Taps Coogan – March 19th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

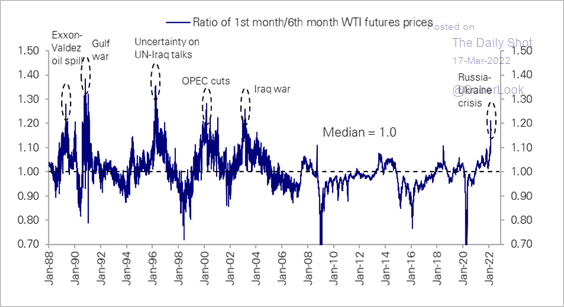

With WTI oil barely back over $100-a-barrel at the time of writing, having dropped from a high of $129 a few days ago, consider the following chart via Lance Roberts and the Daily Shot. It shows the backwardation of WTI futures, which has reached a severity only seen during the past major oil crises. Those previous peak backwardations roughly corresponded to past oil price peaks.

With China locking down tens of millions of people amid another Covid outbreak and with the IEA cutting its global oil demand forecast by 1.3 million bpd in the second half of the year due to slowing growth and high energy prices, it’s not inconceivable to imagine a drop in Russian output being balanced by an increase in production elsewhere along with a painful dose of demand destruction.

It’s anyone’s guess where prices go in the short term, but prices this high are probably above the long term equilibrium price as nearly every oil drilling prospect and operation in the world is viable at prices this high.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.