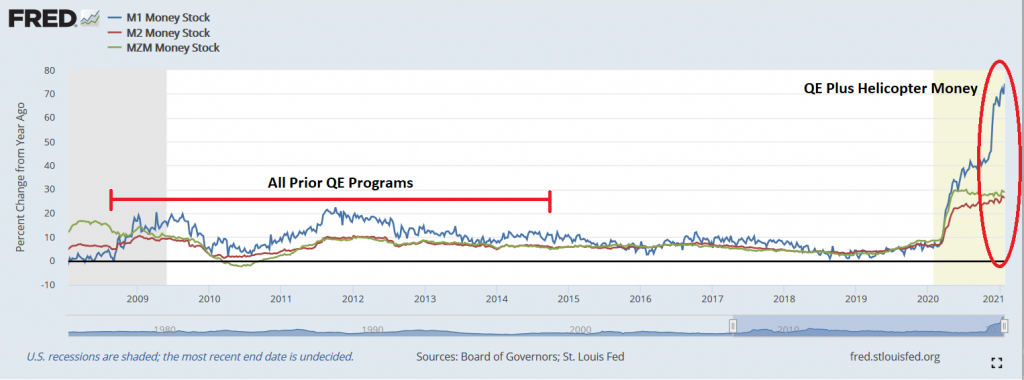

The first argument is that the QE programs which followed the global financial crisis didn’t result in pernicious inflation (at least not as measured by CPI or PCE), so therefore neither will the current QE program.

What that argument misses is that the first generation of QE programs never had much success at increasing the money supply. On the other hand, the current ‘QE plus helicopter money’ program is proving extremely ‘successful’ at increasing the money supply. The difference can be seen as clear as day in the chart below. The first argument is a moot point.

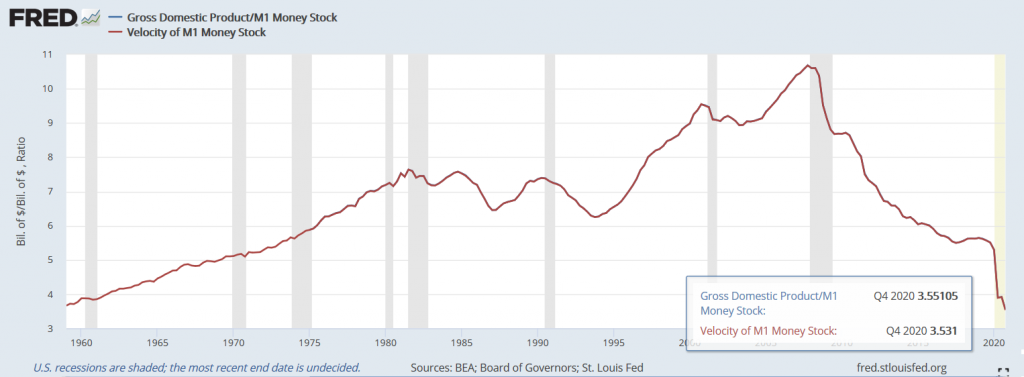

The second argument is that the size of the money supply doesn’t cause inflation. Instead, it is the velocity of the money supply that causes inflation.

That is true. If the Treasury printed $10 trillion and nobody used it, it wouldn’t cause inflation.

However, there is an important caveat. We cannot directly measure money velocity. People may imagine that the Fed is tracking how many times a dollar gets spent in a year, but they are not. The current velocity figures are inferred by dividing GDP by the money supply.

Money ‘Velocity’ IS GDP Divided by the Money Supply

The result is a very imperfect measure of velocity, especially when one recalls that imports are subtracted from GDP and government transfer payments are not counted.

Take just one example. Imagine that Congress sent everyone $2,000, the Fed and foreign Treasury buyers monetized the increase in Treasury debt, and everyone receiving checks immediately rushed out and bought imports from China. Retailers then restocked (sending money to China), paid their employees from the profits (the difference between the retail and import prices), and the employees went right back out to buy more stuff from China. Repeat that process as many times as you like.

The whole affair would be more-or-less invisible to the money velocity calculation. The imports would be subtracted from GDP. The increase in money supply would be reduced as dollars flowed to China and then recycled back into the US in treasury holdings which aren’t counted in M1 or M2.

Money velocity calculations don’t work well in an import dominated economy. This is doubly true when the largest source of imports pegs its currency to the importer.

More fundamentally, as long as the increase in GDP that results from money printing is less than the money printing, velocity will fall the way it’s calculated today.

Perhaps more importantly than all of that, it is not the level of velocity that matters. It’s the direction. A small increase in velocity when the money supply is very large can cause a lot of inflation.

Zoom out and the whole thing gets a lot more clear.

The Fed’s prior monetary expansions didn’t work because the money never made it out of the financial system. This time the money is making it out, but a lot of it is still being saved. When it gets spent, it will be inflationary. Don’t expect forewarning from the velocity numbers.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.