Submitted by Taps Coogan on the 10th of May 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

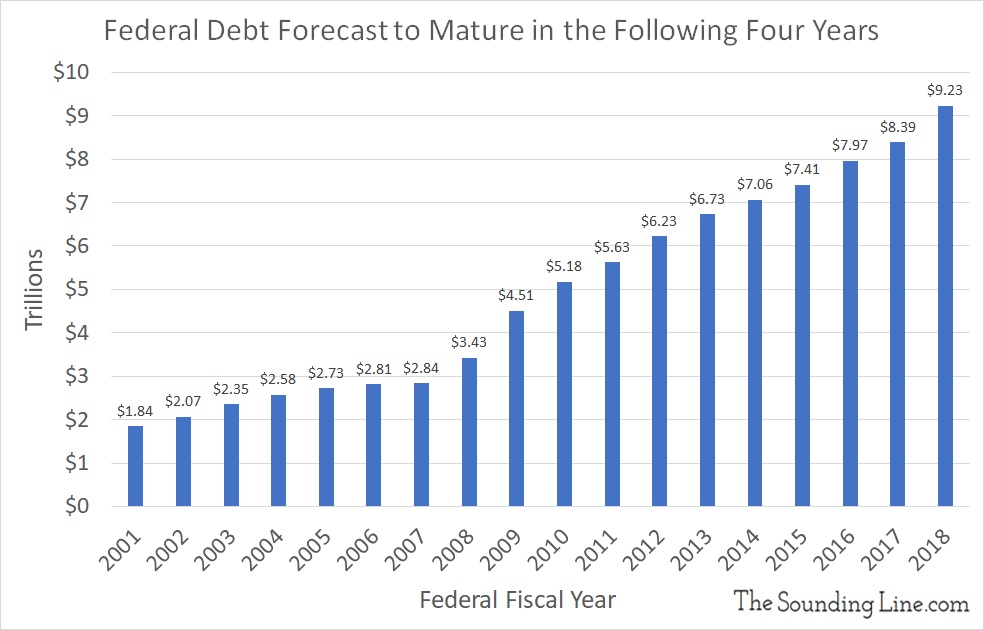

According to the most recent United States Government Accounting Office (GOA) report on the national debt, a record $9.23 trillion of the marketable federal debt held by the public will mature in the next four years. Roughly $4 trillion will mature in the current fiscal year alone, representing the fastest growth in the amount of maturing debt since the Financial Crisis.

The amount of government debt that needs to be rolled over every four years has more than doubled since 2008 and increased over five times since the statistic was first released in 2001.

These statistics only represent money that has already been borrowed by the federal government. Because the federal government is expected to run trillion-dollar-a-year deficits for the foreseeable future, the total amount of federal debt that will need to be ‘refinanced’ in coming years will be trillions of dollars higher than forecasted.

Not only are financial markets going to have to absorb what will inevitably far exceed ten trillion dollars in the next four years, for the first time in years the Federal Reserve is not expanding its balance sheet. That leaves more federal debt for investors to absorb, diverting yet more money that would otherwise be flowing to productive sectors of the economy.

Would you like to be notified when we publish new articles on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.