Taps Coogan – March 9th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

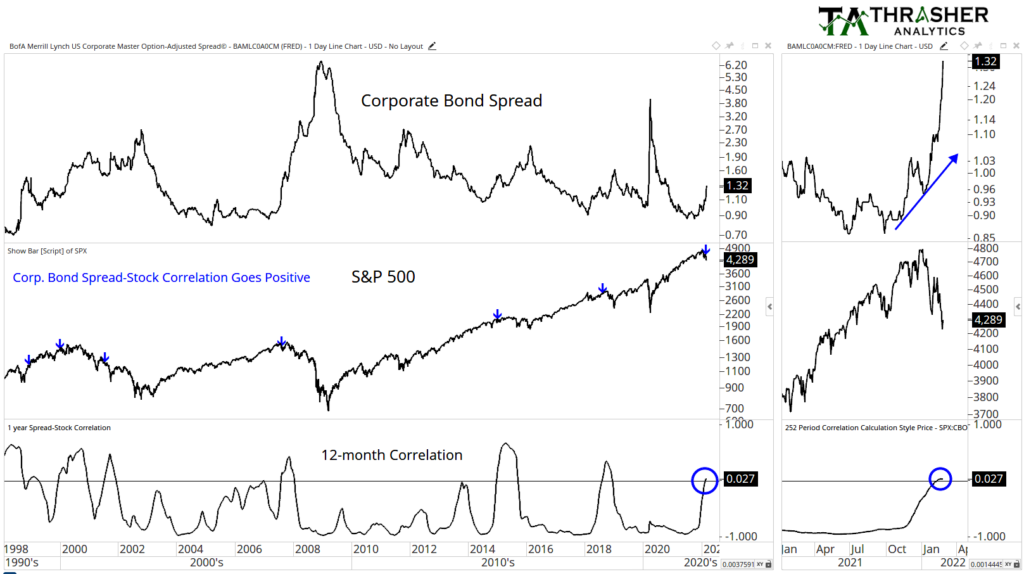

In what has proven to be an ominous sign for stocks over the past 25 years, corporate bond yields and stock returns are showing a positive 12-month correlation for the first time since the notable market weakness in late 2018, as the following chart from Thrasher Analytics shows.

Since stocks started declining at the start of the year, corporate bond spreads have also widened sharply, indicating a broad risk-off sentiment in both markets, the likes of which that has proceeded most of the notable market corrections since the late 1990s.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.