Taps Coogan – June 16th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe

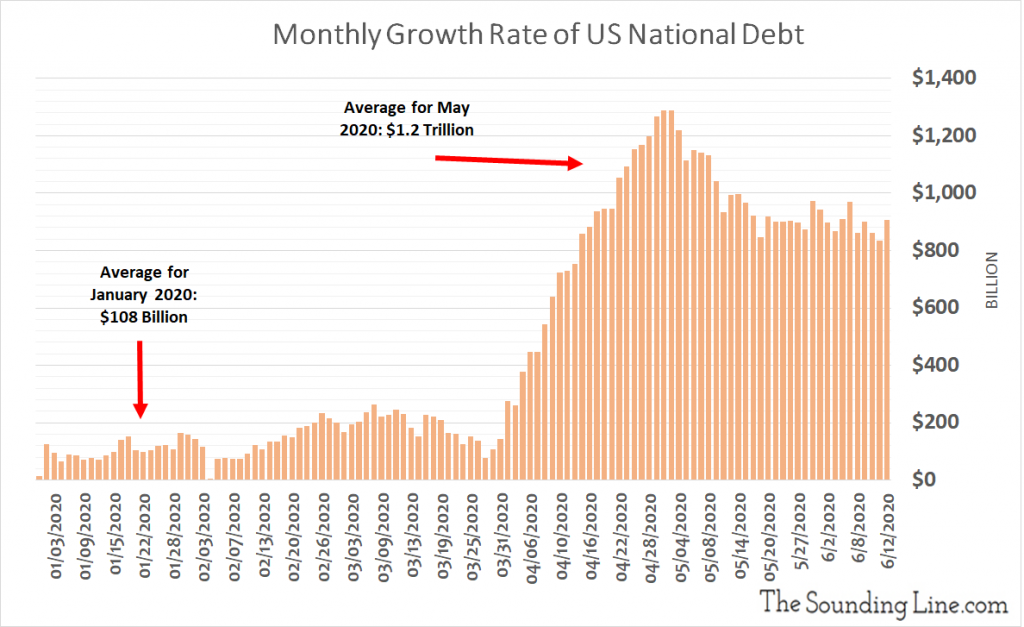

In fiscal years 2018 and 2019, the US national debt grew by $1.27 trillion and $1.2 trillion respectively. As we noted each year, those large increases in debt were approximately the size of the entire Congressional discretionary budget each year (here and here). In other words, essentially all non-entitlement and non-emergency spending from the US federal government for the last two years has been debt funded. That includes every federal agency, the entire military, Congress itself, the federal judicial system, the federal prison system, and pretty much everything that you think of regarding the federal government except mandatory spending programs like Social Security, Medicaire, Medicaid, unemployment insurance, and the interest on the national debt.

Fast forward to today, and the US national debt is growing by about $1 trillion per month. In fact, based on daily data from the Treasury, the monthly growth rate averaged $1.2 trillion in May and is currently clocking in at $857 billion a month as of June 12th.

The national debt isn’t spiking just because of the Congressional stimulus programs. Tax revenues are have plummeted and mandatory outlays for things like standard unemployment insurance are up sharply.

With that in mind, and considering that there are trillions of dollars of additional stimulus snaking its way through Congress, a trillion dollars a month is probably the ‘new normal’ for the time being.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.