Taps Coogan – April 23rd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

The following article is reposted from Statista.com:

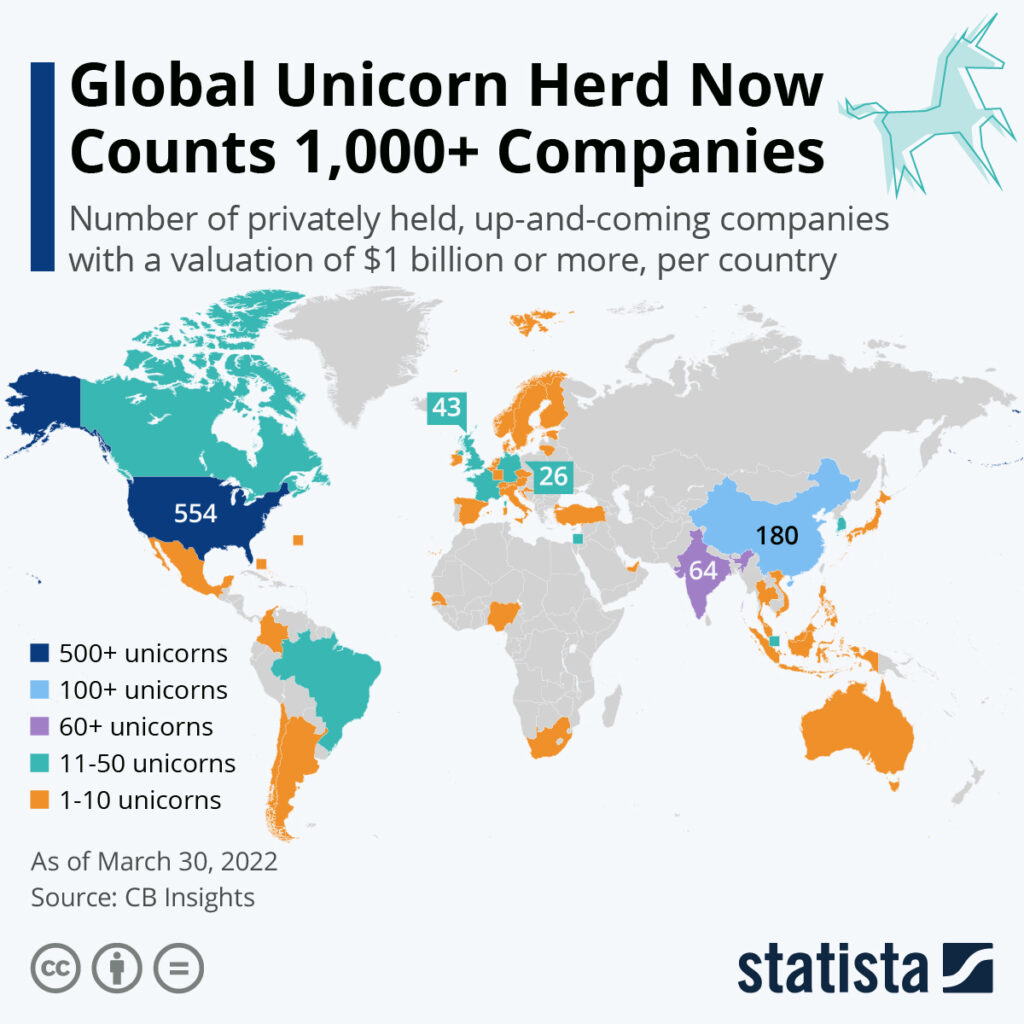

According to CB Insights, there were 1,068 unicorn companies in the world as of March 30, 2022. In 2021 alone, 519 of these privately held startups valued at $1 billion or more were “born”. The global unicorn herd passed the 1,000-mark at the beginning of the current year.

More than half of the unicorns on CB Insights’ list are headquartered in the U.S. Another 180 are based in China and Hong Kong. India is in third place in the international unicorn ranking, followed by the UK and Germany. Unicorns are now found on every continent, but a look at the map shows that their populations in Latin America and Africa are comparatively small.

Despite the obvious imbalance, the top 10 of the world largest unicorn companies looks more mixed than one would expect. Chinese AI and technology company Bytedance is the biggest of the bunch at a $140 billion valuation, followed by Elon Musk’s U.S.-based venture Space X ($100.3 billion) and Chinese fashion retailer Shein ($100 billion). Out of the ten biggest unicorns, five are based in the U.S. and two hail from China. The top 10 also includes Swedish fintech player Klarna, Australian graphic design platform Canva and British payment service Checkout.com.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

It would be a little more insightful to list WHY they are the unicorns they are. the average person in the USA has not a clue what is even meant by “unicorn companies” all they see is “market cap” and throw money at that.

AND at the end of the day so many of those folks are walking away with cold hard cash and think they are an investment genius. Which they are at this point. Who knew the way to generational wealth was to invest in smoke and mirrors.