Taps Coogan – June 23rd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The $120 billion-a-month QE program that the Federal Reserve has been running since last Spring includes $40 billion-a-month of Mortgage Backed Securities (MBS).

In other words, the Fed is buying $480 billion of MBS a year, a pace equivalent to roughly $74,000 per home sold in the US this year or about 25% of the value of current home sales. If you buy a home this year, there is a decent chance that the Federal Reserve will end up holding your mortgage.

Not too surprisingly, home prices are screaming higher at the fastest pace since 2006. That was right before the last housing bubble burst in spectacular fashion.

According to Nobel Laureate Dr. Robert Shiller, creator of the Shiller Home Price Index, author of the landmark book ‘Irrational Exuberance,’ and predictor of the last Housing Bubble, inflation adjusted home prices have reached their highest price in at least 100 years.

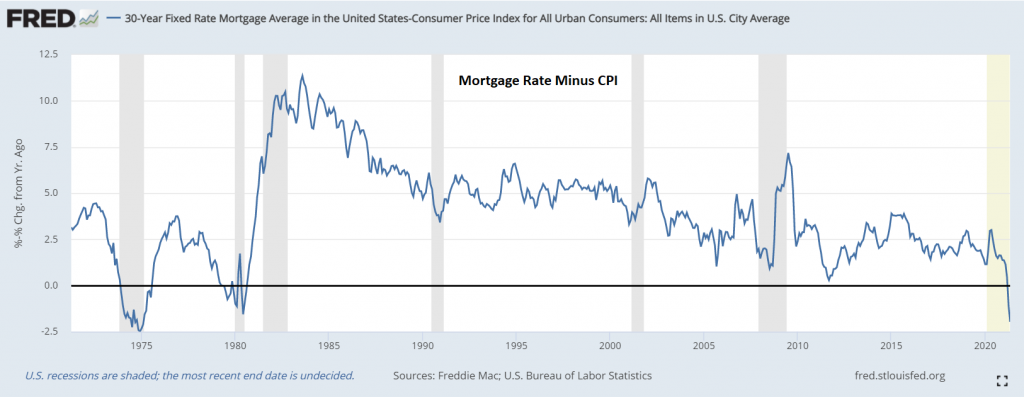

The average 30-Year mortgage is hoovering near all-time record lows below 3%, a level unheard of prior to Covid. The average mortgage rate is now below the CPI inflation rate for the first time since a brief spat in 1980 when mortgage rates were around 14% but inflation was slightly higher.

The US is not suffering from an excesses of affordable housing. To the contrary, housing affordability has become a major impediment to home ownership for an entire generation, stunting dreams of financial independence and family formation. Home prices have risen at nearly double the pace of hourly earnings since 2013 and are currently rising at over three times the rate. That’s the Fed’s beloved ‘wealth effect’ in action.

Nor is the banking system drowning in foreclosed homes selling at plummeting prices like during the Financial Crisis when the Fed started buying MBS the first time. Home prices have been rising for so long now that most foreclosures are profitable for banks and, despite Covid, the foreclosure rate is hovering near multi-decade lows.

So here is a serious question: If inflation and income adjusted home prices are the highest on record, the mortgage industry is healthy, mortgage interest rates are near historic lows, and foreclosure rates are near multi-decade lows, why is the Fed still buying $40 billion a month of MBS?

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

My answer: The Fed is deep state, they are financing black rock, who’s turning the future gen into renters who will be peasants, not wealth builders. They will have total control over who your neighbors will be. They have to have high housing prices for the maximum property tax revenue or all government won’t be able to service their debt load. I’m open to any other insights.

srg – I think you about covered it.