Submitted by Taps Coogan on the 17th of October 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

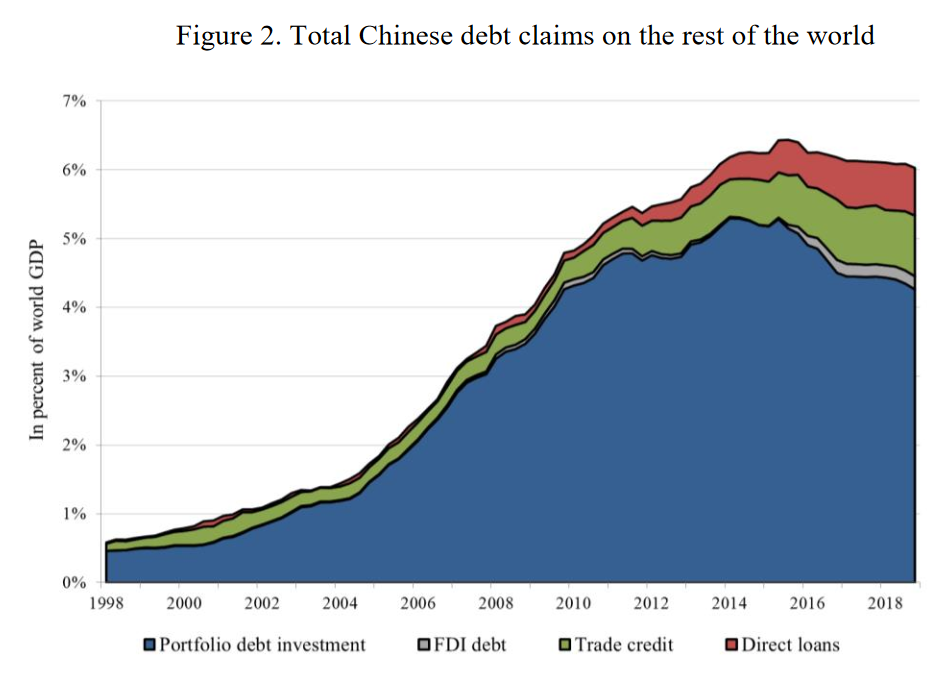

While China’s leading role in the global goods trade is well documented, China’s overseas lending is considerably less well understood. That is largely because China does not publish official overseas lending statistics, nor is there a single repository for Chinese foreign loan and bond holdings.

The Kiel Institute for the World Economy recently tried to rectify this ambiguity by compiling 68 years of data from multiple sources of Chinese overseas lending (PDF). They describe their sources as:

” Our newly assembled database of Chinese lending abroad spans more than six decades from 1949, when the People’s Republic was established, until 2017. The data is granular and was gathered from a variety of sources (the consensus approach as described), including international treaties, debt contracts, policy reports, as well as the work of academics such as the AidData team at William and Mary (Dreheret al.2017). Overall, we combined details on more than 1,947 loans as well as 2,947 grants extended by the Chinese government and state-owned creditor agencies since 1949, to more than 150 countries worldwide, with total commitments of 530 billion US$”

The results of their investigation are as follows:

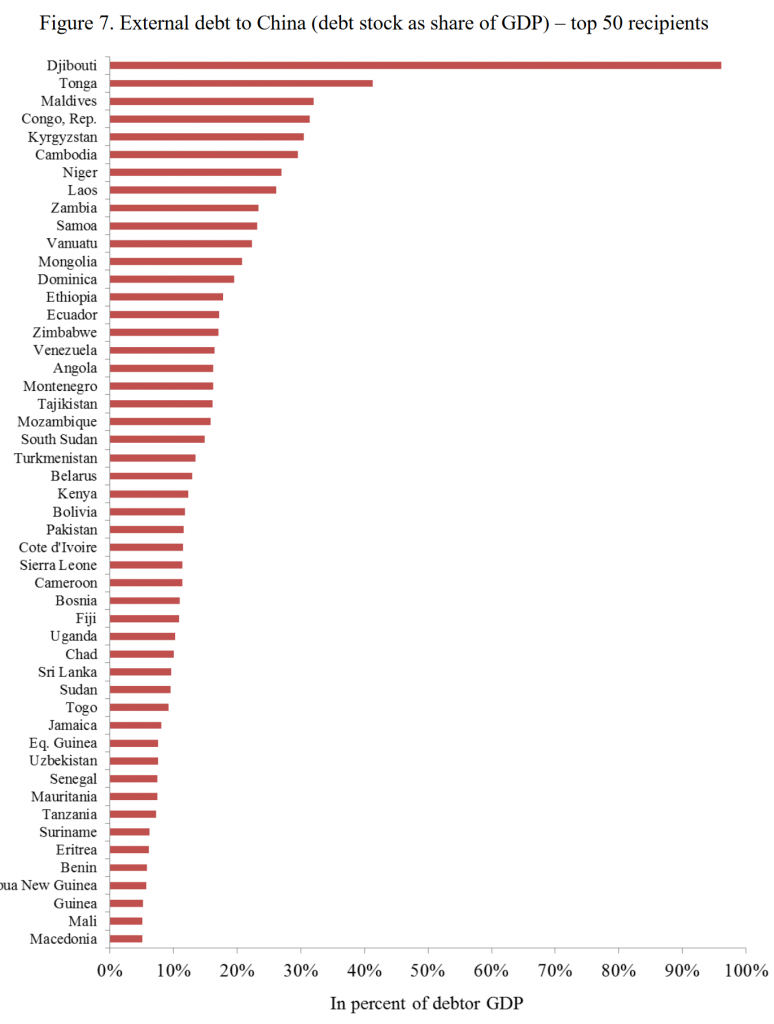

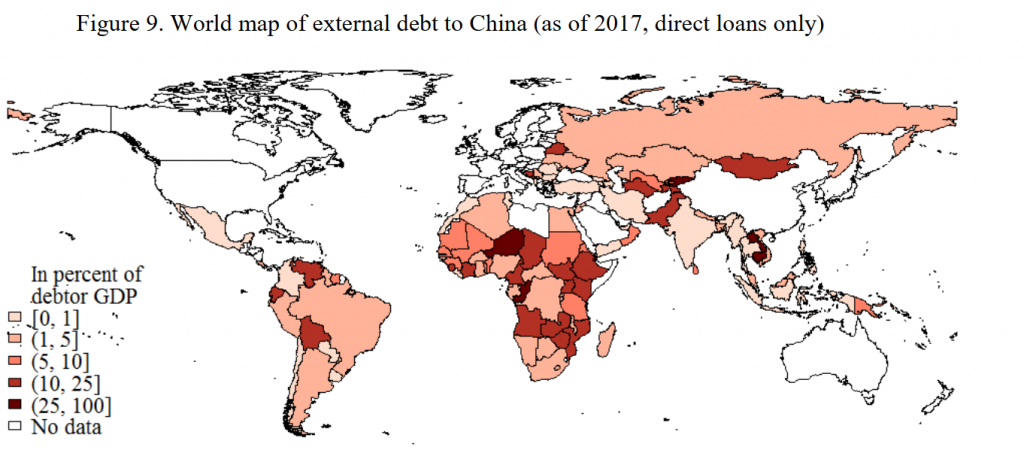

Emerging Markets:

“For the 50 main recipients of Chinese direct lending, the average stock of debt owed to China has increased from less than 1% of GDP in 2005 to more than 15% of debtor country GDP in 2017, at least according to our lower bound estimates. For these countries, debt to China now accounts for more than 40% of total external debt, on average. More importantly, using unpublished data from the World Banks’s Debtor Reporting System and data on BIS reported bank claims, we find that about 50% of China’s lending is “hidden”. Neither the IMF, nor the World Bank, nor credit rating agencies report on these “hidden” debt stocks… The problem of “hidden” Chinese debts is particularly severe in crisis countries such as Venezuela, Zimbabwe, and Iran. Indeed, China does not report any bank claims towards these countries to the BIS, despite substantial known lending flows over the past 15 years.

“Over the past decades,official creditors have typically lent to developing countries at concessionary terms with long maturities and at below-market interest rates. China, instead, often lends at market terms (with risk premia), shorter maturities, and partly with collateral clauses that secure repayment through commodity export proceeds, in particular from oil.”

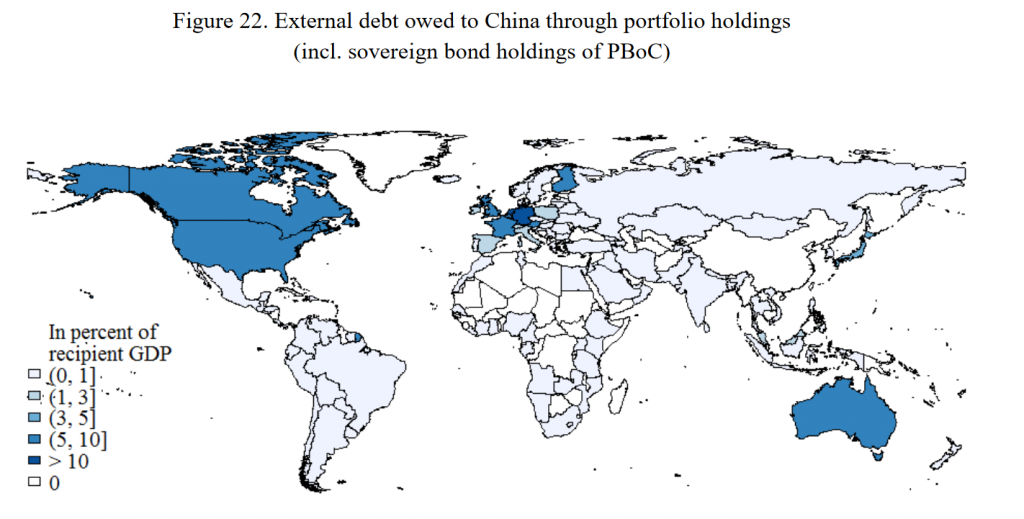

Developed Markets:

“Rather than direct loans, advanced and higher middle-income countries receive portfolio investments, via sovereign bond purchases of the People’s Bank of China (PBoC). As a result, many advanced countries have become highly indebted towards the Chinese government… Other types of state-driven finance, in particular officially guaranteed trade credits as well as equity and FDI flows to advanced countries have also strongly grown. Furthermore, China has built a global network of central bank swap lines, meaning standing lines of credit with the PBoC and foreign central banks, including most advanced economies. The total sum of these official swap line drawing rights exceeds 500billion USD”

The punchline? When combining the direct lending to developing markets and the portfolio holdings in developed markets, China is now likely owed more than $5 trillion of debt by the rest of the world. Remarkably, that constitutes over 6% of total global GDP and about 40% of China’s GDP.

You can read the full report here (PDF).

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

How about a list of who China owes?