Taps Coogan – September 26th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

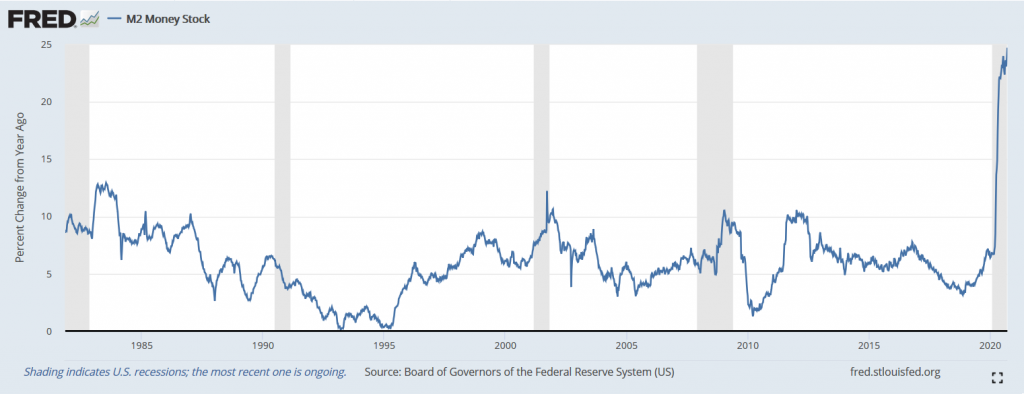

M2 money is now growing at 25% year-over-year, continuing to rise despite a slowdown in the pace of quantitative easing and fiscal stimulus over the summer. We are now witnessing the fastest rate of growth in the money supply on record by more than double.

Whereas past quantitative easing programs had little-to-no detectable impact on money supply growth (the liquidity got trapped at the Fed and banks), the Covid response is a completely different animal. Congressional spending, stimulus checks, expanded unemployment, and the direct monetization of corporate bonds have led to over three trillion new dollars making it into the money supply.

As Milton Friedman famously noted, monetary policy works with long and variable lags. Time will tell what the Fed has done.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

“Time will tell what the Fed has done”

No time to tell needed. The FED has done what the FED always does……enriched wall street and it’s banking partners.

I guess I meant ” Only time will tell what the full ramifications of these policies will be.” Or something like that