Submitted by Taps Coogan on the 17th of February 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

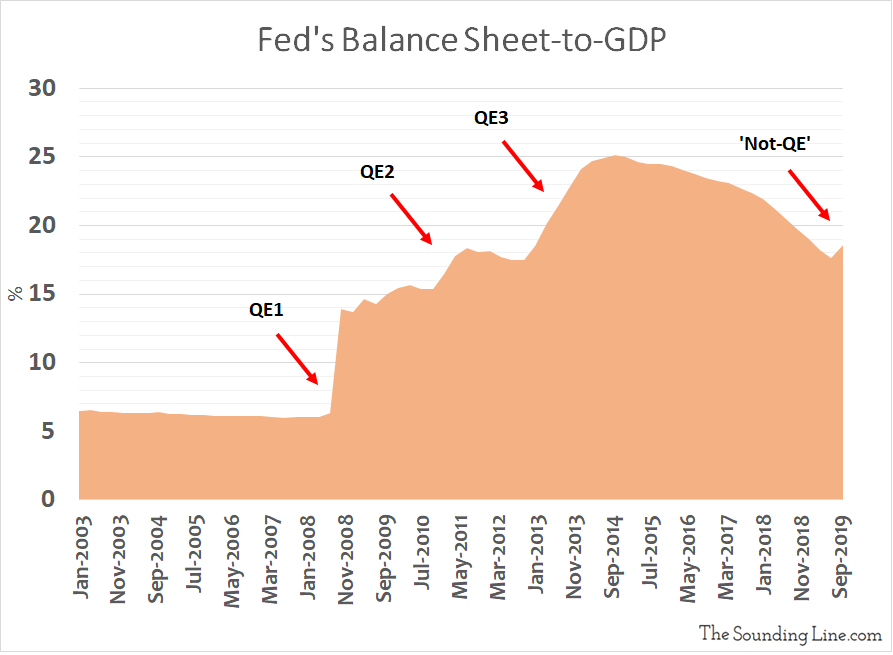

Prior to the Global Financial Crisis, the Fed’s balance sheet typically grew by $30 to $40 billion a year, just enough to keep it at roughly 6% of GDP.

After the Global Financial Crisis, in order to suppress long term interest rates and stimulate financial markets, the Fed radically expanded its balance sheet through quantitative easing programs QE1, QE2, and QE3. By the fourth quarter of 2014, the Fed’s balance sheet had reached a peak of over 25% of nominal US GDP.

Being a ‘temporary’ response to the Financial Crisis, the Fed finally began reversing the growth in balance sheet in 2015, eventually shrinking it down to 17.6% of GDP by Q3 2019.

However, the gradual tightening of monetary policy post 2015 did not stop the rapid growth of corporate and government bond issuance. Eventually, ever increasing demands for dollar funding, stricter bank reserve requirements, and a flat yield curve collided with the shrinking monetary base to cause junk-bond issuance to seize up and equity markets to dive in late 2018, and repo markets to blow out in September of 2019.

In response to the blowout in the repo market, the Fed gave up on the promise of ‘normalizing’ its balance sheet and instead relaunched large scale asset purchases, rapidly boosting its balance sheet back to 18.5% of GDP and rising.

Recognizing that normalizing its balance sheet has become impossible, the Fed is now talking about keeping its balance sheet at somewhere around 20% of GDP indefinitely.

While keeping the balance sheet at 6% of GDP prior to the Global Financial Crisis created an essentially neutral policy, the same logic just doesn’t hold up with today’s massive balance sheet. Keeping the balance sheet-to-GDP ratio at 20% is much more accommodative than doing so at 6%. Some basic math reveals why.

Let’s assume that today’s $21.7 trillion GDP is growing at 4% (nominal). If the Fed’s balance sheet were 6% of GDP ($1.3 trillion) it would need to grow by about $50 billion this year to remain at 6% of GDP. However, if the balance sheet is 20% of GDP ($4.34 trillion), it would need to grow by about $170 billion this year to remain at 20% of GDP. That extra $120 billion on the Fed’s balance sheet becomes part of the monetary base and is lent out in multiples through bank lending, further amplifying the increasing liquidity caused by the larger balance sheet.

Why is this important? The huge size of the Fed’s balance sheet has made it wildly more important to financial markets than it was prior to the Financial Crisis. If the Fed ever finds itself in the position of needing to combat inflation, its balance sheet is going to be a massive liability. Simply slowing down the growth of its balance sheet, let alone actually reducing it, will likely cause cascading negative reactions in markets whose valuations can only be justified by accomodative monetary policy.

Because of that, it is very likely that the Fed will simply avoid tightening policy until inflation has risen far above their target for a very long time. Even then, they will probably drag their feet. The trouble, of course, is that once high inflation becomes embedded, it becomes self-reinforcing and very painful to stop. Even if the Fed refuses to respond to rising inflation, bond holders who have lent out tens of trillions of dollars for decades at virtually no yield will be crushed. If the Fed does react, everyone else will be crushed.

Whatever the odds of rising inflation are right now, inflation will eventually rise and the risks will be enormous when it does (arguably, it already has). The Fed aggressively growing its balance sheet in order to close minute shortfalls in inaccurate inflation measures, particularly given that GDP growth is in line with long term expectations and financial markets are increasingly overvalued by every metric except monetary policy, is reckless.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.