Submitted by Taps Coogan on the 10th of October 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Here is my recipe to destroy the global economy in one easy step:

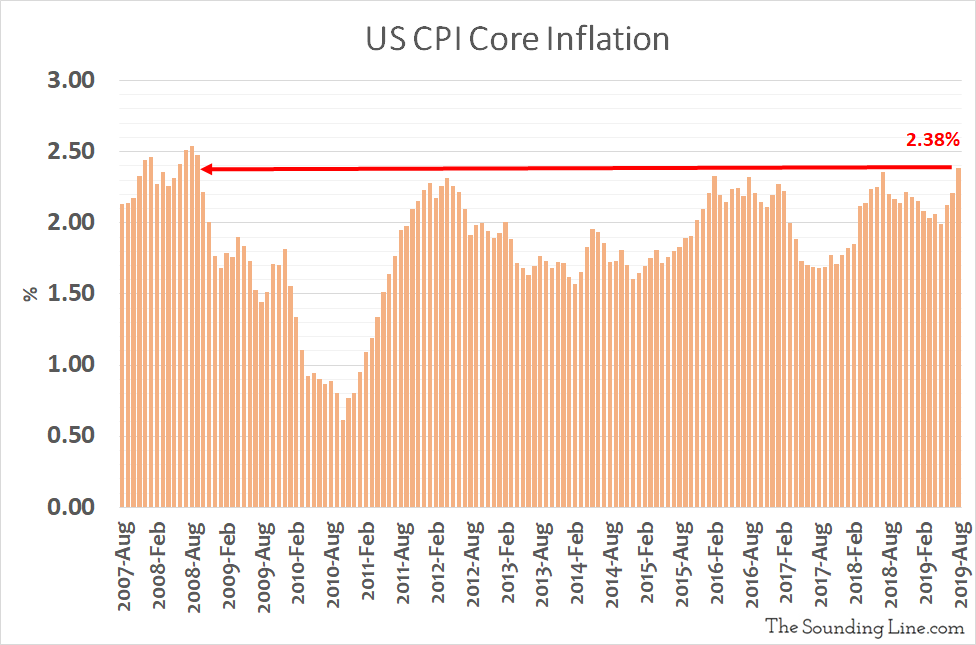

Start with an economy with above average GDP growth, core CPI inflation over 2%, healthy credit growth, the highest real wage growth since the 1970s, the lowest unemployment rate in a generation, high consumer confidence, and historic over-indebtedness. Then start aggressively cutting interest rates and printing money because an ongoing trade negotiation is weighing on the manufacturing sector. Results are most effective if the manufacturing sector’s exports are very small relative to the overall economy.

Continue to cut rates as needed until inflation rises solidly and persistently above 2%. Make sure inflation stays above 2% for an extended period to ‘make up’ for any past undershoots of 2%.

Sound Familiar?

Listening to central bankers and economists today, one would conclude that deflation, not inflation, is by far the greatest threat to the global economy. Fed Chairman Jerome Powell recently said “The proximity of interest rates to the (Effective Lower Bound) has become the preeminent monetary policy challenge of our time.” In other words, low inflation and interest rates are the greatest monetary challenge of our time. The Fed, the ECB, and the BOJ are constantly bemoaning ‘persistent and worrying’ undershoots in inflation.

It apparently goes unnoticed that the current environment of persistently low inflation has coincided with the longest economic expansion and bull market in American history.

Persistently low inflation is what allows central banks to keep interest rates perpetually low. It is what has kept corporate America solvent and buying back their own shares despite the fact that inflation adjusted pre-tax corporate earnings are lower today than they were in 2006. Persistently low rates keep the lights on in our burgeoning industry of structurally unprofitable companies. Low rates have enabled the government to cut taxes and surge spending without worrying about the resulting deficit.

Is the global economy slowing down? Cut interest rates and print money. Trade tensions? Cut interest rates and print money. Overnight funding problems? Cut interest rates and print money. Slowing and aging demographics? Cut interest rates and print money. Uncompetitive regulatory and tax policies? Cut interest rates and print money.

How much easier of an operating regime could central banks really hope for? It’s all possible because inflation remains muted.

The Price for Accommodative Policy Will Come Due When It Ends

Accommodative monetary policy is not a free lunch. It’s a no-money down, 0% interest rate installment plan on a very, very overpriced lunch.

Accommodative monetary policy is causing horrible distortions in the underlying economy, massive bubbles in financial assets, mis-allocations of capital, suppression of prices signals, and the massive and historic over indebtedness of corporate America and the federal government.

However, most of those factors only transform from abstract concerns into problems in the here-and-now when endless monetary accommodation ends. Inflation is the only thing that will end endless monetary accommodation. When just a little bit too much inflation shows up in the economy and the Fed is forced to react to it by tightening monetary policy even though it hurts the economy, all of the problems that are the being built into the economy by 11 years of expedient policy are going to come home to roost.

Central banks aught to be careful what they wish for as we embark on yet another round of rate cuts and quantitative easing (in all but name) despite perfectly adequate growth and inflation.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.