Taps Coogan – October 28th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

We have long maintained that both sides of the transitory inflation debate are half wrong.

The camp that was arguing all year that transitory inflation was a base effect which was going to peter out in a handful of months was radically underestimating the changes in monetary policy that occurred post-Covid (trillions of dollars of never-before-seen helicopter money) and, as a result, has been almost comically oblivious to the persistent rise in inflation that we’ve subsequently seen.

The camp arguing for a decade of double-digit runaway inflation like the 1970s is no less off target. The 1970s were the low point in Post-War US debt-to-GDP and the high water mark in working age population growth. Stocks and bonds, while expensive in the late 1960s relative to the 1930s (a depression), 1940s (a world war), and 1950s, were unfathomably cheap compared to today. The 1970s were, in many ways, the complete opposite economic setup of the current one.

The notion that this economy, which the Atlanta Fed is currently clocking in at just 0.5% annualized real GDP growth, loaded with more debt than during World War II and more expensive stocks than 1929 or 2000, with a shrinking workforce age population, and the prospect for rising taxes and tightening regulations for years to come, can power through successive rate hikes as China’s property bubble implodes is a pipedream.

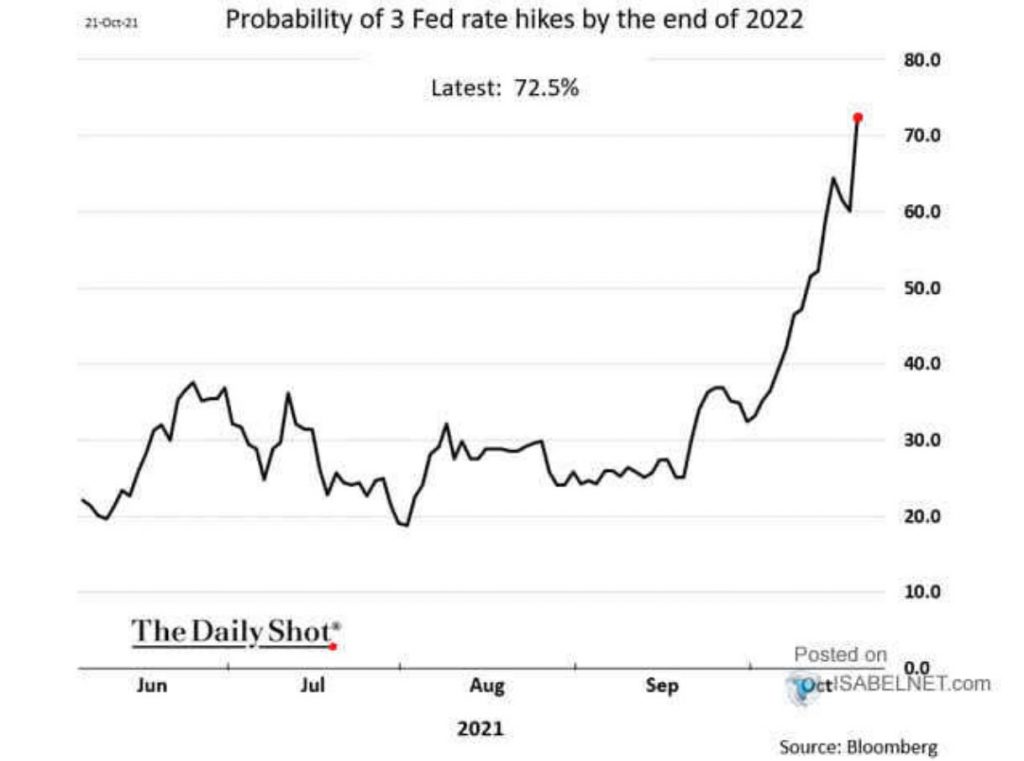

Right now, the market is pricing in an implied THREE rate hikes next year, as the following chart from ISABELNET highlights.

Fat chance.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The global financial system has spun out of control. We might soon be witness to the first global inflationary depression. Several factors make this scenario possible, they are outlined below. If this does occur, fortunes will be made and lost. As investors shift into assets that do well during times of inflation, it is possible they may set in motion a self-feeding loop or cycle. More about this in the following article.

https://brucewilds.blogspot.com/2021/03/the-first-global-inflationary.html